Benchmark has raised its value goal for MicroStrategy’s inventory from $215 to $245.

Analyst Mark Palmer argued the worth of the corporate’s bitcoin holdings and its software program enterprise will proceed to extend.

He additionally believes that the corporate’s excessive inventory value is justified because it supplies extra worth than simply holding huge quantities of bitcoin.

Bears on MicroStrategy’s (MSTR) excessive inventory value due to its perky valuation in comparison with the quantity of its bitcoin (BTC) holdings are overlooking the corporate’s “distinctive” shareholder worth, funding banking agency Benchmark mentioned in a analysis report on Friday.

“We consider the power of MSTR to generate compounding yield on its bitcoin holdings, utilizing what administration describes as “clever leverage,” differentiates its inventory from different technique of gaining publicity to bitcoin comparable to spot bitcoin ETFs,” Benchmark analyst Mark Palmer wrote.

Already bullish on the inventory, Palmer reiterated his purchase ranking and lifted his value goal to $245 from $215. Alongside an increase within the value of bitcoin to $68,400, MSTR shares are larger by 6.6% Friday to $206.19.

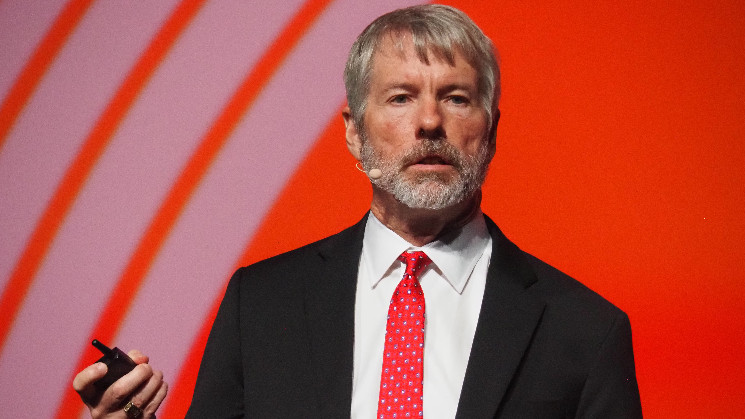

Led by Government Chairman Michael Saylor, the inventory of self-described Bitcoin Growth Firm at present commerce at a 2.4X premium to the worth of its bitcoin holdings, with some merchants thusly believing that holding the fairness as a substitute of BTC itself (or the spot ETFs) is a nasty transfer.

MicroStrategy’s internet asset worth (NAV) is calculated by dividing MSTR’s market capitalization by the worth of its bitcoin stack. The NAV premium not too long ago touched a brand new excessive of two.5 instances its bitcoin holdings, with an organization market cap north of $41 billion in opposition to bitcoin holdings of round $17 billion.

Benchmark believes MicroStrategy’s enterprise mannequin justifies the premium to NAV and that merchants ought to give attention to the corporate’s BTC Yield. Launched by Saylor and staff earlier this yr, Bitcoin Yield tracks the effectiveness of bitcoin investments by measuring the share change over time of the ratio between MSTR’s bitcoin holdings and its absolutely diluted share depend. The Bitcoin Yield stood at 17.8% by way of September 19 in comparison with 1.8% and seven.3% in 2022 and 2023, respectively, in keeping with Benchmark’s knowledge.