Following Bitcoin’s (BTC) flash crash beneath $100,000, new value ranges are rising that might doubtlessly anchor the asset to reclaim its six-figure valuation.

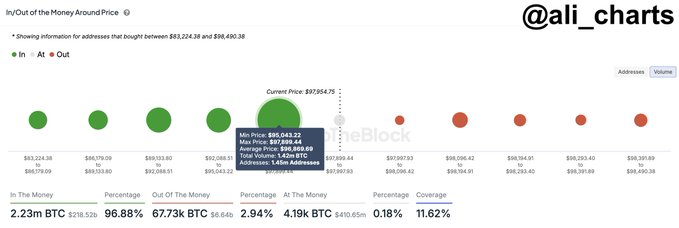

In keeping with on-chain knowledge evaluation, essentially the most vital help zone to watch is at $96,870, the place 1.45 million addresses collectively maintain roughly 1.42 million BTC, as per knowledge shared by a distinguished cryptocurrency analyst, Ali Martinez.

This evaluation recognized this place because the ‘Within the cash’ zone, signifying that these holders are at the moment in revenue. The excessive demand at this value degree suggests robust purchaser curiosity, which may stop Bitcoin from falling additional.

Moreover, Bitcoin is encountering smaller resistance above $100,000, the place the maiden digital forex faces elevated promoting stress.

If the $96,870 help holds, Bitcoin’s downward pattern and upward momentum will possible reverse. Apparently, the extent recognized by Martinez additionally sits simply above the important thing $95,000 resistance.

If these ranges are maintained, they’re possible to assist cement Bitcoin’s bull cycle, which historic knowledge suggests may very well be sustainable within the coming yr.

Bitcoin’s value market high

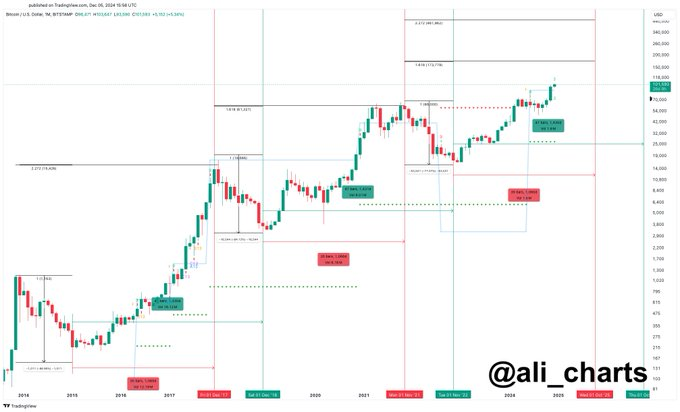

On this case, Martinez had earlier expressed fascination with Bitcoin’s value cycles, noting historic patterns that point out a rhythm. In an X publish, the analyst highlighted that within the final two cycles, it took 1,065 days for Bitcoin to climb from a market backside to its peak and 1,430 days to finish a full cycle from one backside to the subsequent.

If this sample holds, the skilled instructed that Bitcoin may attain its subsequent market high in October 2025. To this finish, it may be assumed that Bitcoin bull run is simply starting.

Regardless of the asset’s volatility, some market gamers level out that Bitcoin will possible see continued progress within the subsequent months.

As reported by Finbold, Commonplace Chartered predicted that Bitcoin may commerce at round $200,000 in 2025, pushed by sustained institutional capital inflows.

It’s attention-grabbing to notice that the banking large appropriately predicted the clinching of the $100,000 spot.

Certainly, Bitcoin continues to get pleasure from momentum triggered by the election of Donald Trump and the appointment of pro-cryptocurrency officers.

There may be anticipation that this momentum will stay sustainable till the year-end, with prediction markets setting an bold goal of almost $130,000 for Bitcoin by year-end.

Bitcoin value evaluation

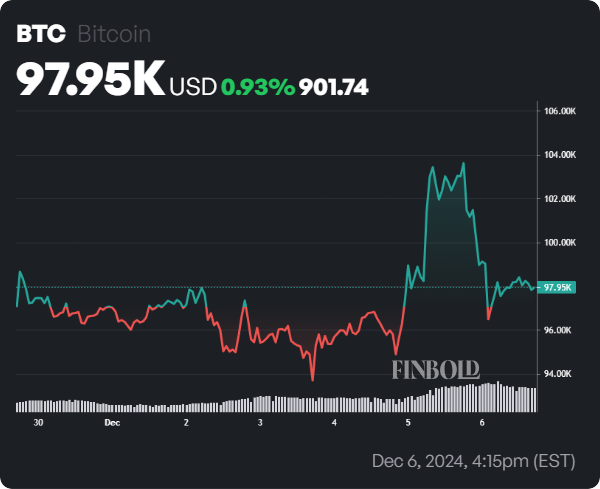

At press time, Bitcoin was buying and selling at $97,689. The asset had prolonged losses on the each day chart, the place it was down over 5%. Nonetheless, BTC has been up virtually 1% over the previous seven days.

Amid the drop on the each day chart, Bitcoin’s sentiment and technical setup level to attainable sustained value progress each within the brief and long run. This risk is highlighted by Bitcoin’s place above key help ranges, together with its 50-day easy transferring common (SMA) at $81,682 and 200-day SMA at $67,668.

The market sentiment is within the “Greed” zone, with a studying of 72 on the Worry & Greed Index, whereas the relative power index signifies stability for the asset.

Featured picture by way of Shutterstock