-

Justin Solar’s crew moved 41,630 ETH, value $146M, into centralized exchanges.

-

Main ETH Deposits Directed to HTX round 39k ETH and a pair of,630 ETH to Poloniex.

-

Ethereum eyes $4,000 after breaking the $3,800 stage as the following vital resistance stage stands at $3920.

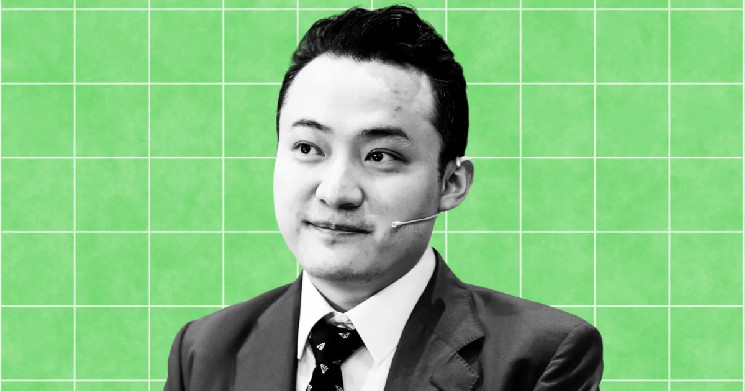

Tron founder Justin Solar’s crew is catching the eyes of crypto lovers within the crypto house by transferring 41,630 ETH, value $146 million, to centralized exchanges. This transfer comes after Ethereum’s spectacular 60% rally over the previous month, hovering to $3,860. Many within the crypto group are questioning: Is Solar cashing out earnings or gearing up for a much bigger transfer?

Justin Solar’s Workforce Offloading ETH Massively

Spotonchain revealed that Justin Solar’s crew has been actively transferring Ethereum into centralized exchanges. Since Ethereum’s value started climbing in November, Solar’s crew has deposited a staggering 41,630 ETH, valued at round $146 million.

Justin Solar (@justinsuntron) deposited one other 20,000 $ETH ($76.3M) to #HTX 8 hours in the past as the worth surged previous $3,800!

Since $ETH started rebounding in early November, he has deposited 41,630 $ETH ($145.9M) into CEXs—39,000 $ETH ($137M) to HTX and a pair of,630 $ETH ($8.76M) to… https://t.co/G3QOPod2L3 pic.twitter.com/8RtZfJg71I

— Spot On Chain (@spotonchain) December 5, 2024

Later, it was discovered that almost all of those funds like 39,000 ETH (round $137 million) have been transferred to at HTX alternate, whereas 2,630 ETH (roughly $8.76 million) have been despatched to Poloniex.

Nonetheless, these deposits have been made at a mean Ethereum value of $3,505, elevating curiosity in regards to the timing and function behind these strikes.

Including to the joy, simply 8 hours in the past, Solar deposited one other 20,000 ETH, valued at $76.3 million, into HTX as Ethereum’s value broke previous the $3,800 mark.

Motive Behind The Switch

The size and timing of those transfers have sparked loads of chatter within the crypto house. Many within the crypto group counsel that Solar could be getting ready for a giant commerce or trying to safe liquidity. Others see it as a strategic transfer, aligning completely with Ethereum’s upward development.

The heavy deal with HTX, the place the majority of the funds have been directed, raises extra questions. May this be a present of belief within the alternate’s stability, or is there one thing greater at play?

Ethereum Value Evaluation

Ethereum is exhibiting power, steadily climbing from the $3,550 help zone. It just lately broke above $3,800, reaching a excessive close to $3,895, fueling optimism amongst merchants.

Ethereum chart evaluation means that the following key challenges for ETH are $3,920 and $3,950. If the worth manages to interrupt by means of these ranges, it may pave the best way for a transfer towards $4,000. A profitable push above $4,000 may even result in additional features, doubtlessly reaching $4,050 or $4,120.

On the flip aspect, if Ethereum struggles to clear $3,920, it may face a pullback. Help ranges to observe embody $3,800 and $3,750, with a deeper dip presumably taking it to $3,600.