It is a section from the Empire publication. To learn full editions, subscribe.

If a thriving blockchain ecosystem had been a recipe, the elements would go one thing like this:

- One consensus mechanism

- 4 DeFi apps*

- A pushed founder/figurehead

- One native stablecoin (a minimum of)

- Two authorized entities (dev studio and basis)

- One token bridge (minimal)

- Three terminally on-line reply guys

The key ingredient could be a number of of the next: funding rounds, mid-cap memecoins, NFT collections, energetic VC funds and third-party validator purchasers.

*Minimal required DeFi apps: DEX w/ token launchpads, lending/collateralized debt, liquid staking, oracle

So, whereas there are actually tons of of sensible contract platforms with midway first rate market capitalizations, not all are buzzing to fairly the identical diploma because the majors — Ethereum, Solana and BNB.

Living proof: XRPL, which has all however $63 million TVL in its onchain apps. Ripple Labs is correct now working laborious on ending its personal recipe, greater than 12 years after its launch.

Beginning simple, XRPL does have the consensus mechanism, albeit with out the same old staking or mining, as a substitute counting on trusted validators. And it already has a couple of token bridges.

There are additionally two authorized entities: the San Francisco-headquartered Ripple Labs and the Estonian non-profit XRP Ledger Basis, which was not too long ago rebranded to the Inclusive Monetary Know-how Basis.

Ripple Labs CEO Brad Garlinghouse clearly ticks the field for pushed founder-slash-figurehead.

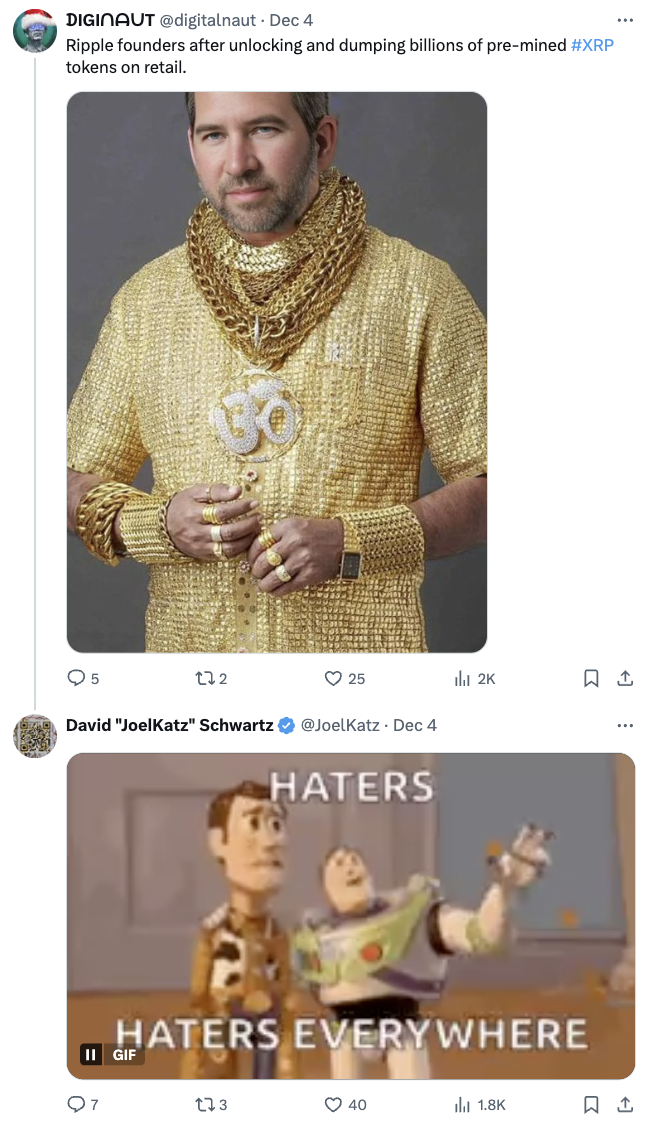

As for the reply guys, David Schwartz, Ripple Labs’ long-serving CTO, has constructed a following on strong reply man vitality (verify).

Each main blockchain may do with a David Schwartz

And anybody who has ever tweeted something remotely critique-adjacent has probably been visited by the XRP Military — which collectively really harnesses the facility of far more than simply two reply guys (verify verify).

That leaves the 4 DeFi apps and a local stablecoin.

XRPL at the moment has 4 DeFi apps with 100 distinctive energetic wallets interacting with them day by day proper now — however three of them are DEXs and one is an NFT market. As of final month, it does have a local oracle, which ought to assist to draw builders.

And conveniently, XRPL is the exception to the rule (with no direct staking XRP as a part of consensus), so it might probably do with out the liquid staking app in any case.

The one elements then left are a bustling lending protocol and a local stablecoin.

Fortunately, a stablecoin may be very a lot on the way in which: Ripple USD (RLUSD), which the New York State Division of Monetary Providers simply accepted for providing.

It’ll be structured equally to Circle’s USDT and Tether’s USDT, backed by money and equivalents (largely short-dated US Treasurys).

With XRPL so near buying all the mandatory elements to actually pop, it’s no shock then that DeFi veteran Robert Leshner is now open to backing tasks constructing out the Ripple ecosystem by way of his fund (VC bonus level get!).

The pièce de résistance for XRPL would then be a roster of its personal mid-cap memecoins, as is conventional fare.

Prefer it or not, these are cooking too, though the most important of which is an XRP Military-themed coin with a $45 million market cap (nonetheless too small).

The intense facet: Solely $15 million in tokens had been traded on XRPL up to now day. Ought to RLUSD discover first rate traction, watch that quantity solely go up from right here to totally spherical out the recipe.

Bellisimo!