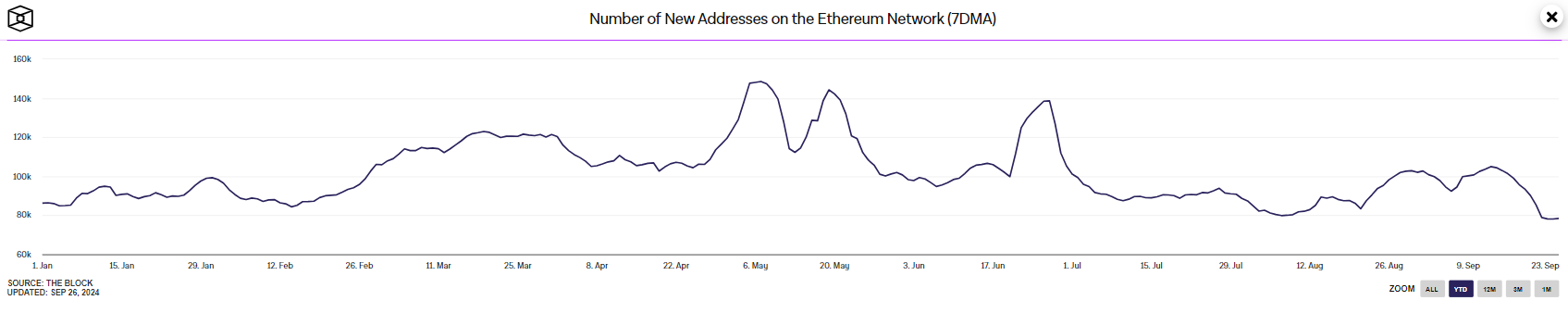

Regardless of a value surge, Ethereum continues to see a drop in pockets addresses. In line with TheBlock’s knowledge, new ETH addresses have dropped by over 44% within the final three months. As of June 27, 2024, the variety of new addresses on the community peaked at 138.62k. Nonetheless, three months later, the quantity has dropped to 78.39k.

New Ethereum addresses plummet to lower than 80k

On June 1, 2024, there have been solely about 100,680 new Ethereum addresses on the community earlier than the determine rose by over 37.7% to 138,620 new addresses on June 27.

Supply: Theblock

Since then, the Ethereum community has seen a sequence of declines in new addresses. On August 1, there have been simply 87,360 new ETH addresses, representing a 37% slip from June 27. Moreover, ETH’s complete lively addresses had tumbled to 615,180 from 722,080 on June 27, culminating in a 15% drop.

On the time, analysts attributed the drop in Ethereum addresses to the launch of spot Ether ETFs in the US, stating buyers most well-liked buying and selling on the ETFs as a substitute of buying Ethereum straight. Moreover, its competitor Solana had seen an increase in new addresses, with fanatics hinting client curiosity shifts in direction of Solana’s new meme cash.

On September 1st, the variety of new ETH addresses rose barely to 102,710. Nonetheless, as of September 25, the quantity had fallen to 78,390, marking a 43% drop from June 27 and a 23% fall from the month’s begin.

Ethereum value climbs with holders repeatedly promoting their property

A number of whales with property on Ethereum’s blockchain have taken benefit of the present value rally to unload their ETH. As an illustration, on September 23, a whale deposited over 3510 ETH into Kraken on September 23. Shortly earlier than this, one other whale had taken out 150,000 ETH and deposited it into different exchanges.

At present, at $2,630, ETH’s value is up 10.68% from final week and up 15% year-to-date. The rise in ETH’s value has invited commentaries, with some mentioning that whales promoting off their tokens might derail additional value will increase, particularly if demand for the token is low, whereas others hinted at additional value surges for the token.

Kingpin Crypto, an unbiased analyst, remarked:

ETH Weekly appears unimaginable, when it comes to value clearly being in an space of demand. If the value can get again above $2750, it’s an absolute no-brainer to go all in into Ethereum imo.

~Kingpin Crypto