Lido, a widely known liquid staking protocol, is about to revolutionize the logic of Ethereum’s Proof-of-Stake by means of a significant crypto replace.

The undertaking has simply launched the Group Staking Module, which permits anybody to develop into a community validator by committing solely 2.4 ETH.

Till immediately, to run a validator node on Ethereum, 32 ETH had been required.

This answer makes entry to consensus simpler, doubtlessly bringing extra decentralization throughout the community.

Let’s see all the main points under.

Lido prompts the Group Staking Module on Ethereum’s crypto ecosystem: validators with 2.4 ETH

Lido, the well-known $25.2 billion LSD protocol, has simply voted for the discharge and activation of a much-discussed crypto improve.

Let’s speak in regards to the “Group Staking Module” (CSM), whose governance proposal was opened on October 22 and concluded simply two days later.

Due to the constructive vote end result from the group, the replace will quickly come into impact on Lido and can introduce particular benefits.

To start with, it’ll permit particular person customers to run validator nodes on the Ethereum PoS blockchain with out requiring the brink of 32 ETH.

As an alternative, the preliminary minimal requirement of two.4 ETH will likely be launched, with the primary validator staking only one.3 ETH.

As well as, those that qualify for the early adoption section will have the ability to reap the benefits of the characteristic by locking crypto in stake for 1.5 ETH.

🗳️ New on chain vote is reside!

Lido contributors are proposing the discharge of the Group Staking Module (CSM), and upgrading the Staking Router to boost compatibility with CSM and future modules.

📅 Fundamental section ends October twenty fourth at 4PM UTC. https://t.co/q6urmprFww pic.twitter.com/45CCd2roOt

— Lido (@LidoFinance) October 22, 2024

The Group Staking Module of Lido vastly reduces the obstacles of Ethereum staking, eliminating technical experience and financial obstacles.

The CSM aligns carefully with the imaginative and prescient of Ethereum co-founder Vitalik Buterin of solo stakers enjoying a vital position in enhancing the community’s resilience.

With extra unbiased stakers, the crypto community is certainly extra diversified when it comes to operators and able to higher repelling potential censorship makes an attempt.

The testnet section of this improve was initiated on July 1st on the Holesky chain, persevering with for the next 3 months.

Throughout the course of, greater than 370 distinctive node operators joined, together with 70 “solo staker” within the first 10 days.

Now that the CSM has been permitted by the group, Lido is predicted to considerably improve the variety of node operators utilizing the protocol.

The present entry barrier for validator nodes at 32 ETH

Presently, to take part within the execution of a validator node on Ethereum, with out going by means of the crypto protocol Lido, at the least 32 ETH are required.

As a part of the Proof-of-Stake consensus mechanism, customers who wish to take part in securing the community, whereas incomes a yield on the similar time, should stake a minimal quantity, set exactly at 32 ETH.

Presently, the Ethereum community has over 1 million validators, with a complete of greater than 34 million ETH staked. The yield is 3.1%.

Supply: https://ethereum.org/en/staking/

The idea of the minimal requirement of 32 ETH primarily serves to encourage the participation of whale. With a decrease threshold, they must have interaction extra particular person validators, inflicting higher pressure on the community through the entry and exit phases.

Then again, nevertheless, such a excessive sum, equal to a price of 82 thousand {dollars}, represents a robust entry barrier for small customers.

A variety of individuals within the crypto world don’t have such an quantity in ETH and are compelled to do staking by means of third-party companies, similar to LSD protocols.

By doing so, the small fish should essentially focus round giant staking swimming pools to benefit from the curiosity on deposits, centralizing the community.

A number of occasions this drawback had been mentioned previously among the many Ethereum group, however a definitive answer had by no means been reached.

Now, nevertheless, it appears to have reached a turning level.

The brand new CSM improve of Lido interrupts this inefficiency, opening the doorways of the validators’ community even to small buyers.

This could favor the decentralization of the crypto community, consequently enhancing its safety and resilience.

Moreover, the brand new module can even assist the thriving international group of solo stakers by means of the Group Lifeguards Initiative, providing an academic contribution.

As confirmed within the press convention by Dmitry Gusakov, collaborator of the Lido protocol and technical supervisor CSM:

“We wish to break down the obstacles, making it potential for anybody, no matter monetary circumstances or technical abilities, to assist shield Ethereum.”

Lido nonetheless leads the liquid staking sector whereas the crypto LDO experiences value bear

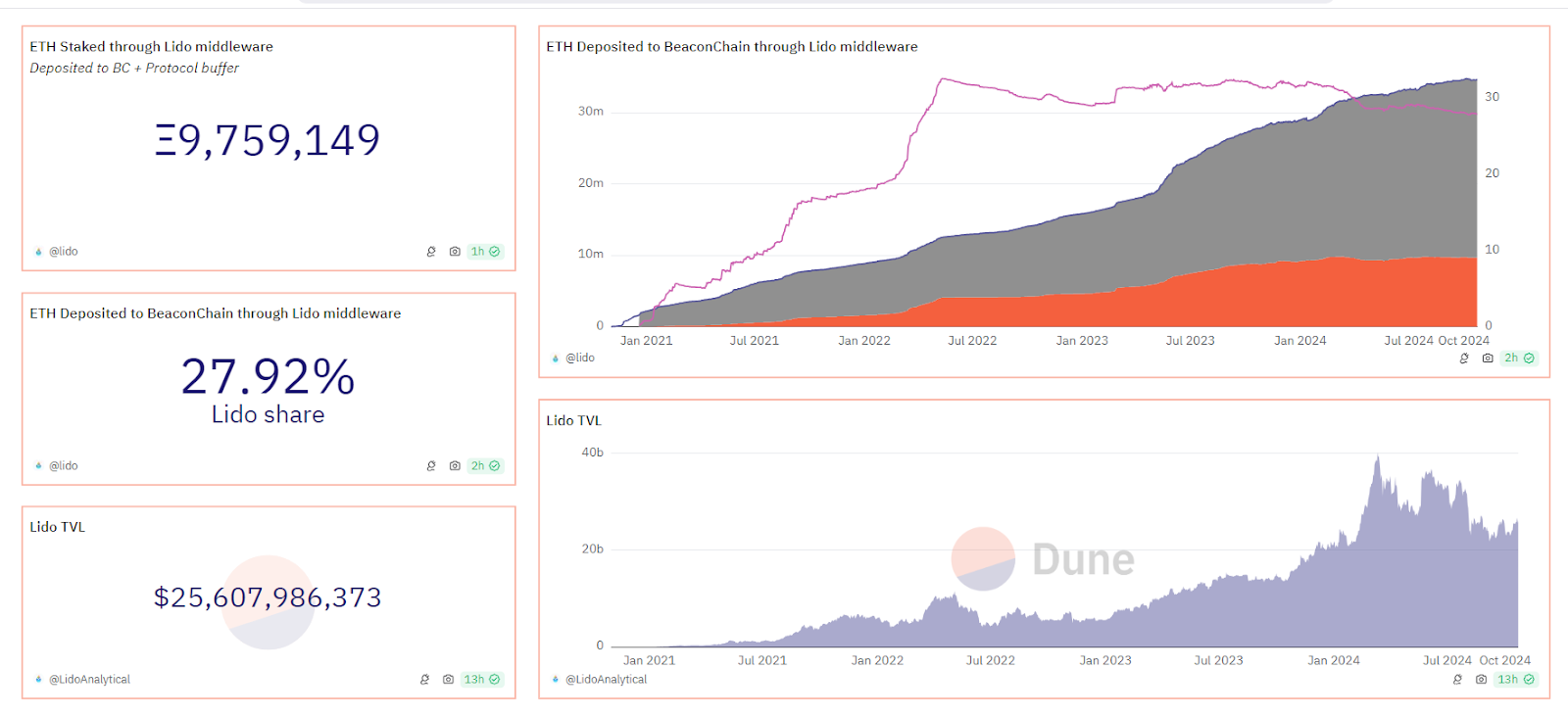

In keeping with the info from Dune Analytics, Lido nonetheless appears to dominate the Ethereum crypto staking market, regardless of the declining numbers.

The protocol holds a market share of 27.92% with 9.75 million ETH deposited by means of the identical middleware.

Which means that virtually 1 out of three validators on the Ethereum community is managed fully by Lido.

The platform boasts a TVL of 25.6 billion {dollars}, making it the dapp richest within the DeFi ecosystem.

In any case, you will need to make clear that from July 2022 onwards, Lido has constantly misplaced floor, ending up providing opponents 5% of the market share.

This case contributes to the growth of the restaking sector, which has launched essential gamers to the market similar to Etherfi, Renzo, and EigenLayer.

Simply to provide an thought of the development that’s underway, within the final 7 days the EigenPods of EigenLayer have launched 62,000 ETH on the Beacon Chain.

In the identical interval, Lido skilled an outflow of twenty-two,000 ETH, highlighting a higher attraction of the newest technology protocols.

Supply: https://dune.com/LidoAnalytical/Lido-Finance-Prolonged

Within the meantime LDO, crypto of governance of Lido, should face a important drop in costs.

Within the final 12 months, the foreign money has misplaced 38% of its worth, dropping from 1.8 to the present 1.1 {dollars}.

After a fast rise at first of 2024, with costs reaching even 3.8 {dollars}, the bears have returned to make their presence felt, pushing strongly downward.

From September onwards, the contraction section appears to have subsided, giving solution to a sideways development.

It’s not excluded that within the bull market LDO can also provide wonderful share returns, however at present the state of affairs is something however bullish.

As the primary signal of restoration, we must always see the crypto return at the least above 1.6 {dollars}, after which proceed within the bull climb.

The market cap of LDO is 1 billion {dollars} on the time of writing, 25 occasions lower than the TVL of the identical Lido protocol.

Supply: https://www.coingecko.com/en/cash/lido-dao