The market has been gearing up for volatility earlier than the launch of spot ETH ETFs within the US at the moment. Whereas ETH’s worth motion has been comparatively uninteresting previously few weeks, plainly massive holders expect worth swings and are dashing to money out.

Glassnode’s knowledge on realized revenue for Ethereum holders reveals a dramatic enhance from $144.598 million on July 21 to $747.311 million on July 22. This can be a vital spike and the best realized revenue in over 40 days.

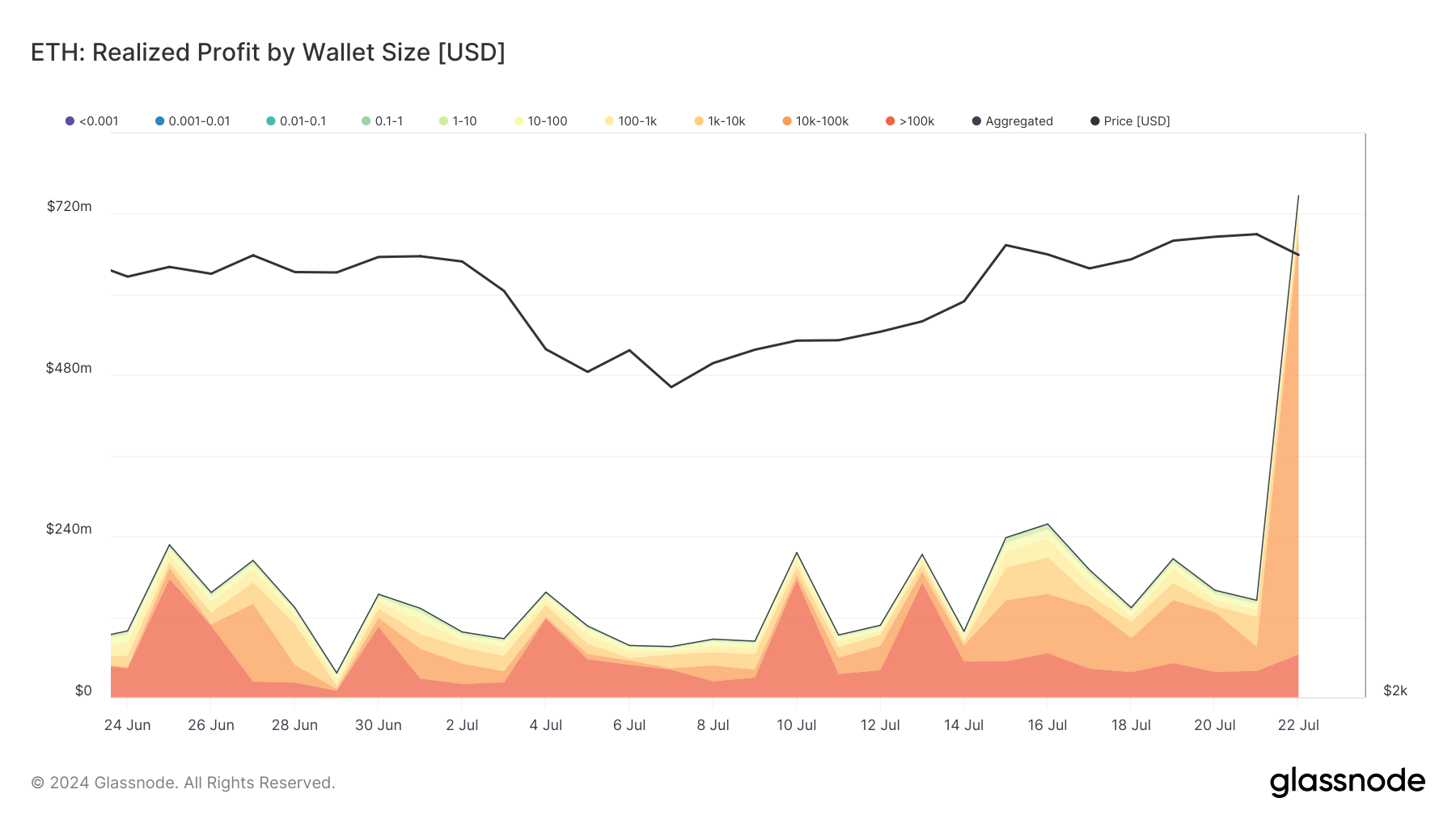

Such a excessive spike warrants an in depth examination of pockets sizes and holding durations concerned within the sell-off. Information reveals that wallets holding between 10,000 and 100,000 ETH realized $626.982 million in income on July 22, up from $35.744 million the day before today. This means that enormous holders, almost certainly institutional gamers or high-net-worth people, are cashing out forward of the ETF launch.

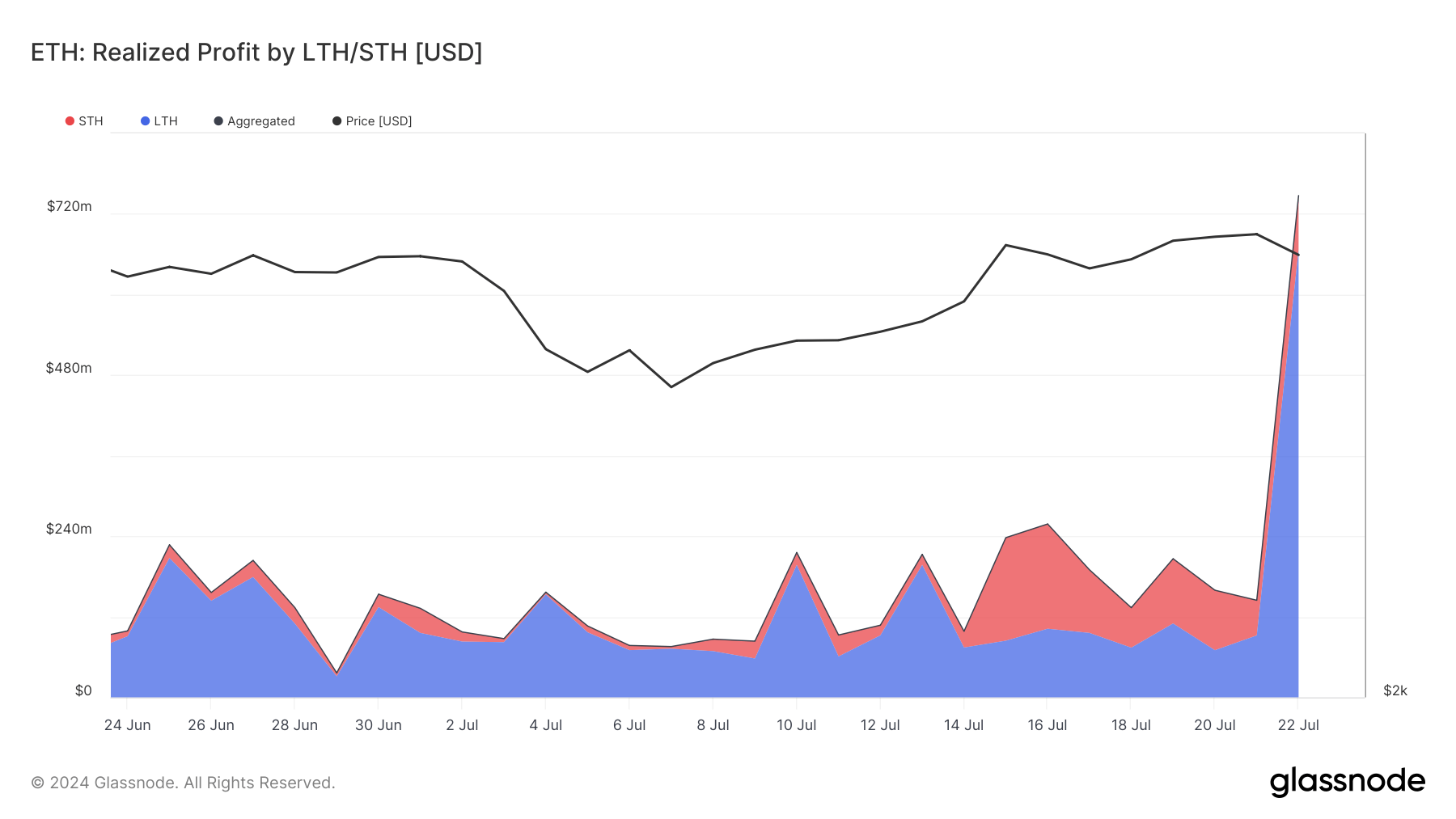

Moreover, long-term holders have been primarily accountable for the numerous enhance in realized income. Income from wallets holding ETH for over a yr surged from $92.751 million to $666.227 million. This habits aligns with a strategic transfer to lock in good points earlier than potential market volatility related to the ETF launch.

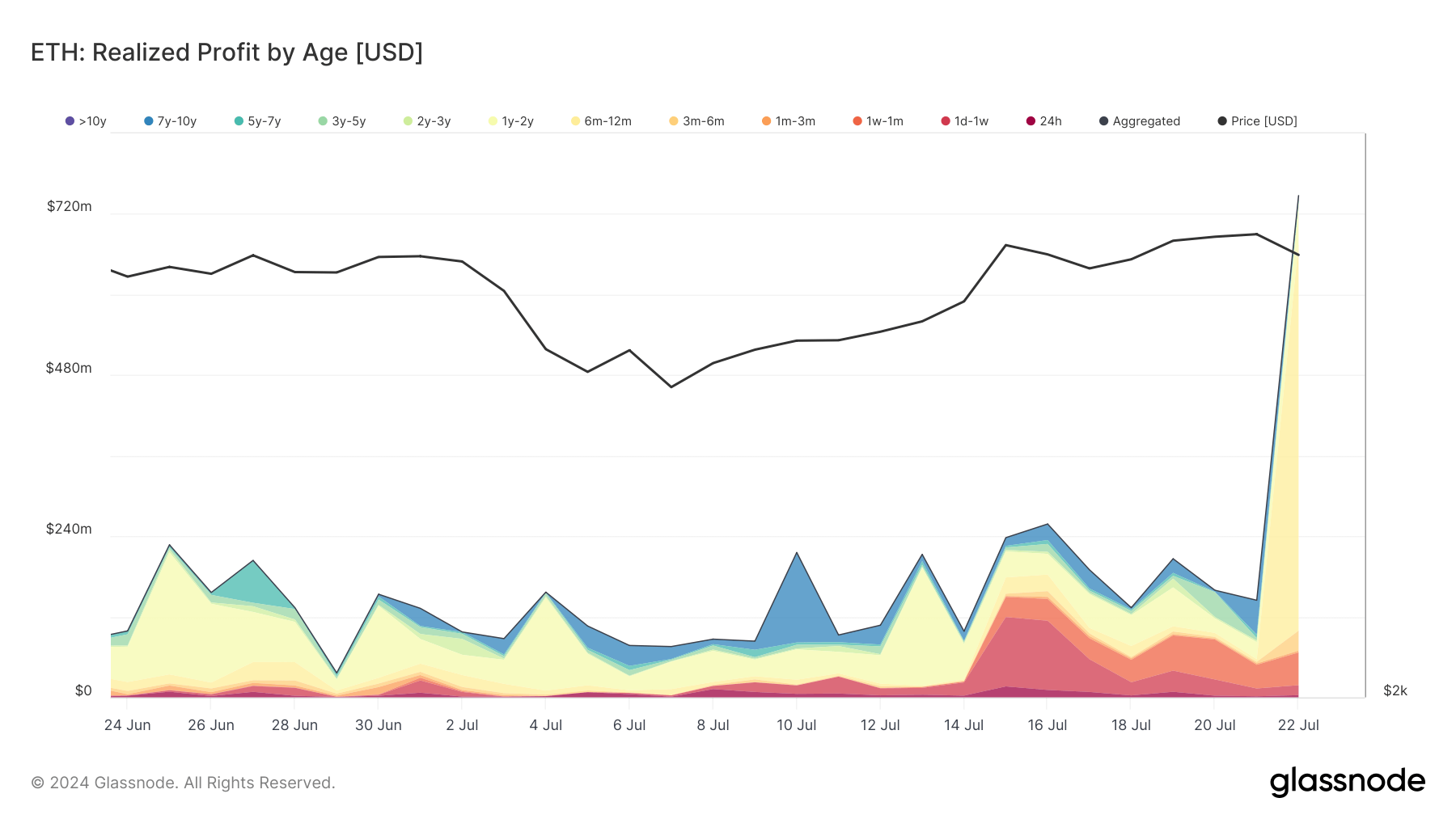

Analyzing realized income by holding age, probably the most vital enhance is seen within the 6 to 12-month holding age class, with realized income leaping to $577.677 million from $3.964 million. This implies that holders from mid-2023 are securing their income.

The spike in realized income highlights the market’s cautious strategy to the anticipated adjustments with the arrival of spot ETH ETFs. As buying and selling heats up, we will count on extra realized income within the coming weeks. cryptoteprise beforehand reported that premarket buying and selling of ETH ETFs has already generated vital curiosity, exhibiting that the market is positioning itself for the entire potential alternatives and dangers related to the brand new ETFs.

It’s additionally doable that enormous and institutional Ethereum holders are realizing income and reinvesting them into ETH ETFs as a substitute of holding spot ETH straight. For institutional buyers and high-net-worth people, ETFs’ regulatory oversight and transparency can cut back the dangers related to holding ETH straight. One other vital profit is the simplified tax reporting related to ETFs. In lots of jurisdictions, ETFs are handled extra favorably for tax functions than holding the underlying belongings straight. This may translate into extra environment friendly tax administration for buyers, particularly with massive asset quantity units.

Liquidity is one other essential issue. ETFs are traded on conventional inventory exchanges, which have a tendency to supply higher liquidity and simpler transaction settlement. For giant holders, the flexibility to shortly liquidate ETH positions with out considerably impacting the market worth might be a considerable benefit.

The put up Massive holders cashed out forward of Ethereum ETF launch appeared first on cryptoteprise.