One of many main breakout successes this yr for the group behind layer-2 blockchain Polygon is Polymarket – the decentralized predictions market the place customers have flocked this yr to put bets on all the pieces from presidential politics to the conclusion of an HBO documentary.

What’s much less clear to crypto analysts analyzing Polygon’s efficiency metrics is whether or not the coup will deliver reduction to holders of the mission’s ailing tokens, down 65% this yr.

Polymarket has soared in reputation amongst mainstream customers, permitting them to make bets on the upcoming U.S. presidential election. Polymarket bettors have added practically $2.4 billion on the query of whether or not Donald Trump or Kamala Harris will win the election in November. Bettors additionally just lately made a market on whom a just lately debuted HBO documentary about Bitcoin would try and establish as inventor Satoshi Nakamoto.

Polymarket is constructed on the Polygon PoS blockchain, and the applying is among the first main natural successes for the group – recognized for a previous advertising technique of paying companions like Starbucks to make use of the community.

So given the applying’s increase in utilization, why has it solely produced a small quantity in greenback figures for the Polygon group, and barely any bump within the value of the native POL token?

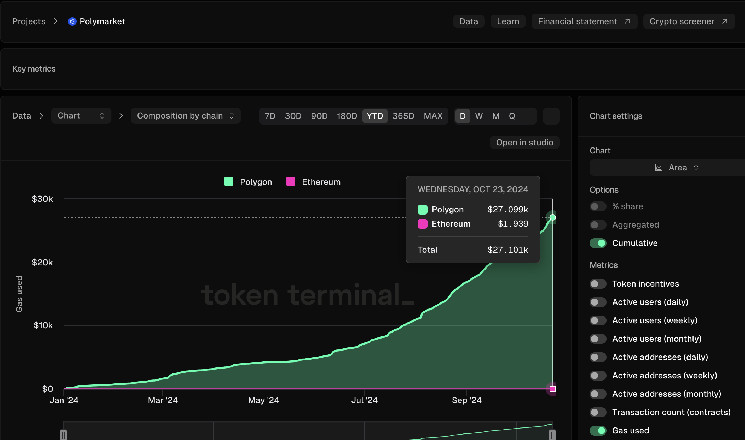

In response to information from Token Terminal, as of Oct. 23, Polymarket has solely introduced in about $27,000 of transaction charges for Polygon PoS in 2024.

The reply, partially, is that the charges are market-based. And these days, transacting on Polygon PoS is extraordinarily low cost.

The typical transaction payment on the Polygon PoS chain on that very same day was $0.007.

Anytime a Polymarket consumer makes a guess, they’re making a transaction on Polygon PoS. As a part of these transactions, they pay charges to Polygon PoS, which is cut up up right into a base payment and a precedence payment. The bottom payment doesn’t go in direction of validators; as an alternative it’s burned – despatched to a null tackle that theoretically ought to profit tokenholders by serving to to cut back the availability.

“That base payment is adjustable and it is based mostly off of community congestion,” Polygon Labs CEO Marc Boiron advised CoinDesk in an interview. “In order the community will get extra congested, that base payment will increase.”

The precedence payment is paid out to a validator.

“You are paying the validator to say, Please embrace me in a block,” Boiron added. “The upper a payment you pay, the sooner the validator will embrace you in a block if there’s extra congestion.”

If there’s ample blockspace, there’s much less of a must pay up.

One other challenge is that, within the grand scheme of issues, whereas Polymarket’s bettors are fairly lively, the quantity of transactions does not come near the extent of high-intensity purposes like decentralized crypto exchanges (DEXs).

Up to now this month, 5.2% of transactions on the Polygon PoS chain got here from Polymarket, in accordance with Polygon’s analysis group. Chainlink makes up 10.38% of transactions on PoS, whereas transfers of the stablecoin USDT make up 4.89%.

Simply to take the instance of a current day’s exercise. On Oct. 23, Polymarket accounted for about 8% of the “gasoline” used on Polygon PoS, based mostly on information from the blockchain explorer PolygonScan. That made it the most important particular person contributor. In blockchain terminology, gasoline is a measure of the computational depth required for any given batch of transactions.

“I take a look at the way it’s constructed,” Boiron stated. “I’d by no means count on quite a lot of charges from Polymarket, as a result of it does not have an enormous quantity of composability, like Uniswap. It has some, however not lots. It is actually simply customers coming there. They’re executing a transaction, after which stopping. So it is inherently by no means going to drive that a lot till, like, the variety of customers goes approach up.”

Consideration is the reward

Polygon for lengthy has appeared for its mainstream breakthrough second, pouring tens of millions into the partnerships with Starbucks and Meta to attempt to deliver Web3 to the lots. These offers by no means actually took off.

The Polygon group is inspired by the big consideration that Polymarket has been getting, hoping the eye will feed into larger numbers within the wider Polygon ecosystem.

Boiron advised CoinDesk: “The query is, like, why is Polymarket so attention-grabbing if they’re solely bringing $20K? The apparent motive is simply, let’s name it consideration.”

The success exhibits that “you possibly can have an amazingly profitable app on Polygon PoS that, like you possibly can, you hardly even know that you simply’re utilizing a blockchain,” he stated.

To look on the brilliant aspect, “Paying solely $20K in transaction charges, frankly, simply displays how low cost it’s to make use of Polygon PoS,” Boiron stated.

The natural explosion of Polymarket has contributed to Polygon’s success due to the eye it brings to the ecosystem, he stated.

“Totally different purposes have totally different roles,” Boiron stated. “For me, Polymarket’s position consists of: We’re giving them tremendous low cost transactions that make it very easy. And a focus is the factor – that’s the worth add – that Polymarket brings for us.”

“Now, that is very totally different from, to illustrate there’s anyone who comes and builds an order e book DEX on Polygon PoS,” he stated. “In the event that they have been doing $20,000 of charges over a number of months, it will be an enormous failure, since you would count on large numbers of orders positioned and canceled and stuffed, then that might drive large numbers of transactions. So the important thing right here is like, totally different purposes have totally different meant functions.”

Learn extra: Polymarket Reportedly Seeks $50M in Funding, Mulls Token as Election Bets Surge