Kraken will delist Tether (USDT) and 4 different stablecoins within the European Financial Space (EEA) because the crypto change prepares for upcoming regulatory modifications underneath the Markets in Crypto-Belongings (MiCA) regulation. The delisting will happen in phases, concluding with computerized conversion of remaining holdings by March 31, 2025.

Along with USDT, different affected stablecoins are PayPal USD (PYUSD), Euro Tether (EURT), TrueUSD (TUSD), and TerraUSD (USDT).

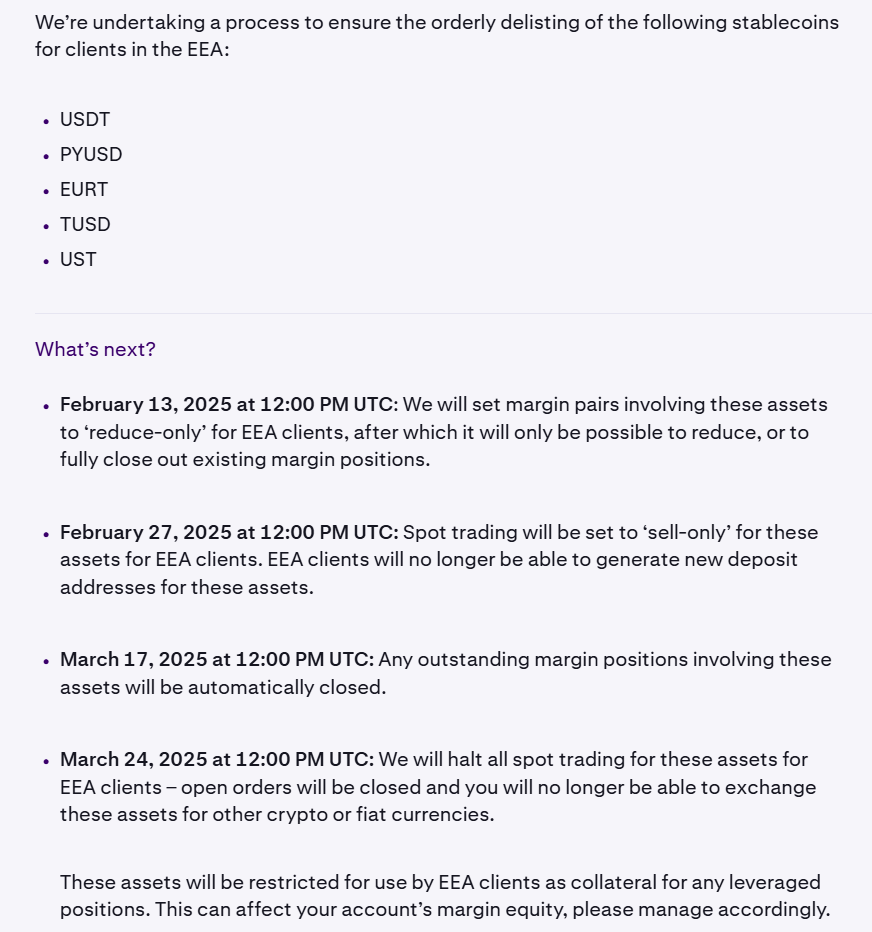

The delisting course of will start on February 13, 2025, when margin pairs involving these property will likely be set to “reduce-only” for EEA shoppers. By February 27, spot buying and selling will likely be restricted to “sell-only” mode, and new deposit addresses will not be generated for affected property.

On March 17, any excellent margin positions involving these property will likely be robotically closed. All spot buying and selling for these stablecoins will halt for EEA shoppers on March 24, with all open orders being closed.

After March 31, 2025, all remaining EEA consumer holdings in these property will likely be robotically transformed to an equal stablecoin. The change famous that affected property deposited to current addresses after the deadline will solely be obtainable for withdrawal.

The change, which operates Digital Asset Service Supplier providers throughout Germany, Spain, Italy, the Netherlands, Belgium, Eire, France and Poland, mentioned final Might it was contemplating delisting USDT within the EU to adjust to stricter stablecoin necessities underneath MiCA laws.

Kraken’s choice comes amid rising regulatory scrutiny of stablecoins in Europe. A number of main exchanges have taken proactive steps to stay compliant and supply long-term providers in Europe.

Crypto.com mentioned Wednesday it might delist USDT together with 9 different tokens in Europe as of January 31, 2025, in compliance with the brand new regulation. The change will droop shopping for and cease deposits, however will enable withdrawals till March 31, 2025.

Customers are suggested to transform affected tokens to MiCA-compliant property by the top of the primary quarter or they are going to be auto-converted to a compliant asset.