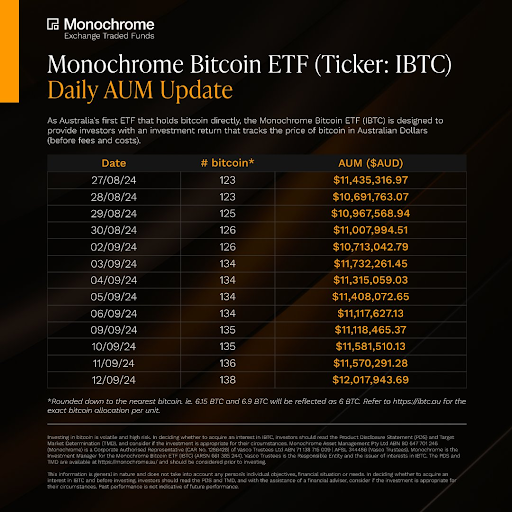

The Monochrome Bitcoin ETF ($IBTC) has seen a gradual improve in belongings, rising from 123 Bitcoins (AUD 11.4 million) on August twenty seventh to 138 Bitcoins (AUD 12 million) by September twelfth, 2024.

Monochrome Bitcoin ETF (Ticker: $IBTC) AUM as of 12/09/24 pic.twitter.com/M8nz3hphBl

— Monochrome (@MonochromeAsset) September 13, 2024

This development in Bitcoin holdings displays sturdy investor curiosity and confidence within the ETF. The ETF’s Belongings Underneath Administration (AUM) fluctuated throughout this era, primarily as a result of Bitcoin’s value swings.

Probably the most important single-day AUM improve was on September third, leaping to AUD 11,732,261.45 alongside an increase in Bitcoin holdings from 126 to 134. The AUM rose from AUD 11,435,316.97 on August twenty seventh to AUD 12,017,943.69 by September twelfth.

Supply: Monochrome

Monochrome Boosts Transparency with Hoseki Partnership

In a transfer to reinforce transparency, Monochrome Asset Administration has partnered with Hoseki to implement day by day proof-of-reserves verification for the $IBTC ETF. This makes it the primary Australian spot Bitcoin ETF to supply such a characteristic.

Monochrome has partnered with @hosekiapp to implement proof-of-reserves verification.

The Monochrome Bitcoin ETF (Ticker: IBTC) would be the 1st Australian Bitcoin ETF to supply traders with unbiased, real-time proof of bitcoin holdings.

Learn extra🔗https://t.co/TQZWYfBuGE

— Monochrome (@MonochromeAsset) September 9, 2024

Hoseki’s verification system will present unbiased affirmation of the ETF’s Bitcoin holdings, giving traders real-time assurance of reserves. This step is predicted to boost the bar for transparency and belief inside the Australian Bitcoin ETF panorama.

Following the Monochrome motion into the crypto market, Bitcoin’s value noticed a lower of 0.45% over the day before today. Regardless of this, as of the press time, Bitcoin was buying and selling at $57,988.81.

Learn additionally: IETH: Monochrome’s Bid to Launch Australia’s First Spot Ethereum ETF

Monochrome’s transfer towards enhanced transparency, coupled with the regular development in its Bitcoin holdings, alerts a constructive trajectory for the Australian Bitcoin ETF sector. Regardless of current market fluctuations, investor confidence in Bitcoin and associated funding merchandise just like the Monochrome Bitcoin ETF seems to be holding sturdy.

Disclaimer: The data introduced on this article is for informational and academic functions solely. The article doesn’t represent monetary recommendation or recommendation of any form. Coin Version will not be liable for any losses incurred on account of the utilization of content material, merchandise, or providers talked about. Readers are suggested to train warning earlier than taking any motion associated to the corporate.