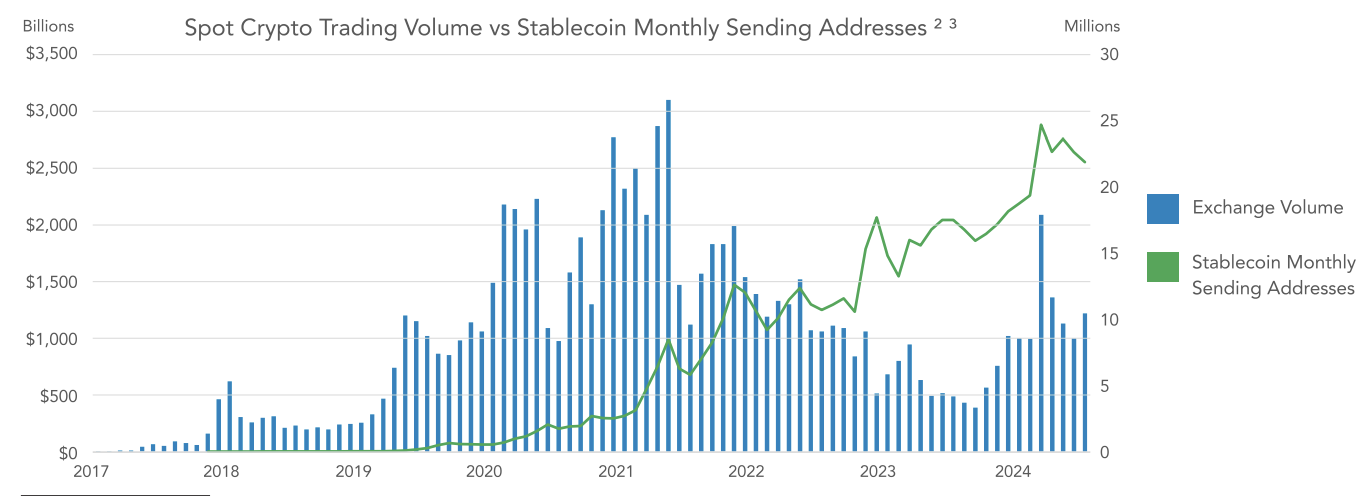

Stablecoins are having a second, that a lot is evident.

As the remainder of crypto trades sideways, the market capitalization of stablecoins has steadily elevated. It sits now at $170 million, per rwa.xzy, although there was a slight dip over the previous few days.

Fort Island Ventures, alongside Artemis, Visa and Brevan Howard Digital made a brand new survey that appears into the prevalence of stablecoins in sure rising markets. The survey regarded into roughly 2,500 crypto customers in Nigeria, India, Turkey, Indonesia and Brazil.

“Our survey outcomes contradict the frequent perception that stablecoins are completely used as a instrument for the speculative buying and selling of crypto property. Forty-seven % of crypto customers surveyed checklist saving in {dollars} as their stablecoin goal, 43% cited environment friendly forex conversion and 39% mentioned yield era. Getting access to crypto exchanges stays the highest use case for these surveyed, however an extended tail or bizarre (non-crypto) financial actions is clear as effectively,” the report mentioned.

Learn extra: Stablecoins are ‘a greater product’ than native currencies in rising economies, Carrica says

“The findings are clear: non-crypto makes use of account for a significant share of stablecoin utilization modes within the nations surveyed.”

Supply: Fort Island Ventures, Artemis

Nic Carter of Fort Island Ventures advised Blockworks he’s been interested by monitoring the info as a result of he wished to raised perceive how of us are utilizing stablecoins.

From right here, Carter will take the findings to Washington DC. Lawmakers on Capitol Hill, and numerous US officers, have been fairly vocal about their stablecoin opinions. There’s additionally a push from Senators Kirsten Gillibrand and Cynthia Lummis to introduce laws round stablecoins.

“When you’re taking a look at rising markets, this can be a case of forex substitution the place financial savings could be held within the naira or the Turkish lira or the Indian rupee, and it’s truly being transformed into the greenback,” Carter defined.

“So this can be a optimistic shopping for stress for the greenback and all of the greenback property that the stablecoin issuers maintain (that are Treasurys). So my level is: It is a movement into the greenback. It’s a brand new supply of demand. It’s very significant, and clearly it’s supportive of US pursuits.”

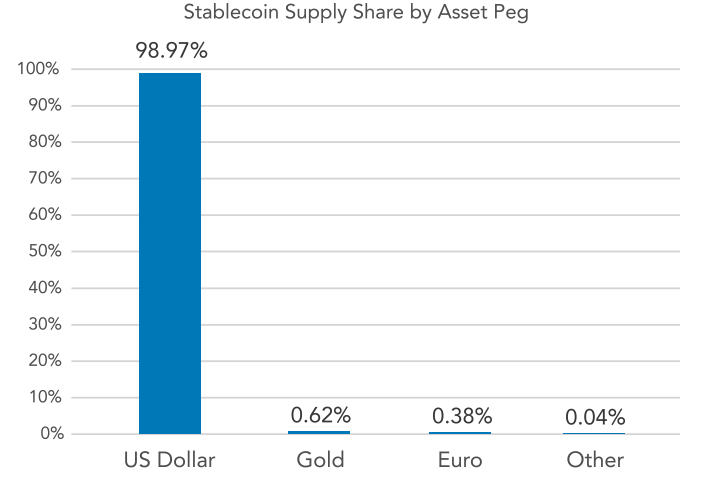

Supply: Fort Island Ventures, Artemis

However whereas it might impress US lawmakers, these in, say, Nigeria may not be as thrilled with a number of the outcomes. As we’ve beforehand reported, Nigeria grew to become extra hostile towards crypto earlier this 12 months, detaining two Binance executives (American Tigran Gambaryan continues to be being held within the nation), and charging Binance with tax evasion and cash laundering.

Nigeria’s makes an attempt to control the business have maybe not been as profitable because the nation hoped, primarily based on the info snapshot from the report. The survey occurred from Might to June earlier this 12 months, with some onchain information being gathered via July. Nigeria arrested Gambaryan on the finish of February.

“Nigerians love stablecoins,” Carter famous. Maybe the nation even has a proper to be “paranoid,” provided that the complete survey outcomes present that Nigeria got here out on prime in each class.

Customers within the nation “transact most ceaselessly, stablecoins compose the most important share of respondent portfolios, they report the best share of non-crypto-trading makes use of for stablecoins, and so they keep the best self-reported data of stablecoins,” the report acknowledged. Different nations equivalent to Turkey had totally different makes use of for stablecoins (the report discovered that Turkish customers have a tendency to make use of them to earn yield, with buying and selling intently following).

“I feel there truly is a crypto dollarization occasion taking place in Nigeria, so far as I can inform, the place individuals are actively deserting the naira and going to {dollars} by way of stablecoins. I feel that is ongoing. It’s the primary actual crypto dollarization occasion,” Carter advised me.

He did warn that he’s unsure when you can “quantify that 15% of [naira’s] devaluation is because of crypto,” particularly provided that the survey focused crypto customers. However the outcomes present that maybe Nigeria has a proper to indicate concern.

Nigeria apart, the research was capable of present that stablecoins, when utilized by some in rising markets, permit entry US greenback publicity, which might be interpreted as a boon for the US.

However, as acknowledged above, there isn’t presently a regulatory framework for stablecoin issuers, whilst Circle — the agency behind USDC — seeks to go public. However Carter additionally thinks that the issuers are “stymied” as a result of none of them can subject interest-bearing stablecoins.

“All the curiosity bearing stablecoins, they’re issued abroad,” he mentioned. Carter pointed to Paxos, which has an interest-bearing stablecoin in Dubai regardless of being a US-based firm. Choices from Mountain Protocol and Ethena are additionally offshore.

“…I do assume that the interest-bearing stablecoins will out-compete the bizarre ones on the margin with time. To allow them to’t do this within the US, as a result of the [Securities and Exchange Commission] is so adamant that it makes it a safety, proper? In order that’s one of many points that’s…hobbled us for now,” Carter defined.

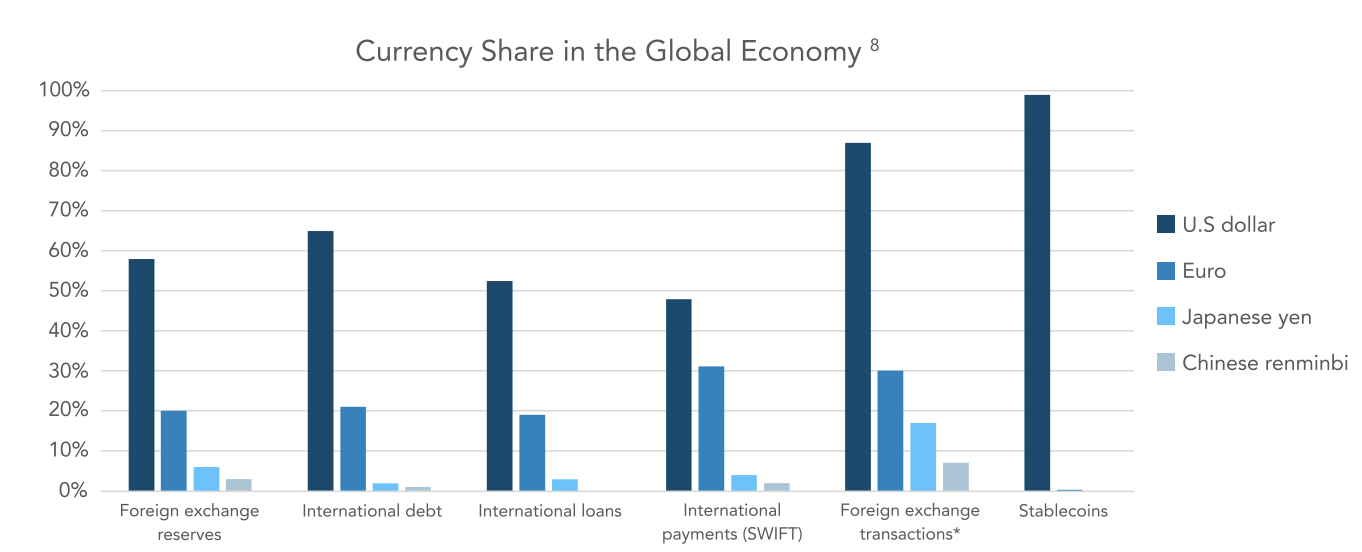

The report factors on the market’s not one single reply to deal with why stablecoins are so closely dollarized.

“The US greenback is the worldwide reserve forex however in no different class of utilization does it dominate to the identical extent it does with stablecoins,” it identified.

However there’s no denying that it appears to have hit its mark with stablecoins. Now time will inform if the US will make the most of that.