Bitcoin, at the moment priced at $103,737 to $104,266 during the last hour with a market capitalization of $2.05 trillion, a 24-hour buying and selling quantity of $49 billion, and an intraday vary oscillating between $102,214 and $105,850, displays a heightened state of market dynamism within the lead-up to Donald Trump’s inauguration.

Bitcoin

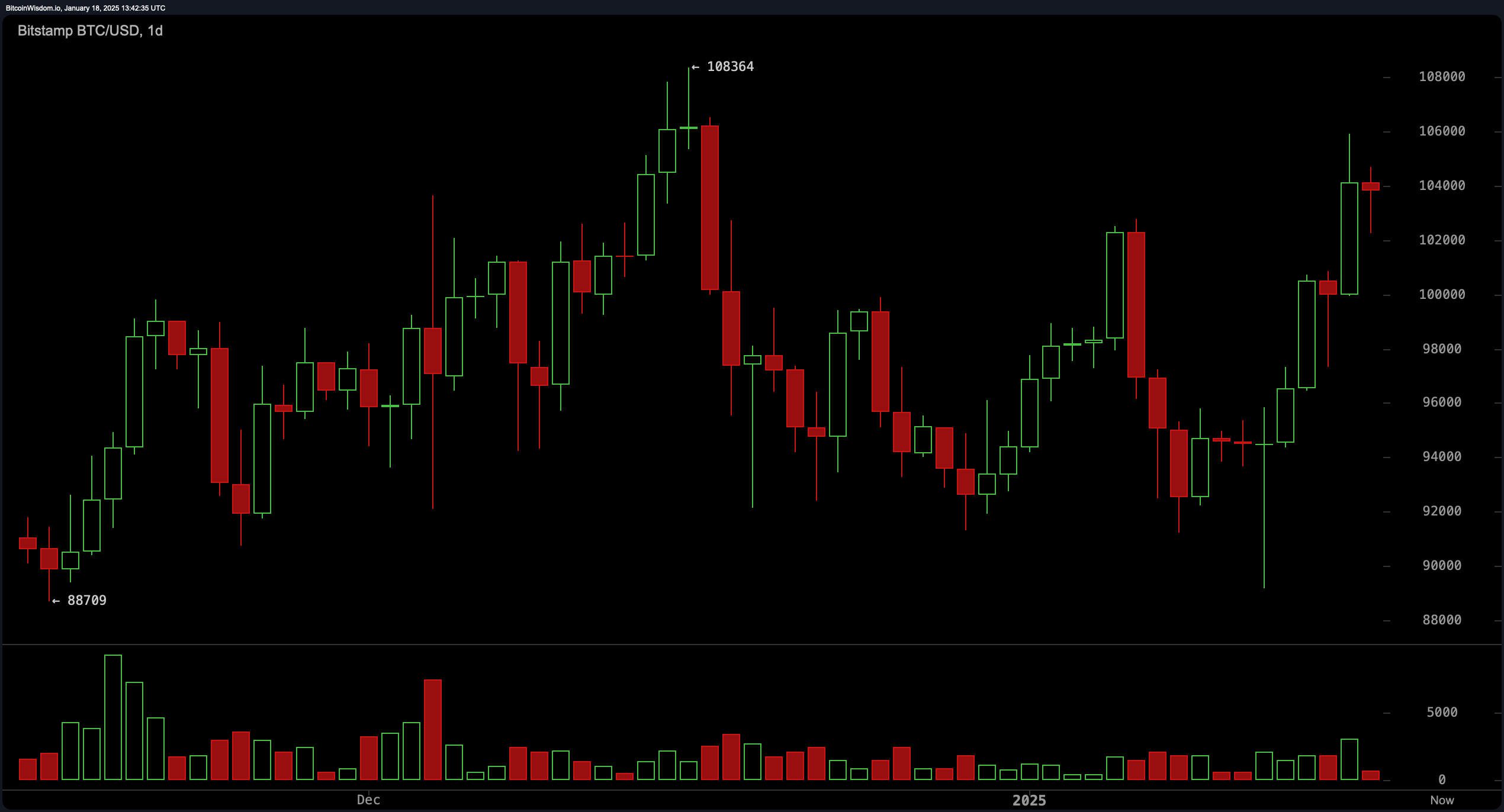

From the attitude of the each day chart, bitcoin’s trajectory stays resolutely upward, characterised by the formation of progressively increased highs and better lows following its restoration from a plunge under $90,000. The asset not too long ago reached an apex at $108,000 earlier than present process a measured retracement, now consolidating inside a structurally supportive zone close to $103,000. Elevated buying and selling volumes accompanying upward worth actions point out intensified demand, whereas the decreased exercise throughout worth corrections factors to a waning of promoting stress. Key thresholds to watch embody the $108,000 resistance degree and a assist zone centered round $98,000.

BTC/USD by way of Bitstamp on the 1D chart on Jan. 18, 2025.

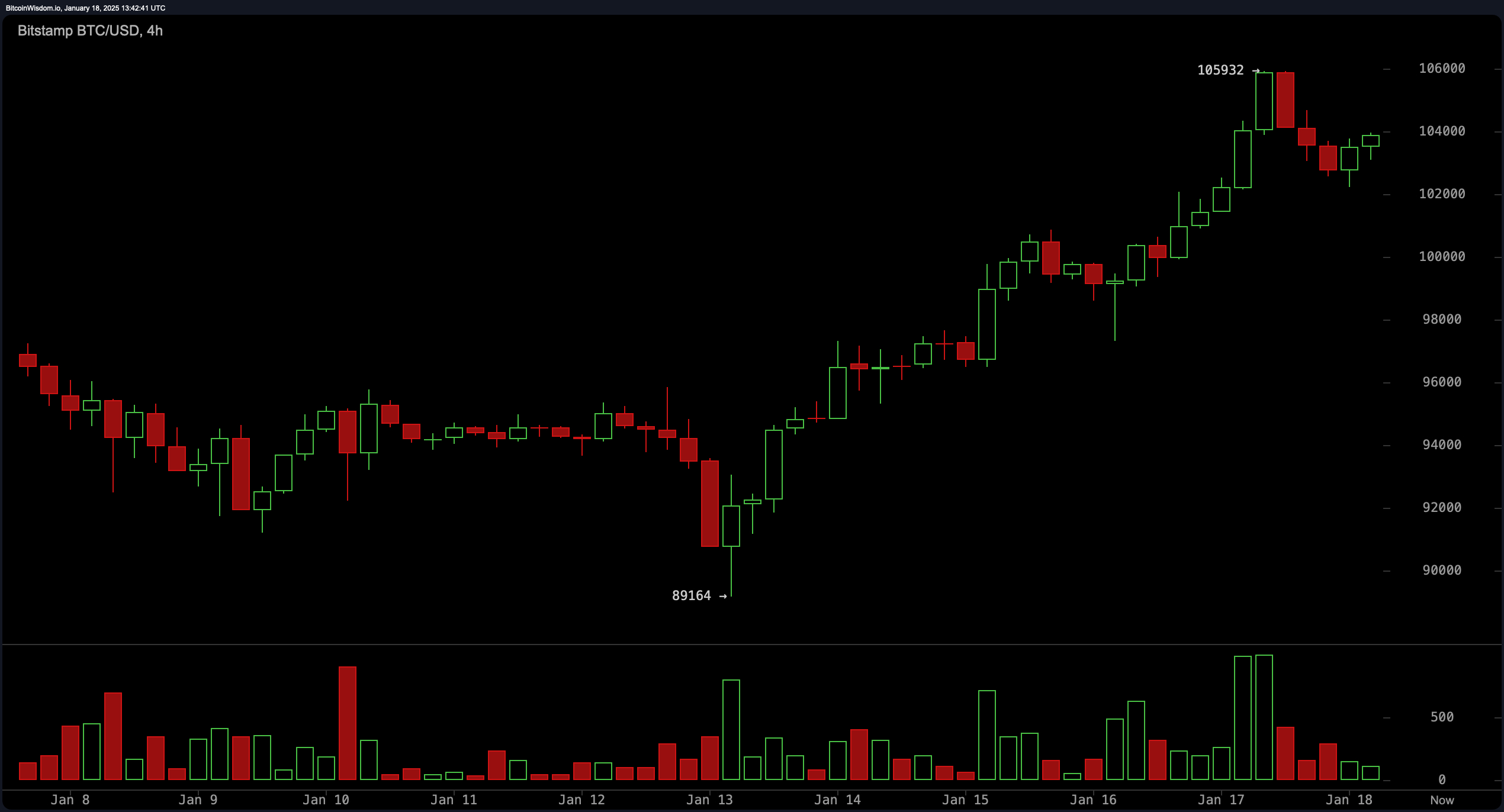

Zooming in on the 4-hour chart, the asset’s bullish momentum persists, underscored by a part of consolidation subsequent to reaching $105,932. This interval reveals a assist degree round $102,000, which correlates with prior resistance, alongside the emergence of a contemporary resistance boundary at $106,000. Elevated buying exercise from Jan. 14–16 suggests an ongoing accumulation part. Merchants specializing in shorter time horizons may discover alternatives to enter positions close to $102,000, with $106,000 serving as a possible profit-taking goal.

BTC/USD by way of Bitstamp on the 4H chart on Jan. 18, 2025.

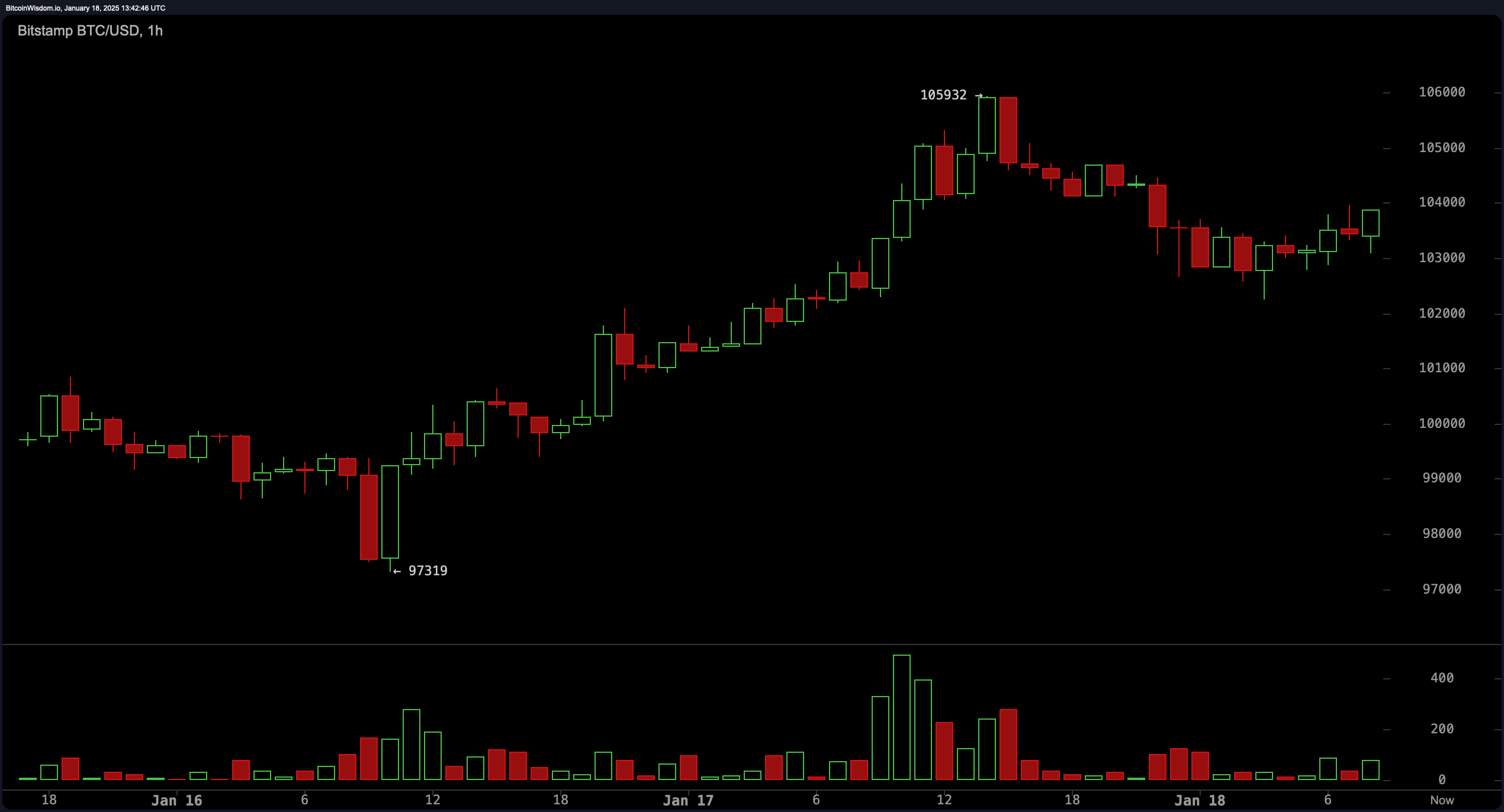

On the 1-hour chart, bitcoin’s short-term momentum displays indicators of moderation after a pronounced advance to $105,932. The next pullback into the $103,000 consolidation zone could current favorable entry factors, contingent upon the integrity of crucial assist ranges. The uptick in buying and selling volumes close to $105,000 factors to elevated promoting exercise, but the broader pattern stays constructive. Intraday merchants could contemplate focusing on $105,000 whereas using disciplined stop-loss measures to mitigate danger.

BTC/USD by way of Bitstamp on the 1H chart on Jan. 18, 2025.

Technical oscillators current a nuanced image: the relative energy index (RSI) at 64 signifies neutrality, whereas the stochastic %Okay at 85 equally displays a balanced stance. The momentum indicator, registering 8,761, helps a bullish bias, as does the shifting common convergence divergence (MACD) at 1,219. Moreover, the alignment of a number of shifting averages—each exponential (EMA) and easy (SMA) throughout 10, 20, 50, 100, and 200 durations—continues to favor sustained upward stress.

In sum, bitcoin’s worth construction reveals a compelling bullish configuration, although merchants could be prudent to observe pivotal resistance ranges and cling to rigorous danger administration protocols, significantly amid the anticipated market volatility surrounding Trump’s impending inauguration.

Bull Verdict:

Bitcoin’s present market construction, supported by constant increased highs and lows, sturdy shopping for momentum, and favorable technical indicators, means that the bullish pattern is firmly intact. So long as key assist ranges, significantly round $102,000 and $98,000, are maintained, the asset stays poised for additional upward motion. A sustained breach above $108,000 may unlock further upside potential, significantly with heightened exercise anticipated within the coming days.

Bear Verdict:

Whereas bitcoin’s total pattern leans bullish, warning is warranted because the asset approaches crucial resistance ranges at $108,000 and $106,000. Any failure to carry assist close to $103,000 or $102,000 may sign a deeper retracement, particularly given the indicators of cooling short-term momentum and elevated promoting stress close to latest highs. Merchants ought to stay vigilant, as intensified market exercise forward of Trump’s inauguration may amplify volatility and disrupt the present uptrend.