Not like extremely anticipated airdrops reminiscent of Berachain and Pi Community, which had been anticipated for years, KAITO’s airdrop caught many customers unexpectedly. The token was launched by a crypto analytics platform with the identical title.

On-chain knowledge exhibits that prime claimers shortly bought off their tokens, resulting in robust promoting strain and bearish sentiment. Nonetheless, if KAITO can regain group belief and capitalize on its plans to tokenize social media content material, it could get well from its latest lows and problem key resistance ranges.

KAITO High Addresses Already Bought Virtually All Their Cash

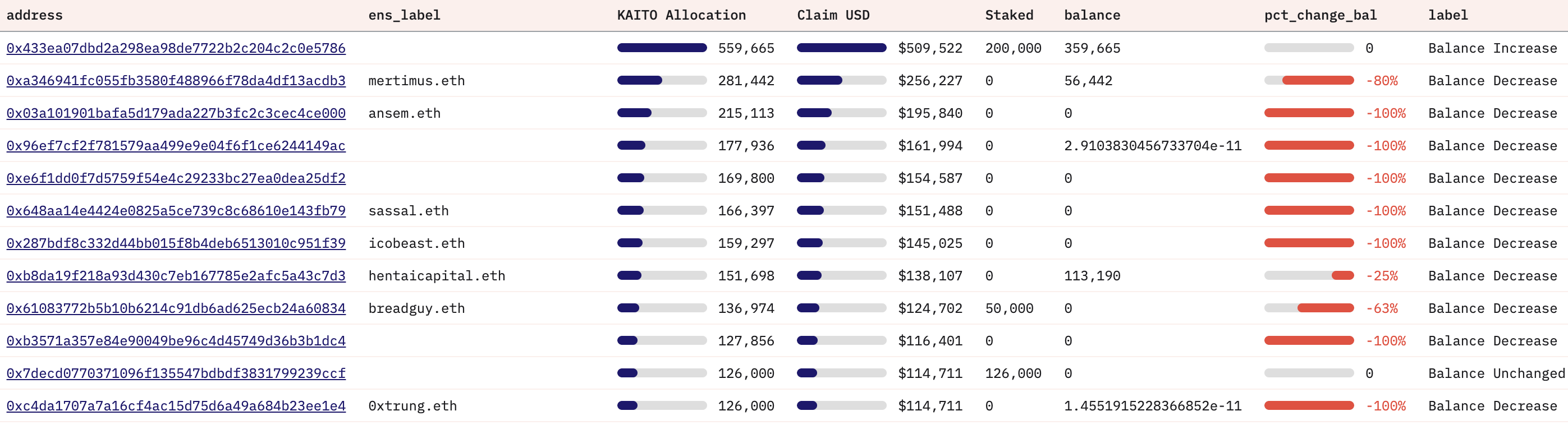

On-chain knowledge for KAITO reveals that the customers who claimed the most important portions of the coin are now not holders, indicating robust promoting strain shortly after the airdrop.

Notably, the highest 12 claimers acquired roughly $2.1 million value of KAITO, however 10 of them have already bought at the least a portion of their tokens, and seven have absolutely exited their positions.

KAITO High Addresses Stats. Supply: Dune.

Solely 3 out of the 12 determined to stake their cash, reflecting a cautious method towards long-term dedication.

This promoting pattern among the many largest claimers suggests a insecurity within the token’s long-term worth or a strategic transfer to safe earnings following the preliminary distribution.

Claimers Are Not Holding Their Positions

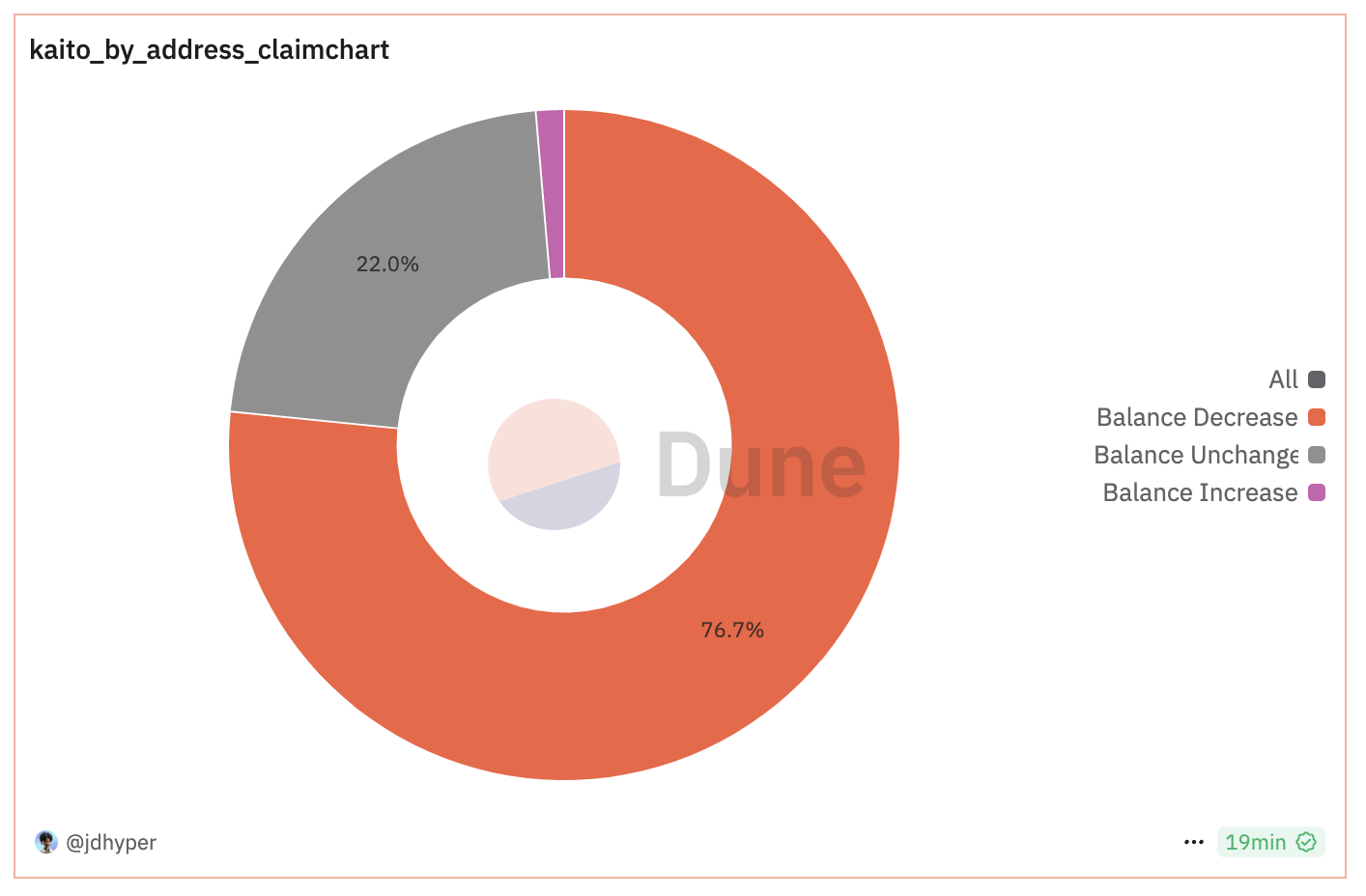

The broader on-chain exercise exhibits the same sample, with 76.7% of all customers who claimed KAITO experiencing a stability lower.

Though not all of them bought their whole holdings, the bulk decreased their publicity, indicating a cautious or profit-taking sentiment.

KAITO Stability Change Distribution. Supply: Dune.

Conversely, 22% of the claimers haven’t moved their tokens, reflecting robust holding conviction, whereas just one.3% elevated their holdings, exhibiting minimal accumulation curiosity.

This distribution sample means that the group’s criticism of KAITO’s tokenomics and airdrop method might need influenced customers’ conduct.

The low accumulation charge mixed with the excessive promoting strain signifies a bearish outlook. The market sentiment seems to be extra targeted on short-term beneficial properties fairly than long-term worth appreciation.

KAITO Worth Prediction: Will KAITO Get well From Latest Lows?

If KAITO can restore group confidence and generate curiosity by its plans to tokenize social media content material utilizing synthetic intelligence, its worth may proceed recovering from the latest lows.

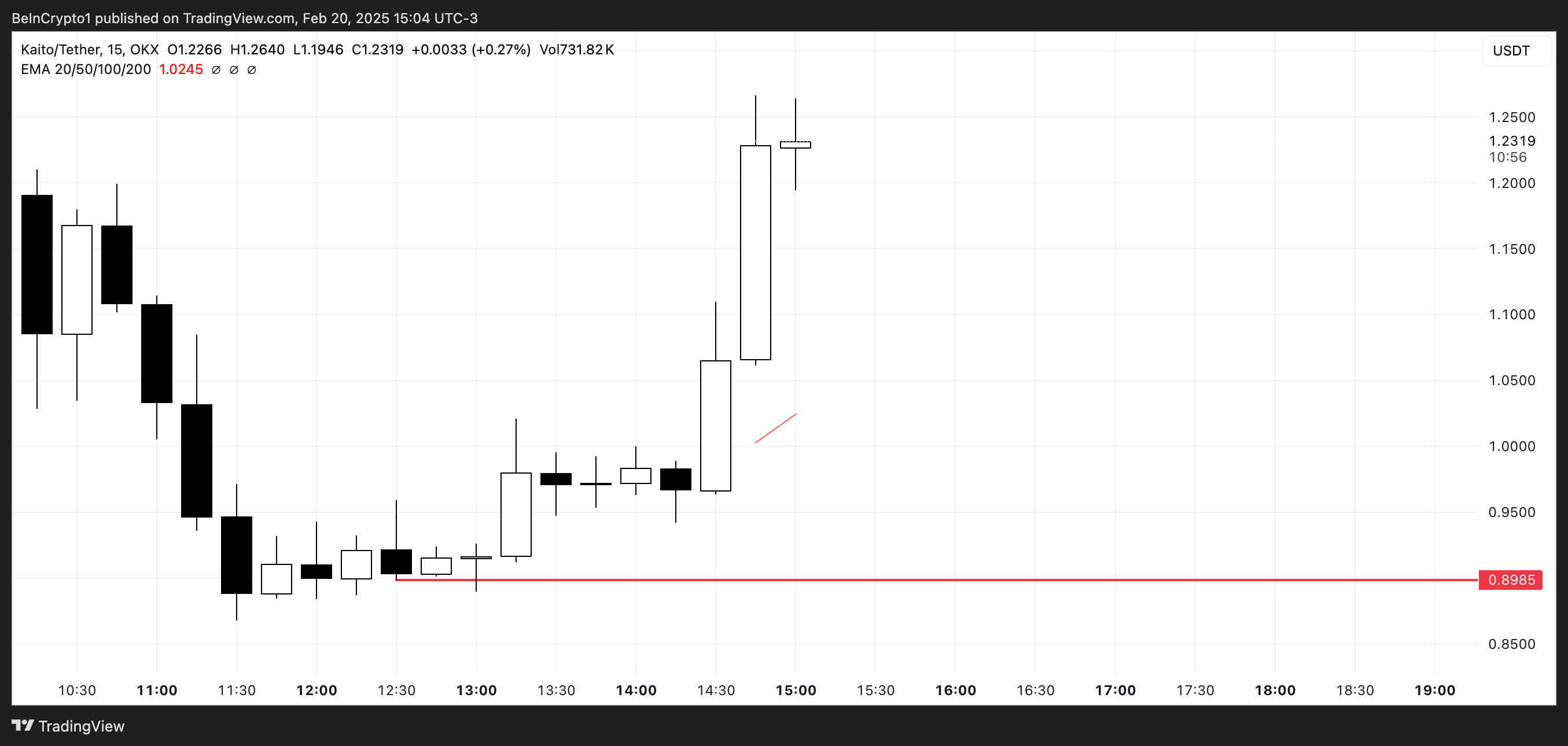

KAITO was exhausting hit within the first hours after its launch, as was the case with many latest airdrops, reminiscent of Berachain. If it could get well from the latest robust promoting strain, it may take a look at $1.5 and even $2 very quickly.

KAITO Worth Evaluation. Supply: TradingView.

Nonetheless, if promoting strain persists, it may face additional declines, particularly as Dune knowledge exhibits that lower than 30% of the entire KAITO provide has been claimed thus far.

This means that a good portion of the tokens may nonetheless enter the market. That would doubtlessly enhance promoting strain and push costs decrease.

If this state of affairs occurs, KAITO may take a look at the help at $0.89. If that degree is breached, the worth may drop beneath $0.8 and even $0.7.