Bitcoin (BTC) is exhibiting indicators of approaching a big low, presenting a possible shopping for alternative for buyers and merchants. Latest worth actions point out a gradual rounding off from its latest peaks, reflecting a gradual however regular decline in market enthusiasm and shopping for strain.

This pattern suggests {that a} main low might be imminent, which savvy buyers would possibly leverage to their benefit.

Buying and selling knowledgeable Alan Santana projected on June 26 that Bitcoin might quickly take a look at a number of key help ranges. At present, Bitcoin is hovering across the $62,473.33 mark, which corresponds to the 0.618 Fibonacci retracement degree—a traditionally robust help throughout downtrends.

Ought to this degree fail to carry, the following vital help lies at $59,883.97, the 0.786 Fibonacci retracement degree. This zone might function a vital shopping for space if the worth stabilizes there. If the decline continues, the worth would possibly drop additional to the 1.236 Fibonacci extension degree at $52,948.21, doubtlessly presenting an much more enticing shopping for alternative.

Technical indicators recommend potential decline

A more in-depth examination of buying and selling volumes reveals a regarding pattern. Since mid-Could, there was a noticeable decline in buying and selling quantity, suggesting a weakening bullish momentum.

This reducing quantity pattern signifies a discount in market enthusiasm and the potential for continued downward strain on the worth. Concurrently, a rise in bearish quantity highlights stronger promoting strain, reinforcing the chance of additional worth declines.

Market sentiment additionally performs a vital function in Bitcoin’s worth actions, at the moment characterised by elevated worry and uncertainty, contributing to the bearish pattern.

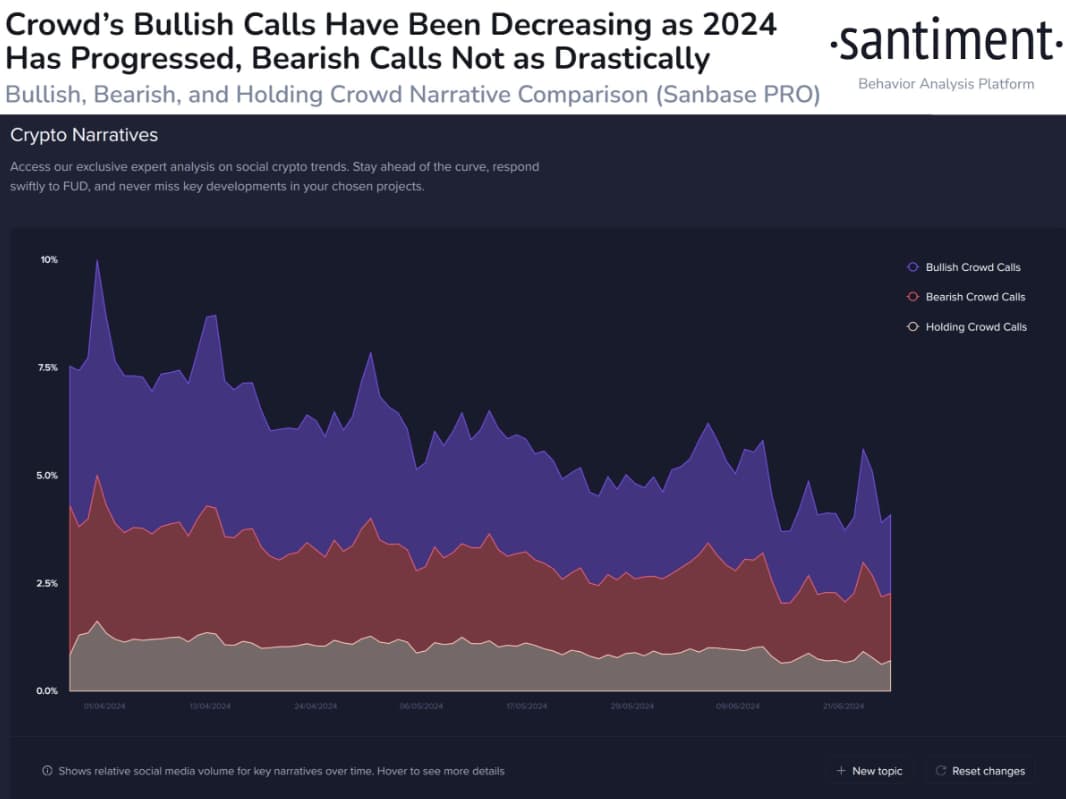

Knowledge from crypto analytics agency Santiment exhibits a big drop in bullish remarks throughout social media platforms like X, Reddit, Telegram, 4Chan, and BitcoinTalk in latest weeks.

Because the Bitcoin halving in April, the worth has been buying and selling sideways. Dealer sentiment was most bullish initially of April however has waned over the previous three months as a consequence of Bitcoin’s incapability to succeed in new all-time highs.

Whereas bearish sentiment has additionally declined, it hasn’t dropped as sharply as bullish sentiment. Santiment suggests this decline in dealer euphoria might be a possible backside sign.

Timing the following shopping for alternative

Timing the following large shopping for alternative in Bitcoin requires cautious monitoring of key help ranges and market situations. Within the brief time period, over the following one to 2 weeks, the essential degree to observe is $62,473.33.

If Bitcoin breaks this help, the worth could shortly drop to the following help at $59,883.97. Traders ought to monitor for a possible breakdown and indicators of reversal round this degree.

A sustained maintain above this degree might sign a shopping for alternative. Within the mid-term, inside a month, the important thing degree to observe is $52,948.21. If the $59,883.97 help fails, anticipate a decline towards $52,948.21.

This degree aligns with the 1.236 Fibonacci extension and is more likely to entice vital shopping for curiosity. Traders ought to put together to enter the market if Bitcoin approaches this degree and exhibits indicators of bottoming out.

Bitcoin worth evaluation

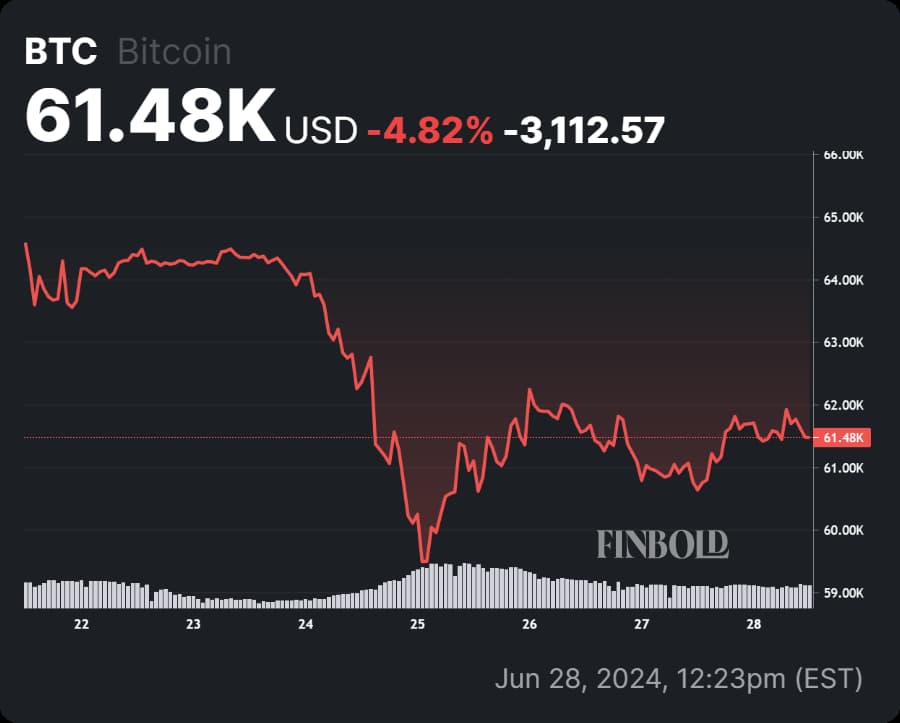

At current, Bitcoin is priced at $61,523.01, with a 1.3% improve previously 24 hours. Regardless of this short-term achieve, the broader pattern stays downward. The present worth formation, mixed with Fibonacci retracement ranges and buying and selling quantity tendencies, suggests a possible for additional worth declines.

Traders ought to put together to grab the following large shopping for alternative by intently monitoring the $59,883.97 and $52,948.21 ranges.

Traders ought to stay vigilant, looking forward to vital help ranges at $62,473.33, $59,883.97, and $52,948.21. By rigorously monitoring these ranges and market situations, they’ll doubtlessly capitalize on vital shopping for alternatives as Bitcoin approaches these key factors.

Disclaimer:The content material on this website shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.