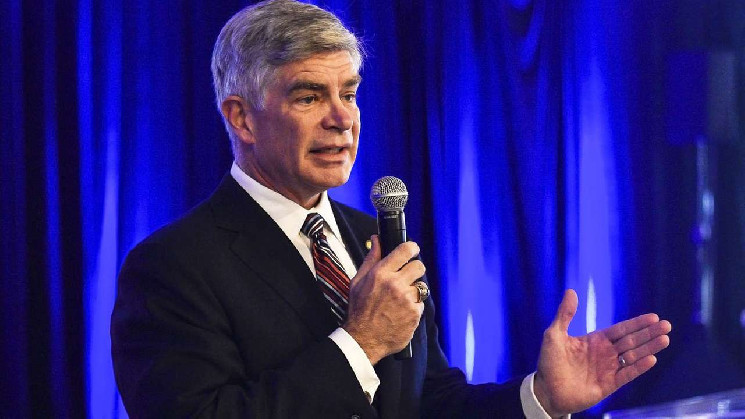

Philadelphia FED President Patrick Harker mentioned in the present day that the US Federal Reserve could reduce its benchmark rate of interest as soon as this yr if its financial forecasts come true as anticipated.

At an occasion hosted by the regional central financial institution in Philadelphia, Harker outlined his baseline situation of slowing however above-trend financial development, a modest improve within the unemployment charge and a “lengthy float” for inflation towards the goal. “If all this occurs as predicted, I feel a charge reduce by the top of the yr could be acceptable,” Harker mentioned.

The FED saved rates of interest unchanged at 5.25-5.50% ultimately week’s coverage assembly. This resolution is a part of the Fed’s ongoing efforts to carry inflation again to its 2% goal charge. As of April, inflation was operating at an annual charge of two.7%, in line with the Fed’s most well-liked measure.

Whereas Harker welcomed final week’s Shopper Worth Index knowledge, he famous that progress in inflation to date this yr has been modest. Harker emphasised that given the final volatility within the financial surroundings, extra knowledge will have to be analyzed within the coming months earlier than making a call.

Harker additionally argued that the FED ought to maintain its coverage charge unchanged for now to cut back upside dangers. These embody the potential long-term persistence of excessive housing inflation and the persistently excessive inflation charge within the service sector, particularly auto insurance coverage and repairs.

However Harker didn’t rule out altering his view on rates of interest as extra financial knowledge turns into accessible. “If the info adjustments a method or one other, I see it as fairly doable there will probably be two reductions or no reductions for this yr, we are going to keep on with the info,” Harker mentioned.

At its final coverage assembly, the median forecast of the Fed’s 19 policymakers was for a single charge reduce this yr. Monetary markets presently count on two rate of interest cuts by the top of the yr.

*This isn’t funding recommendation.