The crypto market lately suffered a big downturn because of the escalating geopolitical tensions within the Center East, with a number of large-cap belongings shedding their recently-accrued good points over the previous week. Particularly, the value of Ethereum crashed from above $2,600 to as little as $2,300 in some unspecified time in the future through the week.

This represents a recent setback for the “king of altcoins,” which has not had a very constructive efficiency up to now few months. Curiously, a preferred crypto pundit on X has come ahead with an on-chain commentary into the habits of Ethereum traders over the past quarter.

How Ethereum Whales Shaving Off Their Holdings Will Influence Worth

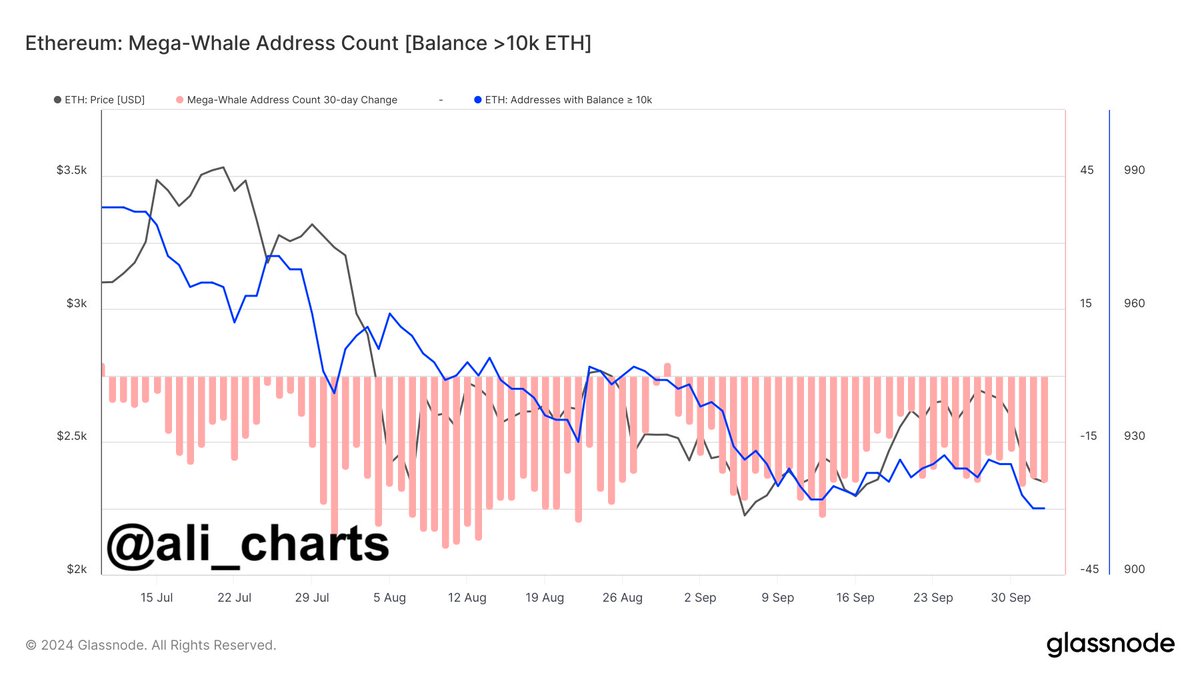

In a current put up on the social media platform X, crypto analyst Ali Martinez revealed {that a} specific group of Ethereum whales has been shaving their holdings over the previous few months. This on-chain revelation relies on the Mega-Whale Tackle Depend, which tracks the variety of addresses holding greater than 10,000 models of a selected cryptocurrency.

Whales discuss with entities (people and organizations) that personal vital quantities of a particular cryptocurrency (Ether, on this case). Buyers normally pay additional consideration to whale actions, as these massive entities are likely to wield notable affect on market liquidity and costs resulting from their substantial holdings.

Supply: Ali_charts/X

Based on Martinez, the variety of whale addresses holding over 10,000 ETH has fallen by greater than 7% since July 2024. This decline within the inhabitants of huge Ethereum holders factors to some redistribution or profit-taking and suggests a notable shift in market sentiment, particularly amongst large-scale traders and institutional gamers.

Curiously, this discount in whale addresses coincided with a interval the place the Ethereum value struggled. Regardless of the approval and launch of spot ETH exchange-traded funds (ETFs), the altcoin’s value fell from above $3,500 in July to as little as $2,200 by August.

As already seen within the token’s value motion over the previous few months, the lower in massive Ethereum holders may diminish shopping for stress on a grand scale, resulting in sluggish value motion. Furthermore, sustained profit-taking actions by these whales may potentiate downward stress on the ETH value.

ETH Worth At A Look

As of this writing, the value of Ethereum sits simply above the two,400 mark, reflecting an insignificant 0.1% lower up to now 24 hours. The cryptocurrency’s efficiency on the weekly timeframe shouldn’t be so insignificant, because the ETH value is down by practically 10% up to now seven days.

The value of ETH rebounds from $2,300 on the day by day timeframe | Supply: ETHUSDT chart on TradingView

Featured picture from Unsplash, chart from TradingView