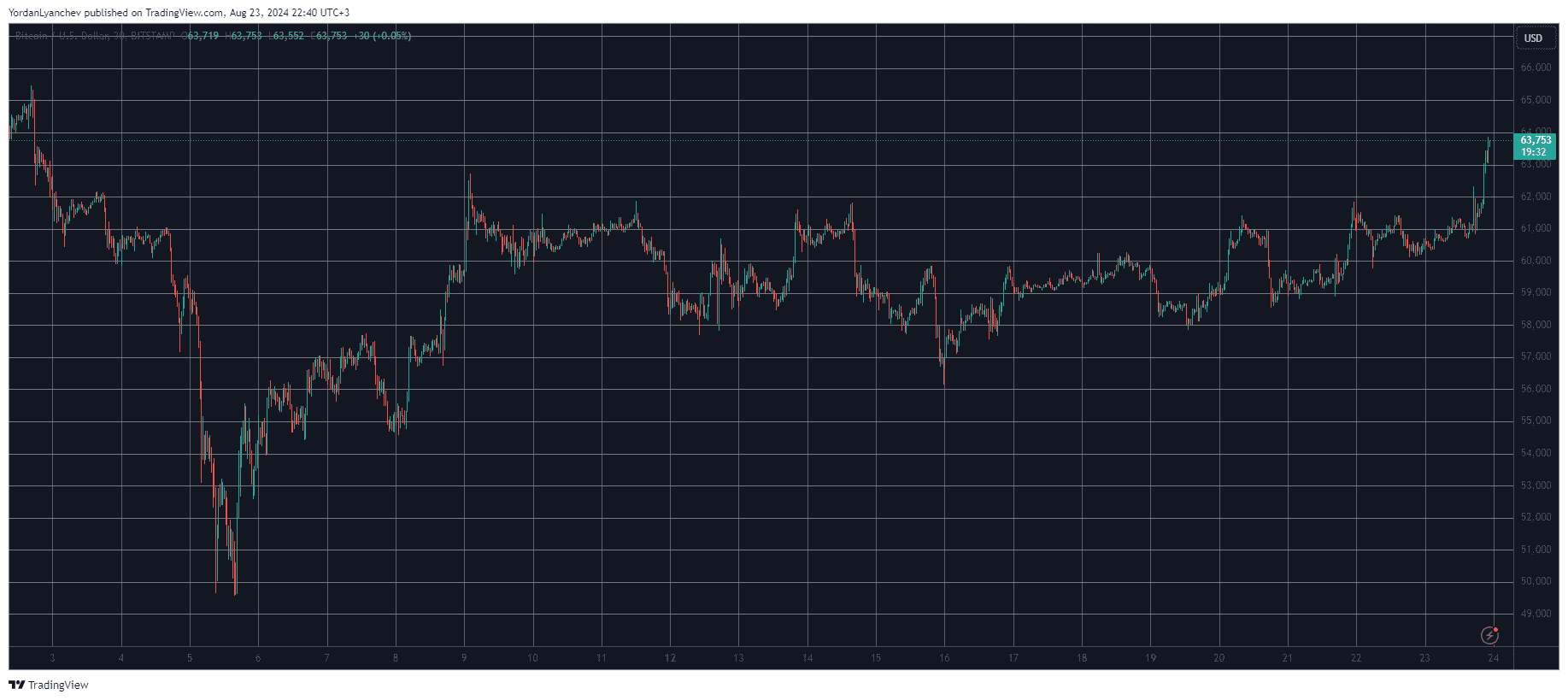

The enterprise week ends with excessive ranges of volatility as bitcoin’s value soared to nearly $64,000 for the primary time for the reason that begin of the month.

This rally, which was principally mimicked by the altcoins, was presumably fueled by the newest developments on the US entrance and its central financial institution specifically.

CryptoPotato reported earlier at this time that BTC had maintained above $61,000 after yesterday’s failure to beat $62,000. Nonetheless, the asset touched that degree earlier at this time after Fed Chair Jerome Powell stated it’s time for the US central financial institution to begin reducing the rates of interest, just like what the ECB and the Financial institution of Canada did in the course of the summer time.

After a direct retracement towards $60,000, the first cryptocurrency headed north as soon as once more an hour in the past. This time, the asset flew previous $62,000 and $63,000 and neared $64,000 to chart a 3-week excessive.

That is probably as a result of decrease rates of interest on the planet’s largest financial system would imply simpler entry to funds that might be allotted towards risk-on belongings like cryptocurrencies.

Most altcoins have additionally produced spectacular positive factors up to now day or so. Ethereum has surged by simply over 5% and now sits near $2,750. DOGE, AVAX, SHIB, DOT, and LINK have added between 5-8% as nicely.

Much more spectacular positive factors come from the likes of NEAR (12%), STX (10%), TAO (12%), APT (11%), FET (22%), and SUI (19%).

This substantial volatility has harmed quick merchants as the whole worth of liquidated positions has risen to over $130 million, with shorts dominating the charts.

Simply shy of 55,000 merchants have been wrecked up to now day, in line with CoinGlass.