In the present day, benefit from the Ahead Steerage e-newsletter on Blockworks.co. Tomorrow, get the information delivered on to your inbox. Subscribe to the Ahead Steerage e-newsletter.

Structural sticky inflation is right here

In the present day’s inflation knowledge tells a narrative of sticky costs which are going to have a variety of hassle coming down and getting us again to the two% goal.

Off the highest, the important thing knowledge factors vs. expectations:

- Core CPI MoM: 0.3% precise, 0.2% anticipated

- Core CPI YoY: 3.3% precise, 3.2% anticipated

- Headline CPI MoM: 0.2% precise, 0.1% anticipated

- Headline CPI YoY: 2.4% precise, 2.3% anticipated

As we are able to see, the CPI print was sizzling. Not smoking sizzling, and in addition not as a result of any main outliers drove it increased. What we’re seeing is absolutely only a broad-based lack of ability for inflation knowledge factors to meaningfully transfer decrease.

Earlier than digging into the new factors, let’s shortly run by way of what accounts for 55% of this month’s inflation: shelter.

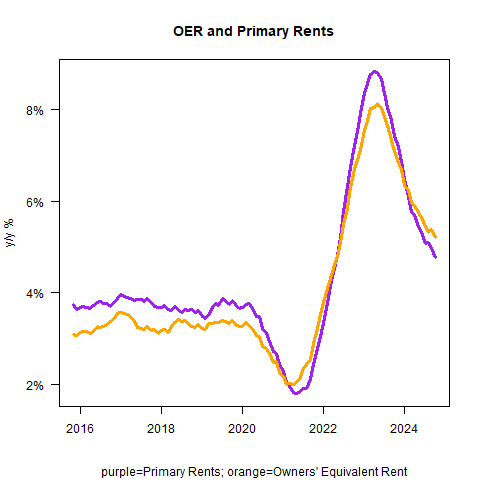

Following a rebound final month, owner-equivalent-rent and first rents each continued their trajectory decrease, resulting in shelter inflation coming in at 0.22% MoM vs. anticipated 0.46%. By all accounts, this was a optimistic end result for disinflation.

That’s about so far as we are able to go by way of optimistic knowledge factors in as we speak’s print.

The massive purple flag is that core items rebounded increased at 0.17% vs. the anticipated 0.02%. Items MoM deflation has been the core driver of the disinflation story we’ve seen this yr and which has allowed the Fed to chop with confidence. So if we’re starting to see a rebound in items inflation, that shall be a priority.

Total, as we speak’s CPI print paints an image of sticky inflation, however not re-acceleration. I believe this print will nonetheless enable the Fed to chop by 25 foundation factors in November, however 50bps is unquestionably off the desk at this level.

— Felix Jauvin

$24

The value goal (in CAD) for Galaxy Digital, in response to a Thursday notice from HC Wainwright & Co., which began masking the inventory. The corporate’s share worth closed at $17.73 CAD on Wednesday.

Galaxy is certainly one of simply two diversified crypto-focused public firms (outdoors of the bitcoin miners) with a market cap of greater than $1 billion, the analysts wrote. And an anticipated sharp crypto rally beginning in This fall could possibly be the one greatest driver of a Galaxy inventory worth improve.

The HC Wainwright & Co professionals added: “Additional, institutional understanding and adoption of digital property has by no means been larger, and we see a wave of incremental institutional capital pouring into the area within the coming years, additional amplifying the upcoming bull market.”

On the bottom at Permissionless

Day two of Blockworks’ Permissionless was in progress when this article went out, however let’s check out a few of what individuals had been speaking about on day one.

There appears to be a relaxed earlier than the storm. And we’re not speaking about Hurricane Milton (our ideas are with everybody within the affected areas and their family members), however relatively the seeming holding sample as we await the Nov. 5 presidential election.

The necessity for regulatory readability was talked about loads. That’s probably not new, however it’s much more highlighted given we’re now simply 26 days from the massive day.

Casey talked about a few of Home Majority Whip Tom Emmer’s ideas yesterday about how the presidential election may impression the crypto business’s trajectory.

Coinbase CLO Paul Grewal mentioned throughout the identical panel that he’s trying past simply the Donald Trump-Kamala Harris match-up.

“Congress goes to matter loads right here, no matter who’s elected as president,” he mentioned.

Throughout a session later within the day, Lumida CEO Ram Ahluwalia argued that Harris — who he known as the “presumptive chief of the Democratic social gathering as we speak” — may terminate SEC Chair Gary Gensler earlier than the election if she needed to.

However he expects to see “establishment” if Harris is elected, implying no fast change in SEC management can be made.

Whereas Donald Trump has vowed to fireplace Gensler, Harris has shared some pro-crypto feedback with out noting how she would possibly handle the company’s present management.

Clearing out the leaders with damaging views of the business needs to be optimistic for an company that general realizes the crypto business’s worth to capital markets and American innovation, mentioned Bitwise’s Juan Leon.

However, he added in a panel alongside Ahluwalia: “I don’t suppose it’s as black and white as individuals on this business appear to be pondering. Actually what issues is the bipartisan help, which is there.”

Whereas regulation was talked about in some form or type in practically each panel I listened in on, another factors price noting strayed from strict coverage.

In a panel on the way forward for bitcoin mining, Marathon Digital CEO Fred Thiel appeared to query the technique of business rival Core Scientific, which this yr has inked high-performance computing (HPC) internet hosting contracts with cloud-computing agency CoreWeave.

Core Scientific has mentioned it initiatives greater than $4.7 billion in cumulative income over the 12-year timeline of the CoreWeave contracts.

However Thiel argued: “That’s a race to zero,” noting that competitors within the enviornment of renting rack area will in the end harm margins.

And we are able to’t not point out the world’s largest asset supervisor being within the constructing.

Samara Cohen, BlackRock’s CIO of ETF and index investments, mentioned we’re in “act one” by way of institutional crypto adoption. This theater analogy got here in lieu of the baseball-focused “early innings” line you sometimes hear (although Let’s Go Mets, am I proper?).

Whereas hedge funds and different asset managers have been leaping in, there stays “a good quantity of plumbing” wanted to unlock others’ capacity to purchase bitcoin (specifically pensions and endowments).

Exterior of regulation, funding pointers consideration and board approval are different hurdles to clear for these asset allocators.

“These items take an extended time period…and this can be a course of that’s underway,” Cohen mentioned.

— Ben Strack

Bulletin Board

- The SEC on Thursday charged crypto market maker Cumberland DRW with performing as an unregistered vendor. Regulators allege the Chicago-based agency has been “working as an unregistered vendor in additional than $2 billion of crypto property provided and bought as securities.” In a press release posted on X, Cumberland expressed frustration with being the SEC’s “newest goal” and pledged to defend itself “in opposition to overzealous regulators.”

- Preliminary jobless claims launched Thursday confirmed 258,000 first-time filers for the week ended Oct. 5, marking the best weekly preliminary claims since August 2023. Analysts had anticipated 230,000.

- Permissionless III continues! Take a look at the day one recap from Blockworks editor Katherine Ross right here, and regulate Blockworks.co for the newest updates.