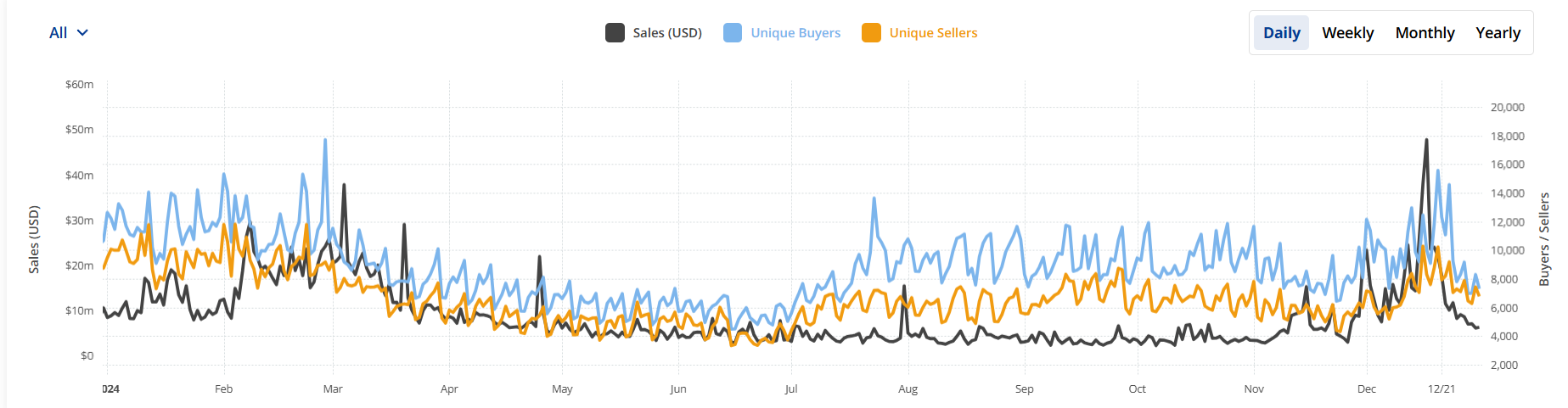

Ending the yr on a excessive observe, December’s gross sales of non-fungible tokens climbed to $877 million, making it the second-best month in 2024.

Blockchain-based digital collectibles had a robust December, with $877 million in gross sales, making it the second-best month of 2024. This increase wrapped up a wild yr for the NFT market, which noticed a pointy restoration within the final quarter.

CryptoSlam knowledge reveals that NFT gross sales for 2024 completed at $8.83 billion, surpassing 2023 by over $100 million. Whereas the 1.1% development won’t appear big, it highlights the market’s potential to bounce again after months of falling gross sales.

NFT gross sales in 2024 | Supply: CryptoSlam

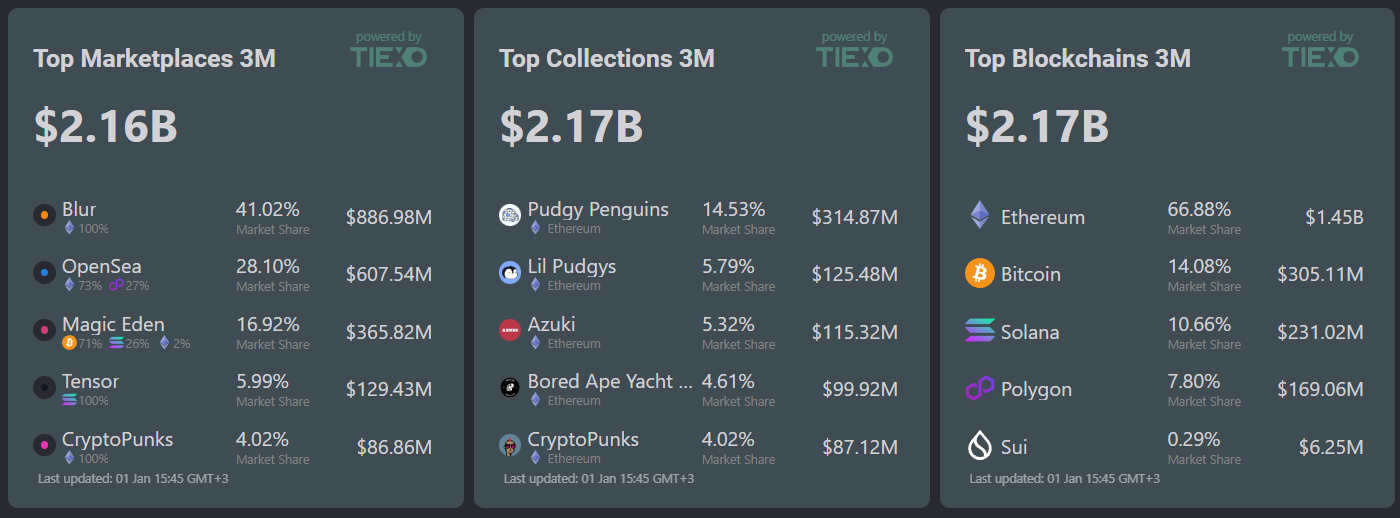

December stood out, due to Ethereum-based collections like Pudgy Penguins, Azuki, and Bored Ape Yacht Membership, knowledge reveals. Ethereum NFTs led the month, bringing in $488.4 million of the overall gross sales, in response to NFT Value Ground knowledge. Pudgy Penguins took the lead, with over $285 million in buying and selling quantity, whereas different collections like Lil Pudgys and Azuki collectively added one other $222 million.

In a commentary to crypto.information, Nicolás Lallement, co-founder of NFT Value Ground, famous that the NFT market had a “sturdy Q1 2024 for each Ordinals (Bitcoin) and Solana NFT collections,” including additional {that a} “repricing of Ethereum-based collections was lengthy overdue.”

“As a set off for that repricing we have now the present ‘token hooked up to NFTs’ meta. Initiatives like Pudgy Penguins, Doodles, and Azuki have both launched or introduced plans for meme/L2 gov tokens, which have pushed important curiosity and repricing in blue-chip NFTs.”

Nicolás Lallement

Lallement factors out that the repricing “isn’t solely pushed by airdrops” as many NFT holders “have shifted earnings from speculative memecoin trades into long-term conviction performs, favoring high quality collections.” He says the development has been “notably noticeable on Ethereum, given the truth that it’s residence to essentially the most consolidated set of blue chip collections.”

“Waiting for 2025, I anticipate a trickle-down impact that may profit the whole NFT ecosystem. It should doubtless begin with collections tied to airdrops, then prolong to Ethereum-based blue-chip PFP collections, generative artwork (corresponding to Artwork Blocks), and finally embody Solana and Bitcoin.”

Nicolás Lallement

The NFT market actually bounced again in This fall. After a troublesome Q3, with solely $1.12 billion in gross sales, it shot up by 96%, reaching $2.2 billion in This fall. November’s $562 million in gross sales helped set issues up for December’s near-billion-dollar displaying.

You may additionally like: Way of life app STEPN GO expands Adidas partnership with bodily NFT sneakers

Trade specialists credit score the rally to growing confidence within the crypto market. As an illustration, DappRadar researchers famous that the rise in token costs in all probability fueled optimism, drawing new patrons into the area. DappRadar’s blockchain analyst Sara Gherghelas believes that the divergence “may be attributed to renewed buying and selling exercise in high-value collections, corresponding to these from Yuga Labs, coupled with rising token costs.”

“Improved liquidity and elevated engagement with blue-chip collections are fostering confidence amongst collectors and buyers, who at the moment are viewing NFTs not solely as speculative property but in addition as cultural commodities,” Sara Gherghelas wrote in a report.

Nonetheless removed from its peak

Regardless of the year-end rally, 2024’s complete NFT gross sales stay far beneath the market’s peak years. In 2021, NFTs generated $15.7 billion in gross sales, practically double this yr’s figures. The next yr was much more spectacular, with $23.7 billion in gross sales.

Lallement believes that that NFTs maintain a “distinctive place” as each high-risk speculative property and standing symbols. He defined that, traditionally, in the course of the later phases of a bull market, contributors who’ve seen their wealth develop are inclined to shift their focus from speculative investments to standing property like digital artwork and collectibles.

“This habits stems from a want to flex wealth and acquire peer recognition inside their communities. For NFTs to return to their 2021–2022 highs, we’ll doubtless want BTC to achieve a big worth degree (e.g., $150K) and ETH set up a brand new all-time excessive (a number of multiples over earlier one, possibly circa $10k).”

Nicolás Lallement

As soon as these milestones are met, Lallement anticipates a “rotation of capital from fungible tokens to pick out NFTs.” He believes that as market contributors begin reallocating their features into high-value collections, it may drive one other wave of inflated valuations. “Robust token efficiency can rejuvenate investor confidence, create a wealth impact, and reignite the speculative and cultural enchantment of NFTs as each investments and standing artifacts,” he concluded, including that this dynamic will doubtless proceed, reinforcing the NFT market’s boom-and-bust nature alongside broader crypto developments.

NFT exercise in This fall 2024 | Supply: Tiexo

Blur and OpenSea had been the highest marketplaces in This fall, making up virtually 70% of all NFT gross sales, in response to knowledge from NFT analytics platform Tiexo. Blur turned out to be the chief with over $885 million in gross sales for the quarter, whereas OpenSea adopted with $607 million. Magic Eden, which focuses on Solana NFTs, recorded $365 million in gross sales.

The variability in market exercise reveals that the NFT ecosystem remains to be maturing. In consequence, nobody platform or blockchain totally dominating. Although Ethereum remains to be the chief in all-time NFT gross sales, Solana and Bitcoin are progressively gaining the share.

The December rally leaves us questioning what’s subsequent for NFTs. Will the momentum proceed into 2025, or will it die down? We’ll doubtless discover out quickly, as analysts predict Bitcoin’s rally will peak in mid-2025, which may affect the NFT market too.

Learn extra: NFT gross sales surge 33% to $302m: Pudgy Penguins #4611 goes for nearly $494k