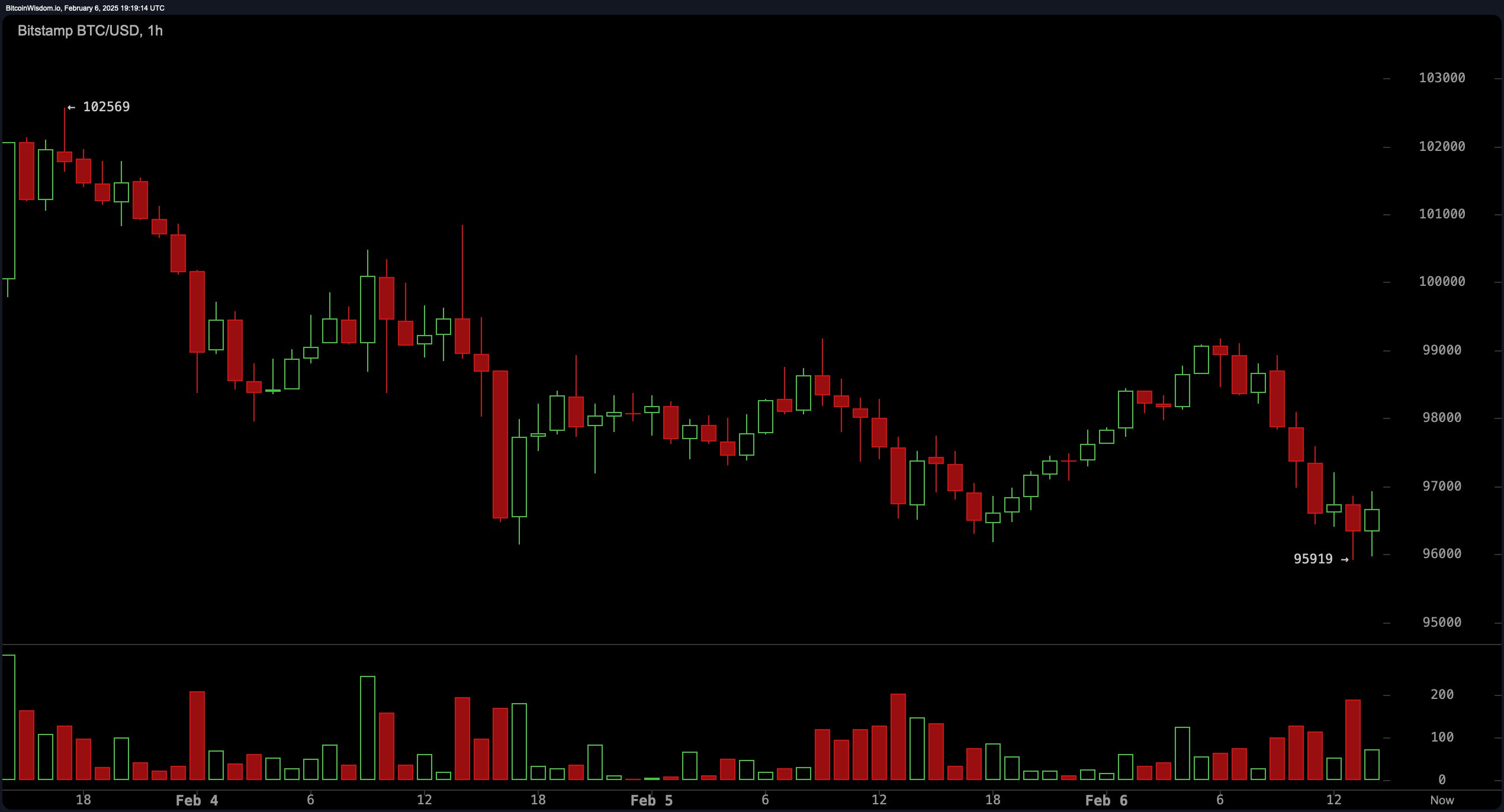

Bitcoin oscillated between $95,850 and $96,234 up to now sixty minutes, boasting a valuation of $1.917 trillion, a worldwide quantity footprint of $47.52 billion, and a every day worth spectrum stretching from $95,850 to $99,131. It now lingers 11% beneath its historic lifetime worth excessive.

Bitcoin

The hourly chart reveals worth stabilization with modest declines as bitcoin falters close to pivotal resistance obstacles. The relative power index (RSI) hovers at 43, reflecting equilibrium, whereas the shifting common convergence divergence (MACD) at -348 hints at persisting bearish tendencies. A commodity channel index (CCI) of -138 flashes a purchase alert, implying non permanent undervaluation, and the momentum oscillator at -5,318 tilts optimistically. But trepidation pervades the market, with patrons reluctant to have interaction at current valuations.

BTC/USD 1H chart on Feb. 6, 2025.

On the four-hour chart, near-term pessimism good points credence as exponential and easy shifting averages (EMA/SMA) throughout 10-, 20-, and 30-period spans uniformly difficulty promote alerts. The EMA (50) at 98,677 and SMA (50) at 98,717 additional bolster resistance close to $98,500-$99,000. Present help clings to the $95,500-$96,000 band, although a breach right here would possibly catalyze steeper declines towards $94,000. The superior oscillator’s destructive studying mirrors anemic directional thrust.

BTC/USD 4H chart on Feb. 6, 2025.

BTC’s every day evaluation uncovers an prolonged retracement following bitcoin’s final worth zenith close to $109,356, with resistance anchored at $109,000-$110,000 and foundational help close to $89,164. Elevated sell-side exercise portends sustained downward traction except bitcoin vaults above the symbolic $100,000 threshold. The 100-period EMA and SMA—$93,103 and $94,767, respectively—emerge as believable security nets, whereas the 200-period counterparts at $83,514 and $78,508 loom as distant flooring ought to bearish currents intensify.

BTC/USD 1D chart on Feb. 6, 2025.

At this pivotal crossroads, BTC’s trajectory balances on a knife’s edge. Speculators anticipate a rebound from $95,000-$96,000, but bearish threats linger ought to help crumble. A decisive push above $98,500-$100,000 might invigorate bullish prospects, whereas a hunch beneath $94,000 might precipitate a descent towards $91,500-$92,000. The saga of provide, demand, and speculative fervor continues unabated.

Bull Verdict:

Regardless of latest bearish momentum, bitcoin holds key help round $95,000-$96,000, and indicators just like the commodity channel index and momentum oscillator counsel potential upside if patrons step in. A breakout above $98,500-$100,000 might set off renewed bullish momentum, reclaiming misplaced floor and setting the stage for a push towards $105,000-$109,000 within the coming weeks.

Bear Verdict:

Bitcoin stays underneath strain, with a number of shifting averages and the shifting common convergence divergence reinforcing a bearish outlook. Failing to carry $95,000-$96,000 might result in a breakdown towards $94,000, and a deeper decline beneath $91,500-$92,000 would verify prolonged draw back dangers, doubtlessly concentrating on the $89,000 stage or decrease within the close to time period.