The value of main cryptocurrency Bitcoin (BTC) hit a brand new six-month excessive this morning, at the moment buying and selling at $69,519.52, in line with a chart on Binance.

After a chronic decline since March, when BTC hit its present excessive, a dynamic resistance line was damaged simply 5 days in the past, sending the key cryptocurrency’s value down greater than 5.4% over the subsequent 5 days. Bitcoin has by no means been nearer to a brand new excessive in these many months than at this second.

Spectacular? Sure, however to not Peter Schiff. The famend monetary skilled, banker and cryptocurrency critic eloquently described the occasion as “meaningless.” It’s meaningless, in Schiff’s opinion, in distinction to gold, which the banker is an lively proponent of, at the moment hitting a brand new excessive of $2,740 an oz.

As normal @JoeSquawk simply talked about #Bitcoin’s meaningless six-month excessive, whereas fully ignoring #gold’s extremely important document excessive!

— Peter Schiff (@PeterSchiff) October 21, 2024

Within the opinion of a banker whose Euro Pacific Financial institution has been frozen by the federal government of Puerto Rico, the truth that gold’s rise to new heights is being fully ignored by the mainstream media, in distinction to the value motion of Bitcoin, is unfair, to say the least.

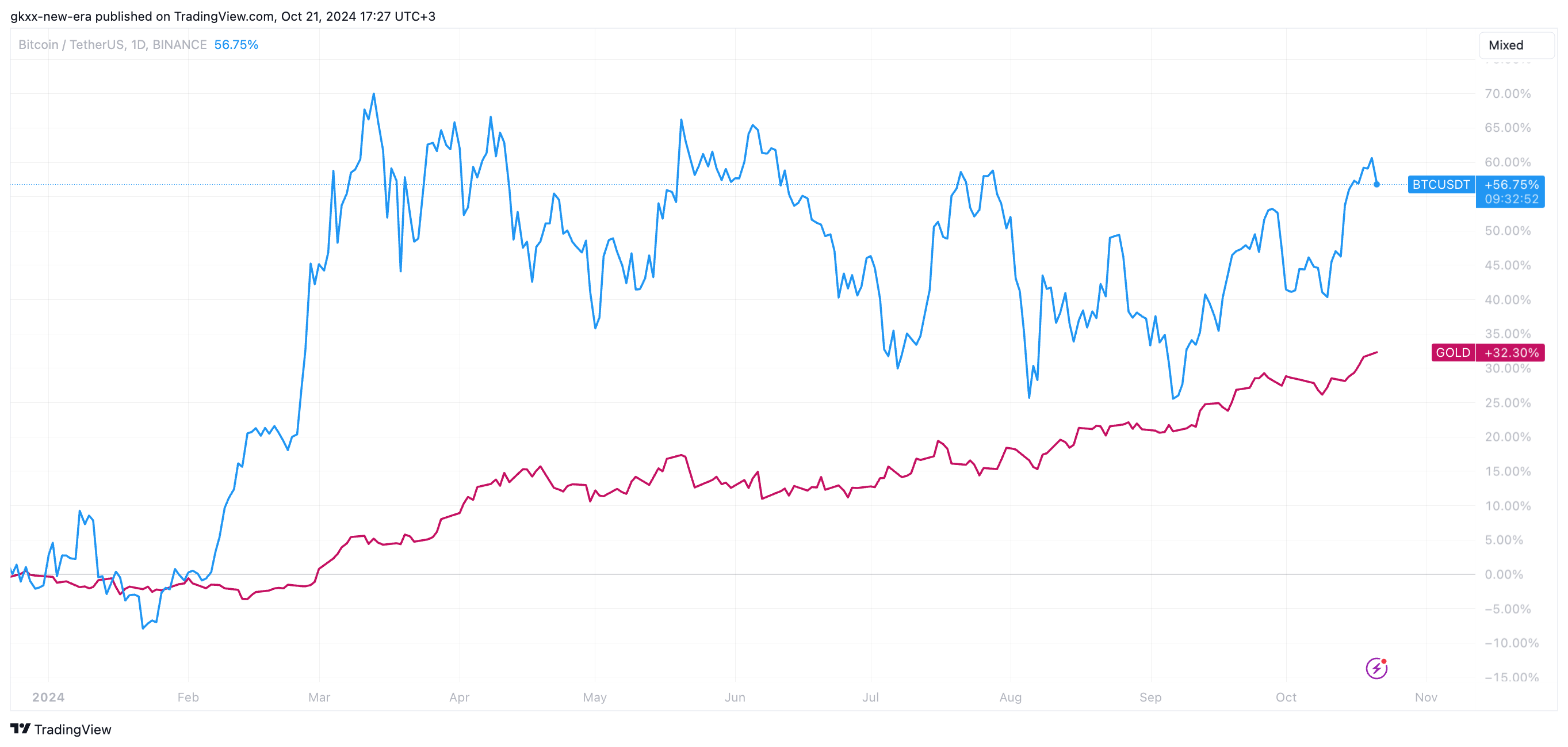

Gold v. Bitcoin

Reporters are both too unaware of economics and finance to grasp the importance of gold’s rise, or it’s a “deliberate” try to cover that significance from the general public, in line with Schiff.

Curiously, whereas Peter Schiff is as soon as once more hailing the prevalence of gold over the key cryptocurrencies, one other well-known determine in monetary circles, Peter Brandt, is predicting an increase of greater than 400% in BTC quotes in opposition to gold.

Nonetheless, in line with the dealer, this doesn’t imply that gold will fall, and quite the opposite, he additionally reveals that along with being lengthy on Bitcoin, he’s additionally lengthy on treasured steel futures.