Cryptocurrency buying and selling knowledgeable Michaël van de Poppe believes that Bitcoin (BTC) is destined for additional correction after failing to breach the $71,000 resistance stage.

In an X put up on June 11, Poppe recognized a number of vital value ranges and areas of curiosity for buyers to look at. He identified that Bitcoin is anticipated to check the assist vary between $64,000 and $65,000.

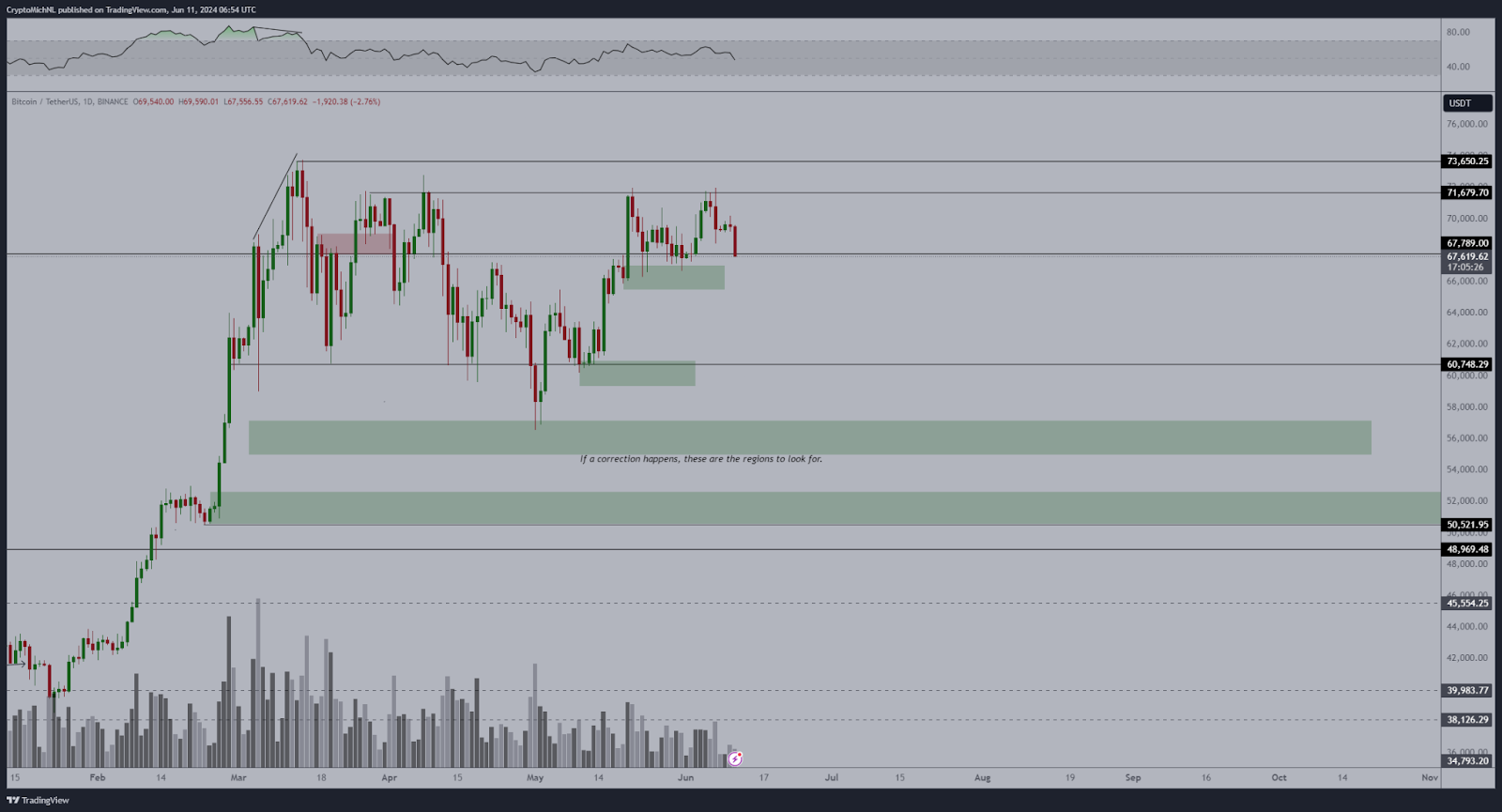

As per the evaluation, this vary is essential because it could possibly be a robust basis for Bitcoin’s value to stabilize earlier than making an attempt one other upward transfer. Ought to the value drop beneath this rapid assist, Poppe signifies a major demand zone of $54,000 to $56,000.

This space is marked as a key stage the place consumers will doubtless step in, offering substantial assist to forestall additional declines. On the upside, Bitcoin wants to interrupt by means of a number of resistance ranges, with the first resistance now set at $71,000.

Efficiently overcoming this barrier might pave the way in which for Bitcoin to retest its earlier highs and probably purpose for brand new report ranges.

Affect of CPI knowledge

The analyst added that the upcoming Federal Open Market Committee (FOMC) assembly and the discharge of Client Value Index (CPI) knowledge are vital occasions that would affect Bitcoin’s value motion. He anticipates that these occasions may set off elevated volatility available in the market, probably driving the subsequent important value motion.

“Bitcoin continues to fall after rejecting the $71K space. Anticipating that we’ll see checks at $64-65K earlier than the markets are reversing again upwards as a result of upcoming FOMC assembly & CPI knowledge,” he stated.

The chart exhibits a constant quantity sample, indicating regular buying and selling exercise. Nevertheless, elevated quantity shall be essential to assist a sustained upward transfer.

Then again, crypto analyst Ali Martinez identified that Bitcoin was buying and selling inside a well-defined parallel channel. In response to Martinez, when Bitcoin trades in such a sample, one should purchase Bitcoin on the decrease boundary and promote on the mid or higher boundary.

On this case, Bitcoin’s decrease boundary is round $67,000, marked as a robust assist stage the place shopping for alternatives are highlighted. The mid boundary is roughly $69,000, an intermediate level for partial profit-taking. The higher boundary is near $71,000, which is recognized because the resistance stage the place promoting or taking income is really useful.

It’s price noting that Bitcoin tried to interrupt from the consolidation part that has characterised the asset in latest days. The drop adopted $64.9 million in outflows from U.S. spot Bitcoin exchange-traded funds (ETFs). The motion marked the primary loss since a minimum of Could 23.

Bitcoin value evaluation

Bitcoin was buying and selling at $67,210 by press time, having plunged by over 3% within the final 24 hours. On the weekly chart, Bitcoin is down 2.5%.

Total, with bears seemingly taking cost of Bitcoin within the final 24 hours, the main focus is on Bitcoin to maintain its value above $65,000, as dropping beneath this stage will open room for additional losses.

Disclaimer: The content material on this web site shouldn’t be thought-about funding recommendation. Investing is speculative. When investing, your capital is in danger.