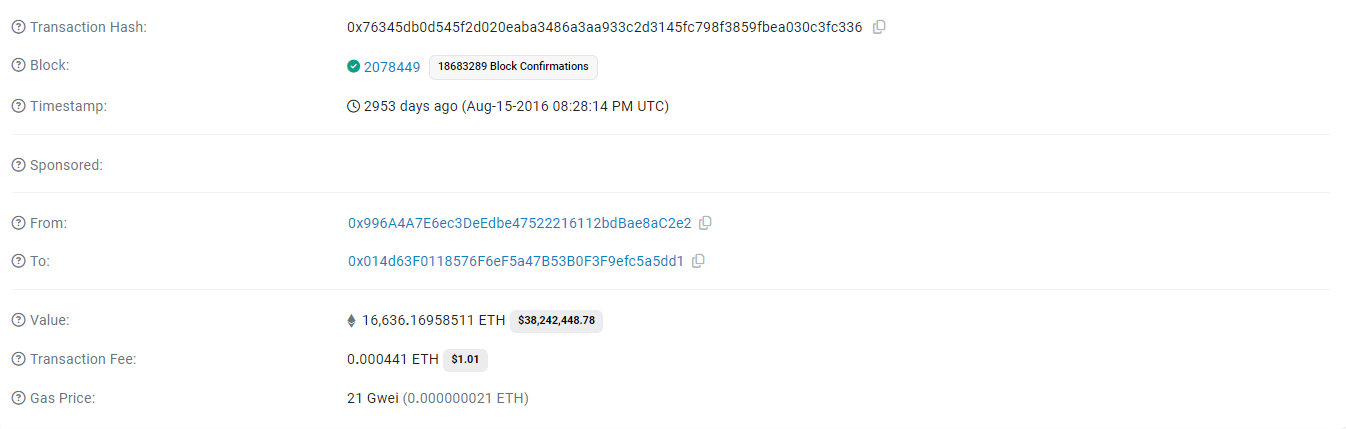

After holding the asset for greater than eight years and reaching a tremendous 446x return on funding, an Ethereum whale working again within the Satoshi period just lately started to promote. In February 2016, this whale purchased 16,636 ETH from ShapeShift for a mere $5.23 per ETH, in keeping with knowledge from Ember.

The whale began promoting a few of its holdings after weathering Ethereum’s big worth spikes. At $2,340 they bought 350 ETH, producing a whopping 446x return. Ethereum is presently having issue sustaining its prior momentum, which coincides with this promoting.

Ethereum has a weak ecosystem because of its poor efficiency and sharp decline in utilization. The ETH/BTC ratio has fallen under 0.4 for the primary time in three and a half years, suggesting that Ethereum is trailing behind Bitcoin.

Since many buyers are avoiding Ethereum in favor of Bitcoin and different property, this decline is indicative of the overall temper amongst buyers. The provision metrics for Ethereum additionally current a tough image. With solely 135K ETH burned yearly, the community is presently experiencing a low burn price.

The builders of Ethereum had not anticipated a deflationary mannequin like this. Fairly than deflation, buyers are involved about Ethereum’s provide development, which is presently estimated to be 0.68% yearly. Ethereum remains to be a serious participant within the blockchain business regardless of these issues.

Its market place, nevertheless, would possibly proceed to undergo from low community exercise and a scarcity of helpful updates or developments to spark curiosity. Sadly, builders couldn’t convey a brand new expertise to the desk that may disrupt the market, like NFTs and DeFi did again in 2021. There was some speak in regards to the potential development of RWAs previous to the Bitcoin halving, nevertheless it looks as if the market didn’t catch up.