Polymarket continued to rebuild its bets, reaching a complete of $10B in cumulative prediction positions. The platform stays among the many prime 5 Polygon apps, driving USDC utilization after increasing into small-scale bets with a bigger variety of energetic wallets.

Polymarket reached a milestone of $10B in complete prediction positions, after recovering from the November 7 lows. The app faces bans and restrictions on one aspect, and a rising person base with predictions on present occasions. This has allowed Polymarket to thrive and faucet each whale bets and small-scale customers.

All of the predictions had been posted immediately on Polygon as token trades, additionally serving as a take a look at to the Polygon POS community. In consequence, the Polygon every day transactions elevated from round 1M on the finish of October to over 3.4M since November. The transaction rely expanded prior to now 4 weeks, from a baseline of 3M transfers to over 3.5M every day transactions.

Polymarket retains drawing in small-scale predictions past the US election

Polymarket invitations greater than 54,000 energetic every day customers, primarily based on DappRadar information. Pairs and outcomes appeal to each large-scale whales and small-scale customers with bets below $10. The app permits for the putting of bets in markets valued below $2,000. Over time, the wager decision time can be changing into shorter, tapping occasions which may be resolved inside days. Median decision time in January is all the way down to 3-4 days, inviting bets on dynamic occasions from social media with a transparent decision deadline.

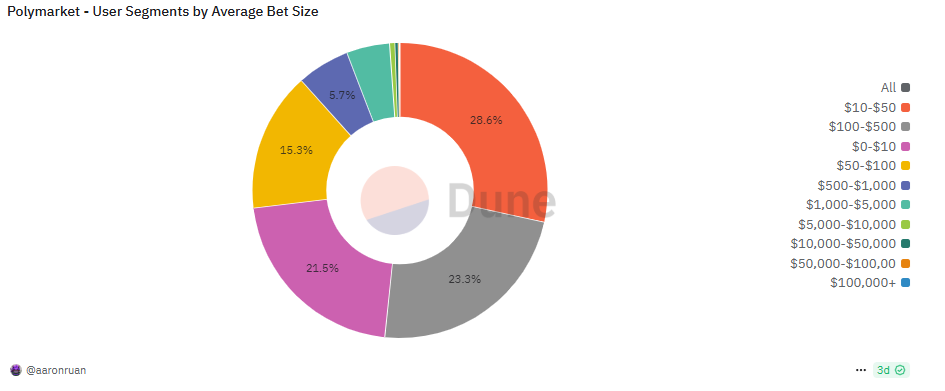

Polymarket drew in a number of segments with small-scale bets below $500, with a big share of bets below $10. | Supply: Dune Analytics

The smaller markets led to an enlargement of wallets that wager on 5 or extra end result pairs. The sustainable demand for extra predictions helped Polymarket regroup after the focus of customers to at least one or two prime markets. The influx of customers continues, regardless of the same old ratio of greater than 84% of the wallets holding unrealized losses. The excessive unrealized loss and determination ratio additionally means the $10B in bets concentrated within the palms of a small subset of customers with odds ranging between 11% and 16% on common.

The most important segments of prediction patrons are within the bets below $10, between $10 and $100 and $100 to $500. The bottom bets are thought of a bid to obtain an airdrop primarily based on engagement.

Bets for non-election predictions even have a smaller common measurement of $178. The presence of whales and large-scale patrons expanded election bets to a median of $292. These bets had been distributed over a person base of over 4M cumulative distinctive addresses.

After the tip of the largest bets on the US elections, new customers that by no means predicted these markets flowed into the app. As much as 48.8% of customers after November 6 made solely non-election bets, driving sports activities, present occasions, crypto and different pairs. Complete customers are nonetheless near the best degree for the previous three months.

The small-scale bets and the influx of customers is seen as a response to new betting proposals, and as an try to realize entry to an eventual Polymarket airdrop.

Will Polymarket revive POL?

The success of Polymarket raises questions on the Polygon native token, POL. The asset has been sliding since its rebrand from MATIC, however there are expectations for a breakout.

POL just isn’t used to make predictions, however is required to pay gasoline charges for all apps. The token lags after video games and NFT collections slowed down on the legacy chain.

The November peak for Polymarket boosted POL to a neighborhood peak above $0.70. At the moment, POL is at round $0.44, with expectations for a neighborhood backside. Analysts see POL escape to repeat the 2021 rally.

At the moment, round 87% of the tokens are swapped, with among the property caught on exchanges that haven’t cooperated with the crew.

Land a Excessive-Paying Web3 Job in 90 Days: The Final Roadmap