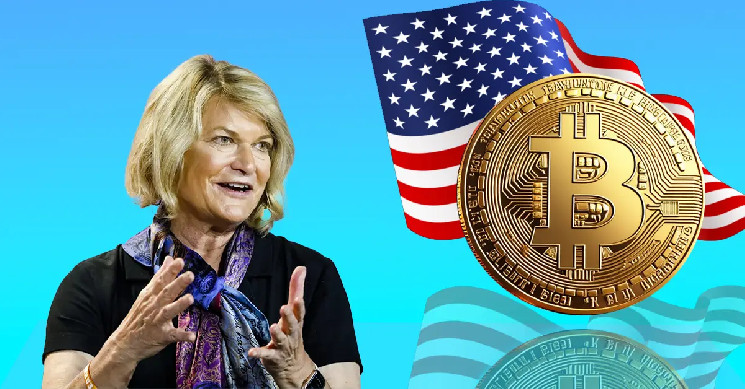

In a current dialog with FOX Enterprise, Senator Cynthia Lummis shared her views on shopping for Bitcoin to scale back US debt.

Lummis remarked that Bitcoin serves as a long-term retailer of worth. She expressed that it must be included in reserves as a strategic asset alongside gold and oil. The senator proposed that the U.S. ought to purchase roughly 200,000 BTC over the following 20 years, aiming to succeed in a complete of 1 million BTC. She asserts that this accumulation may considerably cut back the nation’s debt.

Lummis Suggests Promoting Gold To Purchase BTC

At a time when the federal government is seeking to reduce spending, Lummis emphasised that no new taxpayer {dollars} could be required to implement such a plan and defined that the U.S. authorities may keep away from spending new taxpayer cash by promoting off its gold reserves, particularly the gold certificates at present held by Federal Reserve Banks.

Lummis identified that the U.S. authorities already holds over 200,000 Bitcoin by asset forfeiture funds, which additional positions the nation to ascertain the reserve with none new expense. Curiously, Lummis holds 5 BTC, that are managed inside a blind belief.

She additionally highlighted that it’s essential to guard Bitcoin and individuals who maintain their Bitcoins in particular person wallets.

“We don’t wish to see this asset grow to be owned solely by governments and definitely don’t wish to see it managed by governments as a result of its nice advantage is as a freedom cash,” she underscored.

“A Professional-Bitcoin Cupboard”

“I’m thrilled that President Trump recognized it as one thing that we should always have the beachhead for in america,” she expressed noting that up to now below the present administration, efforts to manage it by enforcement actions, penalties, and lawsuits have pushed this trade into the arms of different nations together with the European Union.

She additionally shared that President-elect Trump appears to be assembling a really pro-bitcoin cupboard. Lummis’s proposal has sparked vital debate amongst policymakers and market individuals. Discussions over its feasibility and long-term results of the proposal proceed.