Nansen, a blockchain analytics agency, is strongly satisfied that one Ethereum addressing controlling a whopping 173,700 ETH value over $650 million at spot charges belongs to the DBS Financial institution, the biggest financial institution in Singapore.

Is The DBS Financial institution One Of The Largest Ethereum Whales?

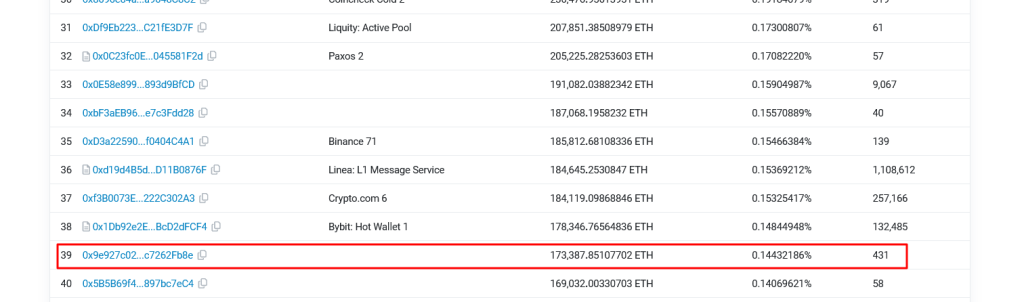

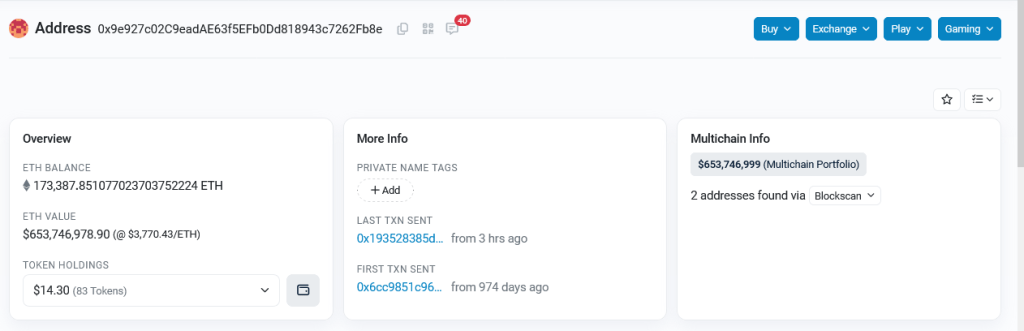

Taking to X, the blockchain analytics platform picked out an deal with “0x9e927…fb8e” as that belonging to the monetary establishment, sparking curiosity and pleasure. Taking a look at Etherscan, the deal with is likely one of the largest, putting it among the many prime 40 largest holders of the world’s second most beneficial cryptocurrency.

DBS Financial institution stands out from the record and is on par with the highest crypto exchanges, primarily Binance and Kraken. The truth that the financial institution is among the many prime gamers in crypto is a large increase and endorsement for the trade, a sphere that’s nonetheless evolving. Encouragingly, with regulatory readability, particularly from regulators in the US, extra establishments will probably heat as much as digital belongings.

It’s uncertain that the financial institution is holding ETH as an funding. Final 12 months, the financial institution launched the DBS Digital Trade. By means of this platform, the financial institution allowed accredited buyers to commerce a number of digital belongings, together with ETH. Even so, there are limitations. For example, the DBS Treasuries don’t enable inward or outward transfers of ETH and different cash. In addition they limit United States residents from collaborating.

Nonetheless, the choice by DBS to launch the change, tapping into their broad expertise within the capital markets and custody, is bullish. It’s a sign that the financial institution’s hierarchy is comfy with rising asset courses like crypto regardless of their inherent volatility.

For now, DBS Financial institution has to make clear whether or not they management the deal with and whether or not the ETH held is their funding. On the identical time, the financial institution has to make public if the over $650 million ETH belongs to the change. From Etherscan information, the primary transaction to the deal with was made 974 days in the past.

Singapore Is A Huge Crypto Participant In The Asia-Pacific Area

In response to Statista, Singapore performs a number one function in selling crypto within the Asia-Pacific area. In 2023 alone, there have been 88 offers serving to increase over $625 million for a number of crypto corporations. By means of favorable authorities insurance policies and adoption, Singapore desires to strengthen its place as a number one pro-crypto hub amid rising competitors from Hong Kong.

In early April, Singapore tightened anti-money laundering measures for crypto corporations. The Financial Authority of Singapore (MAS), the city-state’s regulator, stated it was altering monetary rules.

Modifications made to the Cost Providers Act will now empower the regulator to miss, amongst different issues, digital asset custody and cross-border funds.

Function picture from Canva, chart from TradingView