Bitcoin‘s swift climb above $64,000 has put many of the business inexperienced. Alongside the remainder of the market, Bitcoin reversed weeks of unfavorable efficiency upon information of the assassination try of former US President Donald Trump.

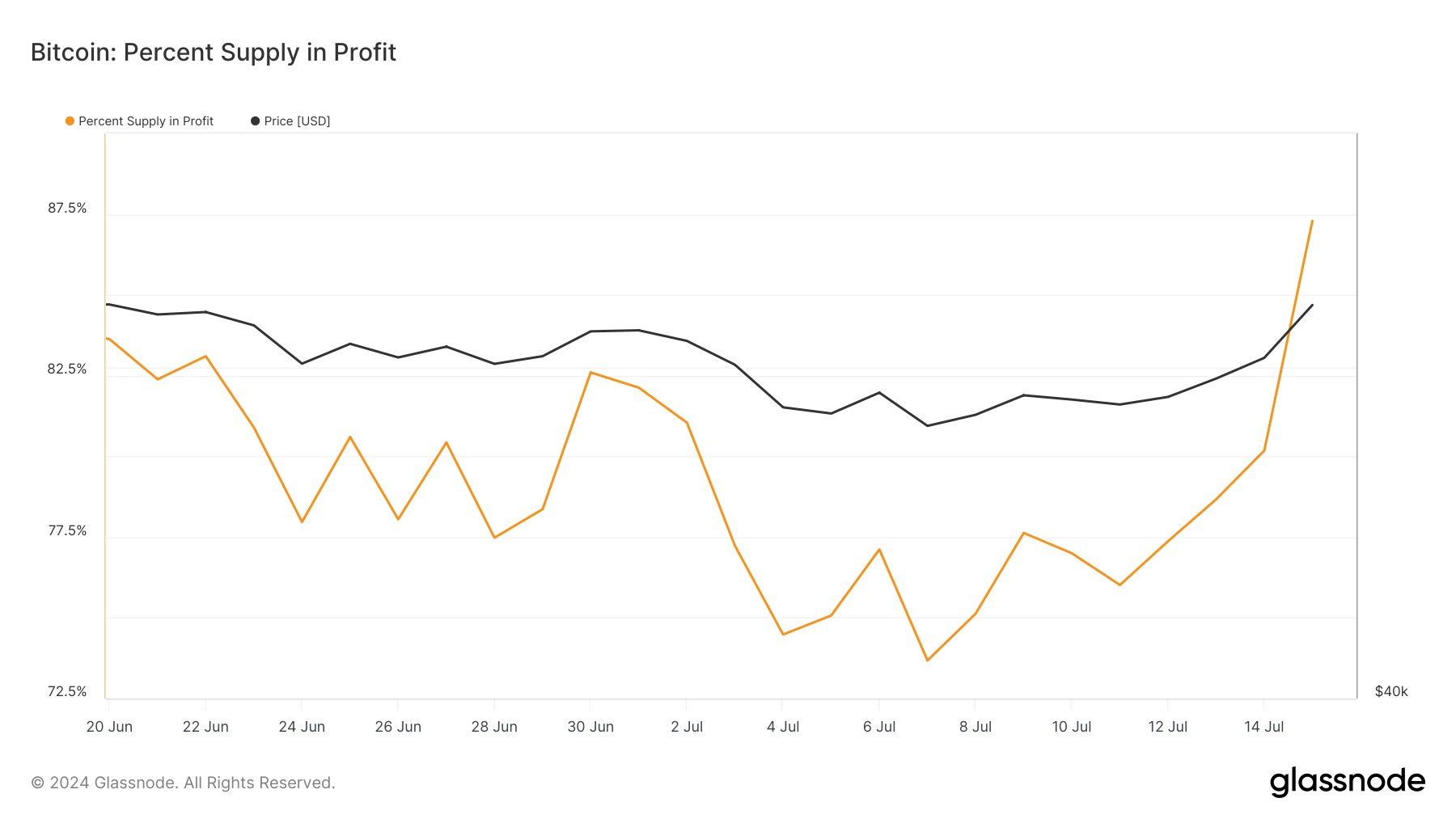

The market’s enhance in profitability might be seen via the proportion of Bitcoin’s provide in revenue. Whereas the metric is easy, it offers a transparent snapshot of the market’s well being and exhibits the distribution of positive factors and losses.

Knowledge from Glassnode confirmed the proportion of provide in revenue elevated from 73.67% on July 7 to over 87.29% by July 15. It represents a major enhance and confirms the extent of the constructive sentiment available in the market. This might probably encourage additional shopping for stress because the market turns into extra worthwhile for a big phase of short-term holders.

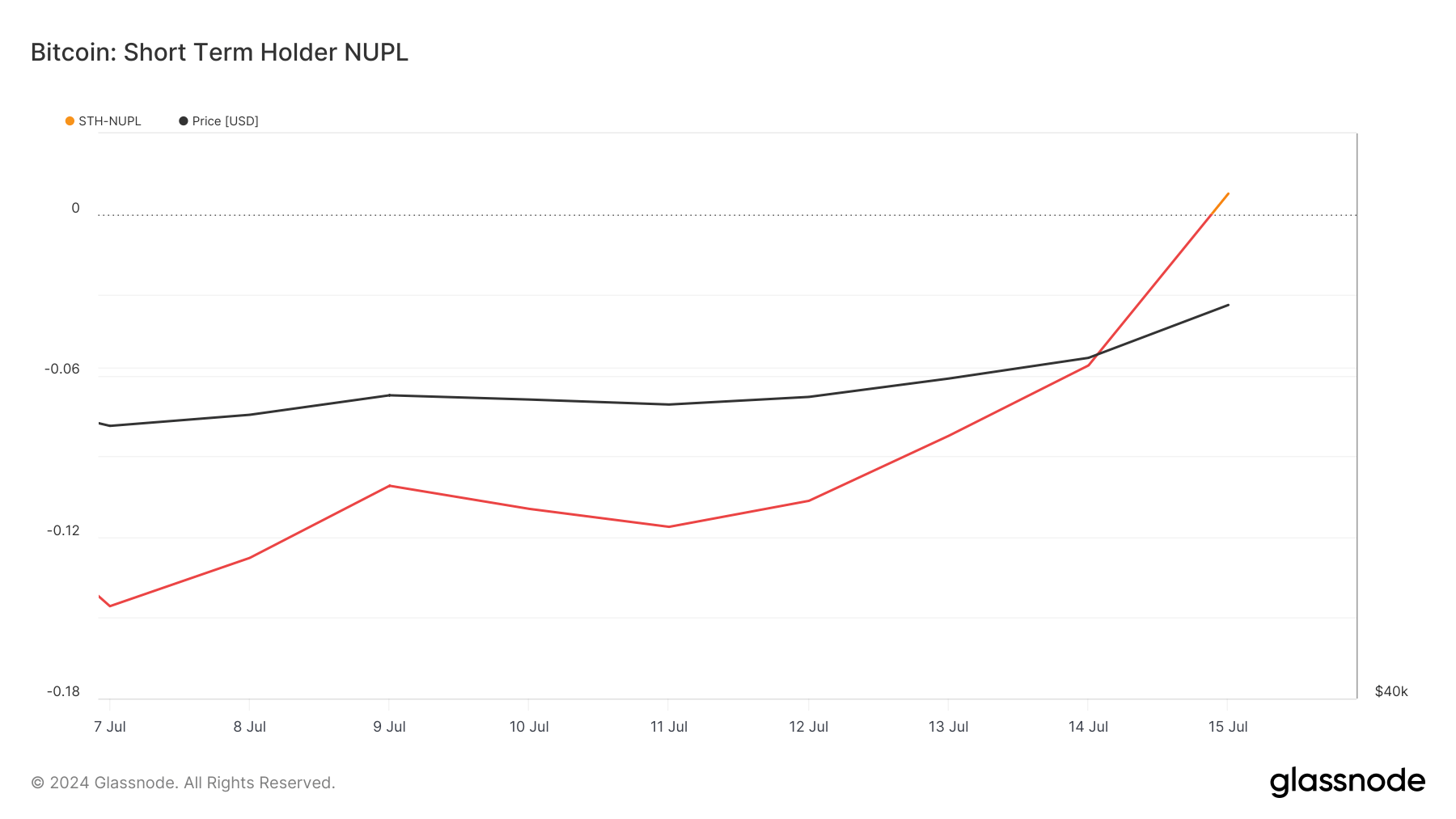

The profitability and sentiment of short-term holders (STHs) are greatest assessed via the online unrealized revenue/loss (NUPL). NUPL measures the distinction between the market worth and the fee foundation of held cash, providing a real-time gauge of whether or not the cohort is in a state of revenue or loss. For STHs, who are usually extra delicate to cost fluctuations and market modifications, a constructive NUPL signifies a positive atmosphere, probably decreasing promoting stress and fostering a extra steady market. Conversely, a unfavorable NUPL may sign misery amongst short-term merchants, rising the chance of promoting and market volatility.

Knowledge from Glassnode confirmed that NUPL turned constructive on July 15 as BTC crossed $64,000. It represents a end result of a gradual enhance we’ve seen over the previous week or so, with STH NUPL rising from -0.1456 to 0.0076. This can be a vital indicator of market restoration and rising optimism amongst current consumers. It means that the market is absorbing new demand successfully, and short-term merchants are starting to see constructive returns on their investments.

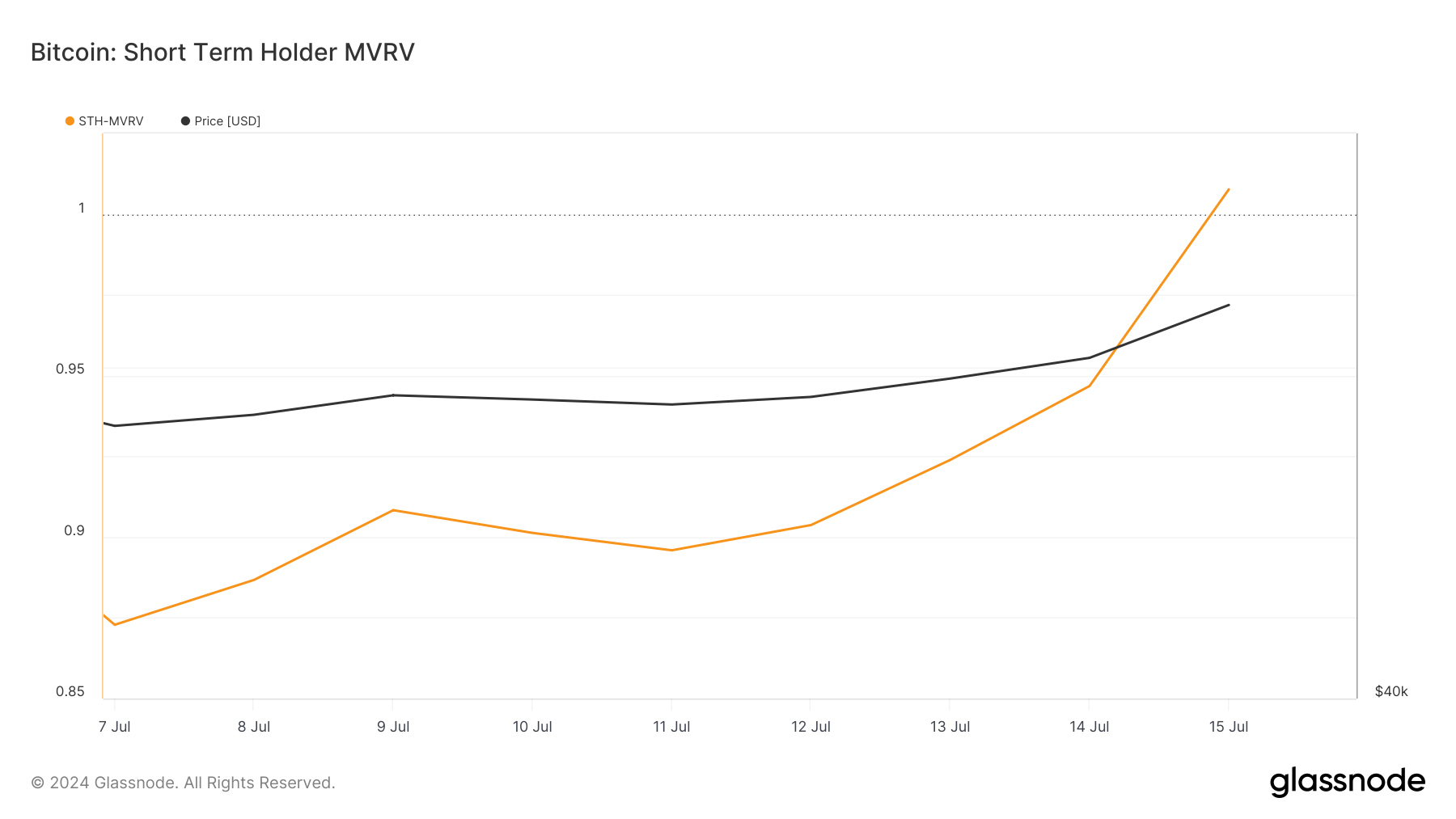

Market worth to realized worth (MVRV) is one other vital metric for assessing STH profitability. It compares Bitcoin’s market worth to its realized worth, offering a ratio that displays the present market circumstances relative to the fee foundation of current investments. An MVRV ratio above 1 signifies that the market worth is greater than the realized worth, suggesting that traders, on common, are in revenue. For STHs, a rising MVRV ratio signifies rising profitability, which might increase confidence and cut back the promoting stress.

Just like the STH SOPR, the STH MVRV elevated from 0.8728 on July 7 to 1.0076 on July 15. This metric transferring above 1 for the primary time since June 20 signifies that short-term holders’ market worth now exceeds their price foundation. This crossover level is a bullish sign, typically suggesting that the market is recovering and short-term holders are gaining confidence as their holdings turn into worthwhile.

The development we’ve seen in each NUPL and MVRV ratios exhibits a major shift within the profitability of short-term holders. The constant rise in these worth and profitability metrics creates a strong basis for the bullish development to proceed within the coming weeks. As extra STHs transfer into revenue, the potential promoting stress they create may lower, permitting for a extra sustained worth enhance.

Nonetheless, a pointy worth correction can probably wipe away this unrealized revenue and push STHs again into the crimson. The reactive nature of this cohort means any unfavorable information might flip the development and create losses.

The put up Quick-term holders get better positive factors as 87% of Bitcoin’s provide now in revenue appeared first on cryptoteprise.