Bitcoin funding agency Metaplanet is about to lift ¥10.08 billion (roughly $70 million) by providing its eleventh collection of inventory acquisition rights to all frequent shareholders.

In an Aug. 6 assertion, the Japanese firm outlined plans to allocate ¥8.5 billion (round $58.76 million) of this raised funds to buy extra Bitcoin.

The agency mentioned it might distribute one inventory acquisition proper per frequent share to shareholders, as recorded on Sept. 5. These rights allow shareholders to accumulate Metaplanet inventory at a worth of ¥555 (round $4) between Sept. 6 and Oct. 15.

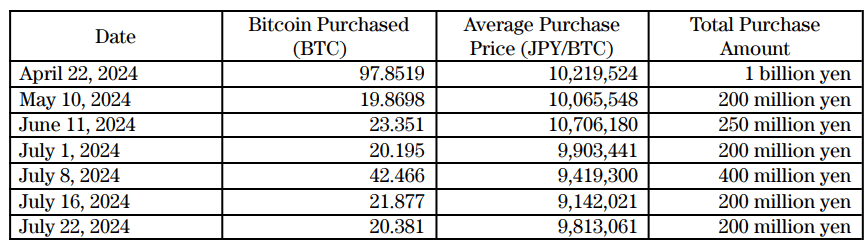

The brand new funding will allow the corporate to considerably develop its Bitcoin holdings, aligning with its long-term progress technique. Metaplanet at the moment holds about 246 BTC, valued at round $13.4 million.

In the meantime, Metaplanet’s transfer is straight from the playbook of MicroStrategy, a enterprise intelligence agency that has gathered over 220,000 Bitcoins by means of debt and fairness raises since 2020.

Bitcoin pivot

Metaplanet plans to make use of the funds raised primarily to accumulate Bitcoin and put money into associated sectors.

The agency restated its perception within the flagship digital asset’s long-term potential regardless of the latest declines in Bitcoin costs.

Moreover, it highlighted BTC’s energy as a hedge in opposition to forex depreciation, notably the yen, which has not too long ago depreciated massively in opposition to the US Greenback.

Metaplanet acknowledged:

“A rise in Bitcoin costs is anticipated to strengthen our steadiness sheet, improve asset worth, and positively contribute to our earnings.”

The corporate revealed that it was contemplating potential future enterprise ventures throughout the BTC ecosystem, including that it may generate extra earnings from its Bitcoin holdings by promoting lined calls on the flagship digital belongings.

Metaplanet’s shift in direction of Bitcoin comes because it has strategically exited most of its lodge enterprise, which had suffered from declining income and recurring losses over 5 consecutive intervals.

In the meantime, it urged that the lodge division might be rejuvenated by remodeling it to strategically cater to Bitcoin fans and companies whereas providing distinctive providers and producing extra income sources.

Talked about on this article