On November 6, CNBC’s MacKenzie Sigalos spoke with Michael Bucella, Co-Founde and Managing Accomplice at crypto-focused funding agency Neoclassic Capital, on CNBC’s “Energy Lunch” to debate how the crypto market may very well be impacted by the incoming Trump administration.

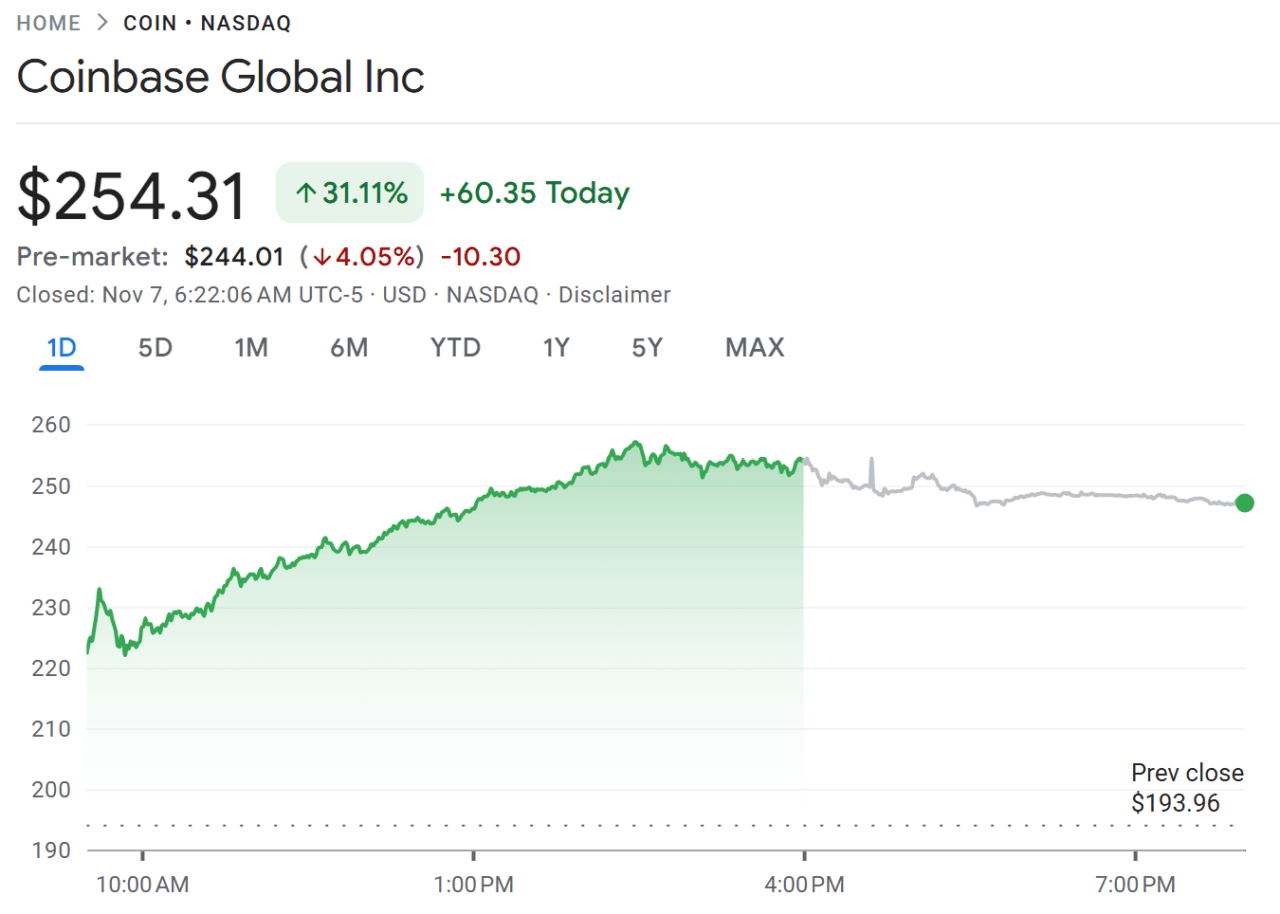

Bucella explains that Donald Trump, who was initially not supportive of the crypto sector, has lately adopted a a lot friendlier stance. Over the previous six months, Trump has pivoted, making a number of guarantees that enchantment to crypto advocates. Certainly one of Trump’s outstanding pledges entails eradicating SEC Chair Gary Gensler from his place, which Bucella believes may create a extra favorable regulatory setting for the trade. In keeping with Bucella, this potential management change has led to a rally within the shares of corporations like Coinbase and Robinhood, with Coinbase’s inventory worth surging by roughly 30%.

Supply: Google Finance

Bucella factors out that one other promise from Trump that has crypto fanatics excited is his dedication to assist the Bitcoin mining trade. Bucella notes that Bitcoin miners are actively engaged in discussions with Trump, in search of to safe funding and coverage assist. If Trump follows by means of on his dedication to develop infrastructure for vitality and transmission, Bucella suggests this might create the vitality capability wanted to gas the mining operations that underpin the Bitcoin ecosystem.

In July, Trump floated the idea of a nationwide “crypto stockpile,” which, based on Bucella, would contain the federal authorities holding onto seized Bitcoin reasonably than auctioning it off as is presently performed. Bucella sees this coverage as a possible optimistic for the Bitcoin market, as it could scale back the out there provide of Bitcoin, probably growing its worth by curbing the frequency of presidency sell-offs.

Discussing broader crypto funding methods, Bucella argues that whereas rapid market responses have proven an uptick, the actual energy of crypto lies within the mid-to-long-term liquidity cycles. He states that crypto funding advantages from an financial setting with bigger deficits and excessive liquidity:

“We’re in an excellent place for liquidity cycles for crypto… for the subsequent two cycles, so name it the subsequent eight years.“

Featured Picture through Pixabay