Whereas Bitcoin (BTC) dropped to $63,400 in the course of the week, it began to recuperate yesterday night and rose above $67,000 once more.

Whereas a higher rise in Bitcoin is anticipated, information on Private Consumption Expenditures (PCE), which is carefully adopted by the FED when making rate of interest selections and is taken into account a number one inflation indicator, has been introduced.

Accordingly, all information introduced concerning private consumption expenditures in June had been as follows:

Core Private Consumption Expenditures Worth Index (Annual) Introduced 2.6% – Anticipated 2.5% – Earlier 2.6%

Core Private Consumption Bills Worth Record (Month-to-month) Introduced 0.2% – Anticipated 0.2% – Earlier 0.1%

Private Consumption Expenditures Worth Index (Annual) Introduced 2.5%– Anticipated 2.5%– Earlier 2.6%

Private Consumption expenditures Worth Index (Month-to-month) Introduced 0.1% – Anticipated 0.1% – Earlier 0.0%

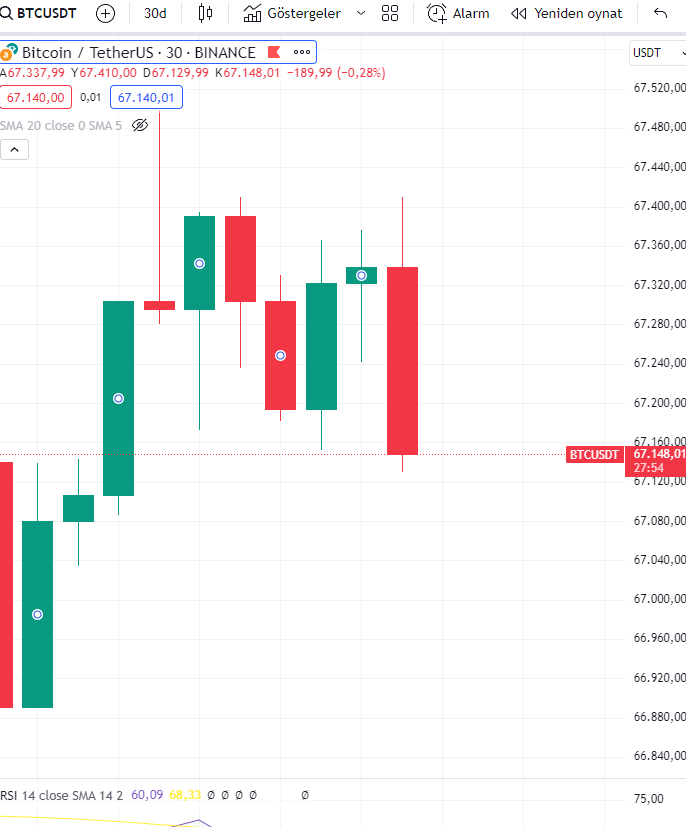

What Was Bitcoin’s Preliminary Response?

Curiosity Charge Reduce Expectations Proceed!

Whereas it’s now sure that the FED will make its first rate of interest minimize in September following optimistic inflation information, it’s thought that an rate of interest minimize in July will likely be untimely.

In response to CEM FedWatch, the chance that the FED will hold rates of interest fixed on July 31 is priced at 93.3%, whereas the chance of an rate of interest minimize in September is priced at 87.7%.

*This isn’t funding recommendation.