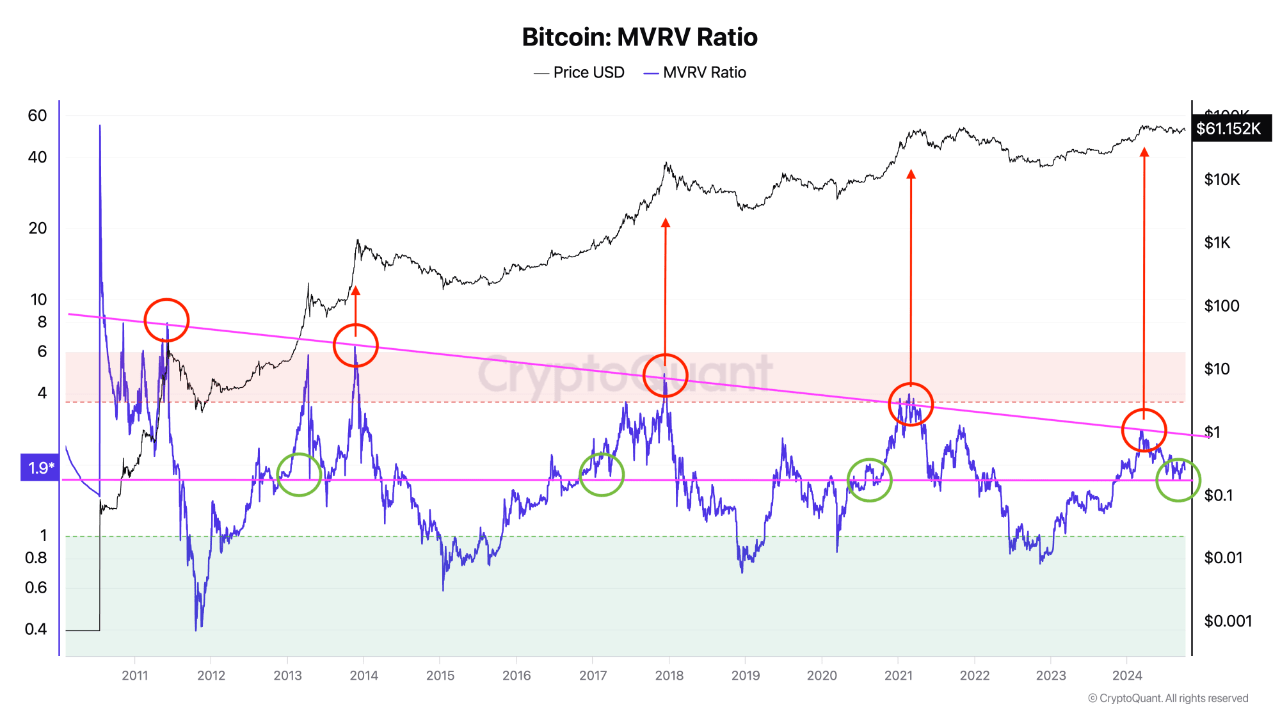

A CryptoQuant analyst utilizing the pseudonym “tugbachain” has not too long ago make clear a key pattern inside the Bitcoin market. Posting on the CryptoQuant QuickTake platform, the analyst targeted on the Market Worth to Realized Worth (MVRV) ratio, an essential metric within the Bitcoin market.

In keeping with tugbachain, the MVRV ratio reveals a historic downward pattern. Ought to this pattern proceed or get breached, it could result in a serious affect on Bitcoin.

MVRV Ratio And Its Impending Impression On Bitcoin

The MVRV ratio, as defined by tugbachain, is a software used to gauge whether or not a cryptocurrency is overvalued or undervalued. This ratio is calculated by evaluating the market worth to the realized worth of Bitcoin, offering insights into investor habits and market tendencies.

The analyst highlighted that the MVRV has confirmed helpful in figuring out market tops, bottoms, and notable peaks and troughs through the years. The MVRV ratio has traditionally demonstrated three main Bitcoin halving cycles, every marked by distinctive worth habits and investor sentiment.

The present ratio sits round 1.9, with vital assist famous at 1.75. The query raised by tugbachain is whether or not breaking the downtrend may result in an increase within the MVRV ratio to the 4-6 vary, which has traditionally signaled a Bitcoin peak.

The analyst wrote within the put up:

Presently, the MVRV ratio reveals a historic downtrend with vital assist at 1.75. With the ratio now sitting at 1.9, the query arises: if it breaks the downtrend and reverses the downtrend, may it as soon as once more climb to the 4-6 vary, marking a Bitcoin peak as seen in earlier cycles?

BTC Market Efficiency And Technical Outlook

Bitcoin has seen heightened worth exercise in latest weeks within the broader market context. The asset rallied above $66,000 final week, sparking enthusiasm within the crypto group with hopes for a bullish October, playfully termed “Uptober.”

Nevertheless, this upward momentum was short-lived, as BTC skilled a notable worth correction quickly after. Inside the previous week alone, Bitcoin has seen a decline of round 7.2%, falling to a buying and selling worth of $61,496 on the time of writing.

Regardless of this correction, BTC has rebounded barely, posting a modest 1.9% achieve over the previous 24 hours. Other than tugbachain’s evaluation, different crypto market analysts have supplied extra views on the MVRV ratio’s implications for BTC.

Ali, a outstanding analyst on the social media platform X, has identified that the MVRV ratio’s habits since Could has notably impacted Bitcoin’s worth actions.

Ali noticed that every rejection of the MVRV ratio from its 90-day common has traditionally led to a big correction in Bitcoin’s worth. In keeping with Ali, the newest rejection has already resulted in a ten% drop, suggesting the potential for additional draw back strain.

Featured picture created with DALL-E, Chart From TradingView