The final time the DXY index was above 103, it was in the course of the Yen carry commerce unwind again on Aug. 5 when bitcoin dropped to $49,000.

Over 94% of the bitcoin circulating provide is now sitting in revenue, historic information inform us profit-taking ought to begin to construct up.

Bitcoin {BTC}}, the biggest token by market cap, has surged 12% this week, seemingly setting the stage for a report excessive within the coming weeks.

The anticipated progress towards new highs, nevertheless, could also be sluggish resulting from profit-taking. That is as a result of information tracked by Glassnode present roughly 5% of the BTC circulating provide is in loss, whereas the remainder of 95% is in revenue.

The latter means there may very well be promoting strain from worthwhile holders liquidating their cash in a rising market.

Traditionally, bitcoin has confronted promoting strain, leading to value corrections, at any time when the % of provide in revenue has crossed the 94% threshold.

Lengthy-term holders (LTH), outlined by Glassnode as these holding cash or not less than 155 days, may very well be the one taking earnings, residing as much as their fame of being good merchants or people who purchase when costs are depressed and promote right into a rising market. As of writing, LTHs maintain solely 500,000 BTC at a loss, which is a small fraction, contemplating they maintain 14 million BTC as a cohort.

In the meantime, short-term holders presently personal 235,000 BTC at a loss, the bottom since March throughout bitcoin’s all-time excessive.

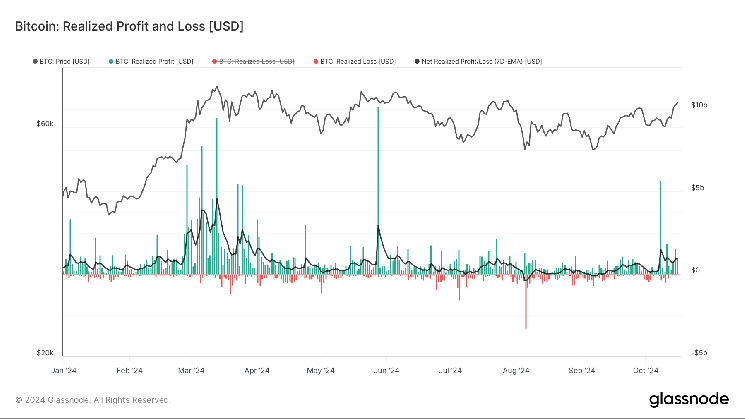

Revenue-taking has begun

Realized revenue has elevated over the previous week, signaling revenue taking from some buyers.

Glassnode information reveals that over $11 billion in realized revenue has taken place in simply over every week, with $5.6 billion on Oct. 8 alone, making it the only greatest profit-taking day since Might 28.

Robust momentum

Two elements present the true power of this rally: bitcoin dominance making new cycle highs and approaching 60%, which was final seen in April 2021.

As well as, BTC stays resilient even because the DXY index continues to climb increased, now above 103.5. The final time the DXY index was above 103 was in the course of the yen carry commerce unwind on Aug. 5, which despatched bitcoin plummeting from $65,000 to $49,000 over a number of days.