Ethereum’s value is in a vital zone close to $4K, dealing with resistance but additionally exhibiting indicators of consolidation. Whereas the market stays bullish general, short-term fluctuations inside the $3.5K-$4K vary are anticipated earlier than a possible breakout or deeper pullback.

Technical Evaluation

By Shayan

The Each day Chart

Ethereum has made spectacular progress, surging towards the psychological $4K resistance area. This value degree coincides with Ethereum’s yearly excessive and is a robust space of promoting strain. Lately, the rejection at this line has brought on a slight decline, signaling that the resistance is proving troublesome for consumers to beat.

After the correction, the market entered a interval of low volatility, suggesting a short-term consolidation section. This section might final inside the $3.5K-$4K vary as consumers and sellers attain a standoff. The RSI indicator’s bearish divergence helps the notion of an overbought market, reinforcing the chance of this corrective stage.

Whereas the worth has confronted some resistance, ETH consumers will possible make one other try and push previous $4K. Nonetheless, earlier than that, a interval of sideways motion is anticipated because the market digests the latest positive aspects.

The 4-Hour Chart

On the 4-hour timeframe, ETH maintains a bullish market construction, persistently forming increased highs and better lows. Regardless of the rejection at $4K, the general pattern stays upward, as Ethereum has been trending inside an ascending value channel.

The failure on the $4K resistance zone has led to a interval of consolidation, with the asset hovering slightly below this vital degree. The decrease boundary of the ascending channel, presently round $3.7K, gives short-term help. If the worth continues to keep up it, a bullish surge towards the $4K threshold is probably going.

Alternatively, a break beneath the channel’s decrease trendline might point out weakening bullish momentum, with a attainable pullback towards the $3.5K help degree within the mid-term. Nonetheless, if consumers handle to defend it, one other try to interrupt $4K might be imminent.

Onchain Evaluation

By Shayan

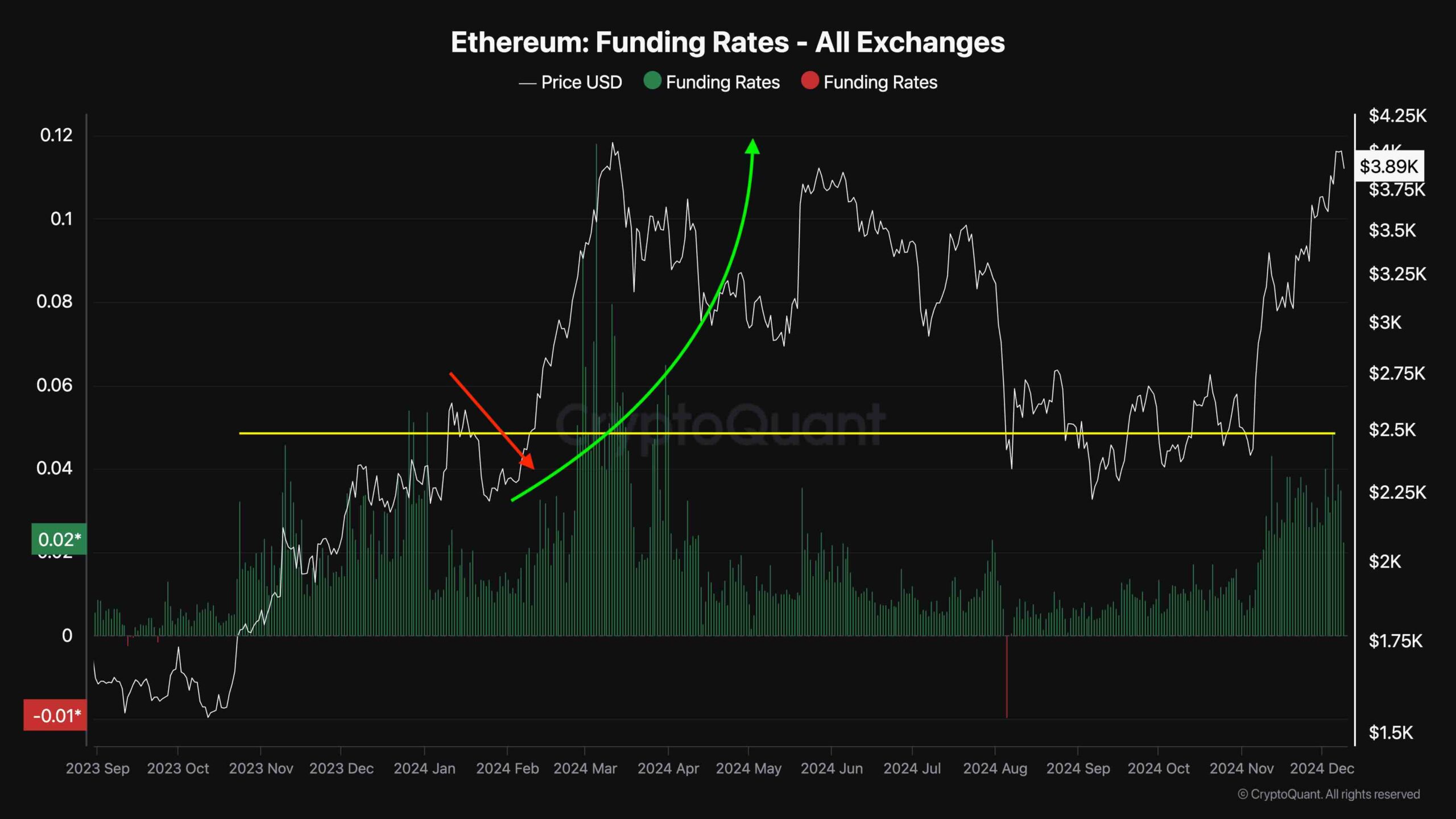

Ethereum’s Funding Charges metric, reflecting futures market sentiment, has surged to its highest degree in months, coinciding with a major value rally. This highlights robust bullish sentiment, with merchants anticipating new all-time highs. Nonetheless, the market could require a correction to maintain this momentum.

Funding charges are at ranges final seen in January 2024, when Ethereum rallied by 88%. This displays elevated long-position curiosity as optimism grows. Much like January, this sharp improve suggests the chance of a pullback, permitting the market to stabilize and keep away from extreme volatility.

Whereas Ethereum’s rally is underpinned by bullish sentiment, the spike in funding charges indicators the necessity for a short-term correction, paving the best way for more healthy and extra sustainable value development.