NFTs are securities — or so the SEC appears to be making ready to argue in court docket, with OpenSea the potential defendant.

Placing apart the deserves (or lack thereof) of a case towards the agency, most NFT exercise occurs elsewhere nowadays.

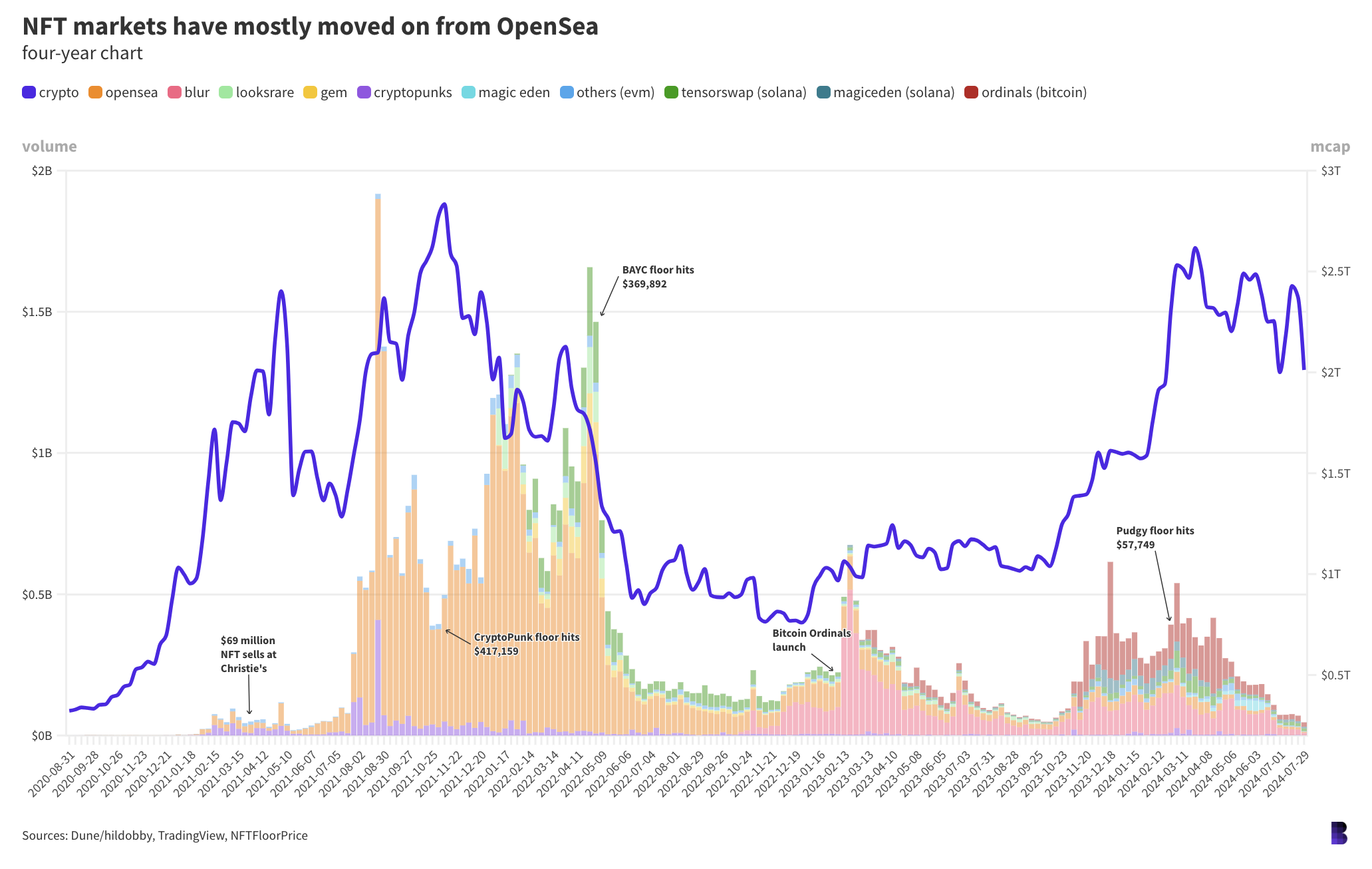

The chart under plots US-dollar denominated buying and selling volumes for NFT marketplaces on EVM chains, proven by the colourful columns within the background. Crypto’s complete market cap is in any other case mirrored by the blue line.

It contains NFT trades on Ethereum, Base, Blast in addition to Solana and Bitcoin, over the previous 4 years.

The information factors to over $62.75 billion in NFT commerce volumes since August 2020, with OpenSea facilitating almost 58% of it.

A take a look at simply the previous 12 months reveals a complete of $11.37 billion in NFT buying and selling quantity. OpenSea, primarily based in New York, solely contributed 10% of these trades.

Blur alone processed $3.75 billion, about one-third of the full, whereas Solana marketplaces Tensorswap and MagicEden made up 6.6% and eight%, respectively.

If we bundle all Ordinals buying and selling underneath one umbrella, $3.8 billion in Bitcoin-native collectibles have been traded prior to now 12 months (up till the beginning of August), making up virtually 34% of yearly quantity. Ordinal volumes are proven at the hours of darkness crimson columns on the chart.

(EVM knowledge was sourced from this Dune dashboard by consumer @hildobby, and from right here for the Solana quantity. The Bitcoin knowledge got here from CryptoSlam.)

(Each hildobby’s knowledge and CryptoSlam filter out volumes suspected to be the results of wash buying and selling, so precise onchain volumes are greater, however this could mirror natural buying and selling exercise for a lot of the NFT market.)

NFTs going their very own approach (NGTOW)

Granted, a loss for OpenSea would in all probability bode poorly for different NFT marketplaces.

So there’s nonetheless room for the SEC to “shield traders,” because the company sees it, even when that’s develop into a meme within the crypto area.

It’s unproven whether or not a securities ruling would put an finish to NFTs as a precious idea in crypto. It might probably simply drive artists, issuers and different creatives to distance themselves from their work, avoiding a move of the Howey check.

Maybe, within the worst case, there may very well be much less incentive for enterprise capitalists to ape into numerous NFT ecosystems — particularly if the promise of future positive factors from the efforts of others have been really not a part of the attract. And there’s extra to crypto than enterprise capital, even when it may not appear that approach at occasions.

In any case, NFTs have lengthy been a simple goal for haters. Barring the extra ridiculous use circumstances — from burning artworks to tokenizing farts in jars — even the preferred NFT markets are normally a lot much less liquid than prime fungible cryptocurrencies, to not point out a lot smaller.

This normally makes them much more vulnerable to mini bubbles and other forms of manias. Which attracts a variety of consideration, each optimistic and damaging.

It may very well be that NFT markets are following their very own cycle schedules, probably separate from the remainder of the crypto market.

NFTs have solely been traded with any actual measurement for 3 years, with its largest cycle to this point principally occurring throughout the first.

Blur (in coral pink on the chart above) reignited a number of the hearth when it launched late 2022. Bitcoin did it once more by means of Ordinals. And whereas these volumes have just lately dried up, sillier issues have occurred in crypto than NFTs discovering sustained market curiosity.

Except the SEC ruins the enjoyable for everybody with its potential OpenSea case, that’s.

If solely it had rained on the parades of Sam Bankman-Fried, Alex Mashinsky, Su Zhu, Kyle Davies and Do Kwon a little bit earlier. Possibly we’d nonetheless be within the throes of NFT mania.