After the USA Securities and Change Fee (SEC) lastly accredited functions from Nasdaq, Cboe, and NYSE to checklist exchange-traded funds (ETFs) tied to the worth of Ethereum (ETH), sure trades by a US politician have come into the limelight.

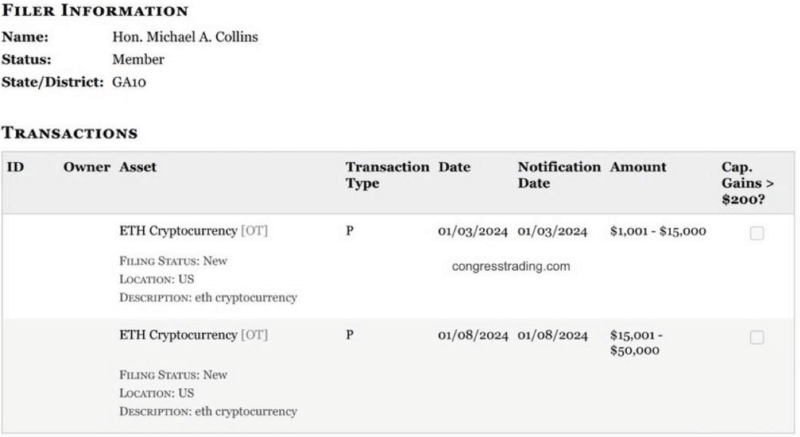

Particularly, Michael Collins, the US consultant for Georgia’s tenth congressional district, disclosed in January 2024 a $65,000 funding in Ethereum, as Finbold reported on the time, and extra not too long ago, highlighted by Quiver Quantitave, in an X publish on Could 24.

Moreover, along with his January 2024 purchases, Collins had additionally purchased Ethereum thrice in 2023 – on October 9, November 5, and December 28 – in gross sales that amounted to $75,000, based on the info shared by markets analytics platform uncommon whales on January 10.

For these questioning, Consultant Michael Collins has purchased round 75k in Ethereum, $ETH since October ninth, earlier than the Spot Bitcoin ETFs.

Ethereum is up ~59% since his first purchase. https://t.co/Crnzut2oRw

— unusual_whales (@unusual_whales) January 10, 2024

Ethereum information impact

In the meantime, Ethereum was at press time altering palms on the value of $3,687.03, which represents a drop of three.50% within the final 24 hours however nonetheless an advance of 21.68% throughout the earlier seven days, and an collected acquire of 13.03% on its month-to-month chart.

That stated, based on crypto buying and selling knowledgeable Michaël van de Poppe, the crypto market had already priced within the current optimistic Ethereum information, as mirrored within the type of the crypto asset’s sturdy 20% transfer, however the precise itemizing and influx would exhibit whether or not a robust upwards continuation can occur.

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.