Regulation professor and filmmaker Brian Frye and songwriter Jonathon Mann have filed a lawsuit in opposition to the U.S. Securities and Trade Fee.

The legal professionals argue that the SEC’s method to regulation threatens the livelihoods of artists and creators experimenting with NFTs.

Proud to symbolize my consumer and buddy Jonathan Mann @songadaymann in his courageous and sadly obligatory lawsuit in opposition to the SEC.

Artwork will not be a safety, and musicians working in a digital medium shouldn’t have to rent costly securities legal professionals simply to launch music. https://t.co/FBYL9FZZfG

— Jason Gottlieb (@ohaiom) July 29, 2024

Desk of Contents

What the lawsuit says

In response to the doc, the plaintiffs wish to decide whether or not NFT falls below the regulator’s jurisdiction. The legal professionals requested the SEC to reply what actions might result in making use of securities legal guidelines to create and promote NFTs. The lawsuit additionally asks for details about registering NFTs earlier than they are often offered.

“Two latest administrative actions launched by the SEC counsel that the SEC is entering into the artwork enterprise, figuring out when artwork must be registered with the federal authorities earlier than it may be offered.”

The doc’s authors in contrast non-fungible tokens to Taylor Swift live performance tickets, usually resold on the secondary market. Mann and Frye are in precisely the identical place on this lawsuit. The legal professionals argue that it will be absurd for the SEC to categorise such tickets or collectibles as securities:

“They’re artists, and so they wish to create and promote their digital artwork, with out the SEC investigating them or submitting a lawsuit.”

The SEC’s first lawsuit in opposition to NFTs

In 2021, the media firm Impression Principle launched the Founder’s Keys NFT assortment. The corporate promoted the venture from October to December 2021. The gathering included tokens of three totally different rarity ranges.

Consequently, in August 2023, the SEC accused Impression Principle of selling securities with out registration. The corporate used NFTs to draw traders, elevating about $30 million. This was the regulator’s first case in opposition to NFTs.

At the moment we charged Impression Principle LLC, a media and leisure firm headquartered in Los Angeles, with conducting an unregistered providing of crypto asset securities within the type of purported NFTs. Impression Principle raised roughly $30 million from a whole bunch of traders.

— U.S. Securities and Trade Fee (@SECGov) August 28, 2023

The SEC believes the corporate positioned the venture as an funding in enterprise. Specifically, it assured holders excessive income and promised intensive prospects.

Thus, the regulator thought-about that the desired NFTs had the options of an funding contract and, consequently, have been categorised as securities. By selling the gathering, the corporate violated federal legal guidelines on this business.

Impression Principle agreed to pay a $6.1 million effective with out admitting or denying guilt. As well as, they determined to destroy the tokens and their mentions from web sites and social networks.

What is taken into account securities in response to the SEC

The Commodity Futures Buying and selling Fee considers cryptocurrency a commodity. The regulator proposes to use the tax regime developed for items to cryptocurrency and to treat the actions of issuers as producers of products. Nonetheless, no guidelines within the U.S. would oblige issuers to register tokens as items.

When assessing the standing of cryptocurrencies, the SEC appeals to the Howey take a look at.

The regulator sees the brand new monetary instrument as having safety traits and believes cryptocurrency falls inside its legislative area.

In response to the SEC, all tokens, in a technique or one other, fall below a number of standards designated by the company: pre-sale or fundraising, guarantees to enhance the venture by means of ongoing enterprise and advertising and marketing improvement, and the usage of social networks to reveal the venture’s capabilities and benefits.

Nonetheless, no arbitration physique might resolve the dispute between two American regulators, so every company works by its imaginative and prescient of the scenario.

You may also like: Vitalik Buterin addresses ‘principal problem’ in US crypto regulation: ‘You’re screwed’ since you’re ‘a safety’

Merchants are shedding curiosity in NFTs, not like regulators

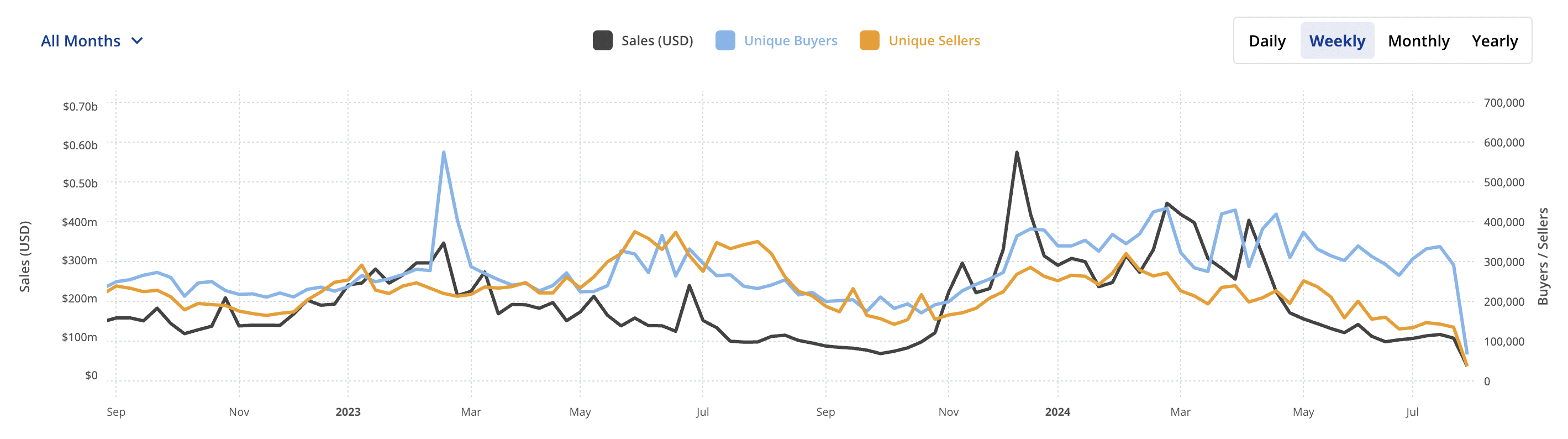

Regardless of the regulators’ curiosity in non-fungible tokens, the joy round NFTs continues to say no. Thus, in July, the quantity of gross sales within the NFT sector amounted to $395.5 million, in response to CryptoSlam. It is a new minimal since November 2023.

The NFT sector has been in a downward development for a very long time. Gross sales quantity and the variety of distinctive patrons and sellers have been steadily falling since March 2024.

Supply: CryptoSlam

As well as, gross sales quantity fell by 45% in Q2 2024 in comparison with Q1 — $2.2 billion in opposition to $4.1 billion.

The decline in July started in the midst of the month. On the identical time, in early July, there have been indicators of a restoration in gross sales quantity after a major drop in June. On the identical time, July grew to become the third-largest month by way of transaction quantity in 2023.

Throughout this era, 9.9 million transactions have been recorded, in comparison with 5.7 million in June. Nonetheless, this could hardly be a optimistic signal for the reason that common sale value in July reached a brand new minimal since September 2023 — $39.56.

What threatens NFT: SEC or a decline in curiosity

In response to the newest lawsuit in opposition to the SEC, the standing of non-fungible tokens stays to be decided. Nonetheless, the regulator is attracting much less curiosity on this space because of the waning pleasure round NFTs.

In any case, the SEC’s method to regulation threatens NFTs, which have been initially conceived as a component of creativity in your entire blockchain and cryptocurrency area.

You may also like: Will crypto regulation change after the SEC’s head of the crypto left?