Ethereum is agency, trending larger, and outperforming the world’s most beneficial coin, Bitcoin. Earlier right this moment, Ethereum costs broke $3,900 earlier than retracing sharply under $3,800 and bouncing again to identify charges.

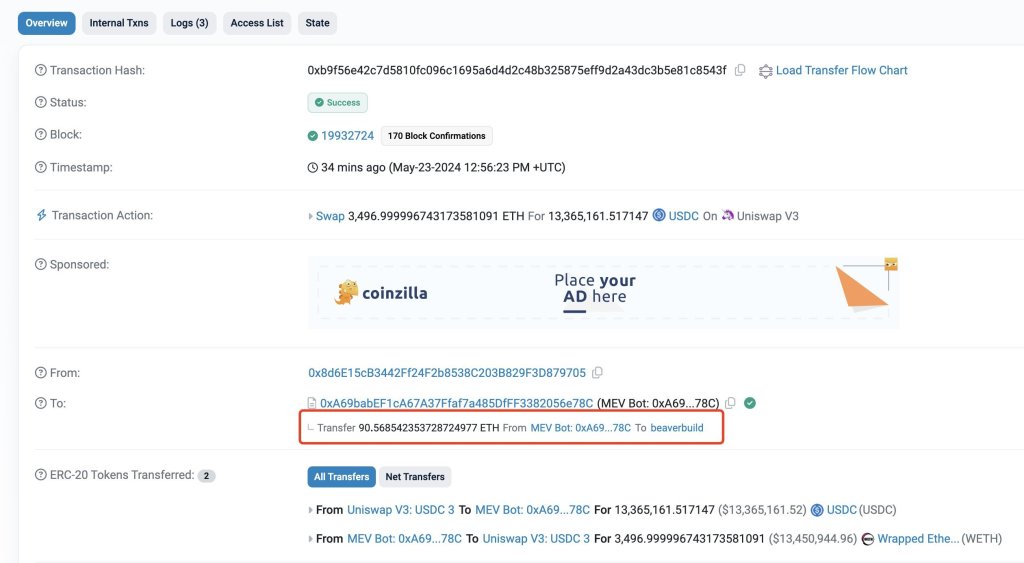

In an try to clarify the unexpectedly excessive volatility, particularly with costs quickly dropping from $3,900 and sinking under $3,800, some analysts declare that a big promote order by a Most Extractable Worth (MEV) buying and selling agency, Symbolic Capital Companions, could be accountable.

Ethereum Is Risky Above $3,800: Doable Clarification

In a put up on X, one crypto journalist, citing one other supply, mentioned Symbolic Capital Companions offloaded 6,968 ETH, value over $27 million, with a mean promoting worth of $3,930 in a single minute. Notably, one in all these transactions concerned promoting 3,497 ETH concurrently, with a “excessive bribe payment” of 90 ETH.

Whereas the precise motive behind this bulk dump stays unclear, their motion appeared to have impacted costs, inflicting volatility.

At spot charges, Ethereum is up 30% from Could 2024 lows. Technically, the uptrend stays so long as costs are buying and selling above $3,700. On Could 20, ETH costs broke above $3,300 and $3,700. These have been two key resistance ranges that are actually supported.

So long as costs development above $3,700, bulls might need a basis for an additional leg up, taking them to March highs of round $4,100.

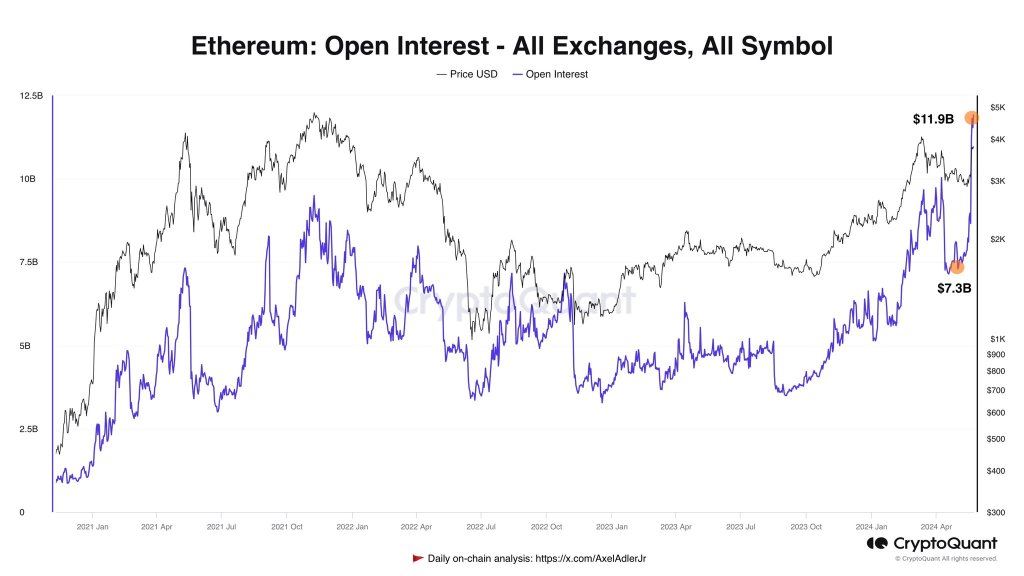

Even with ETH volatility being excessive, general sentiment stays constructive. One analyst on X notes that over the previous three weeks, open curiosity in Ethereum futures throughout a number of exchanges, like Binance, OKX, and even Bybit, rose to over $4.6 billion.

Open curiosity is a metric that exhibits the variety of open leveraged positions, lengthy or brief. When the quantity will increase, merchants are assured within the coin’s prospects.

Spot ETH ETF Fueling Curiosity

To this point, the joy about Ethereum is said to the constructive progress in approving spot exchange-traded funds (ETFs). When writing, america Securities and Trade Fee (SEC) has been actively speaking with potential issuers. Modifications have been requested, significantly regarding ETH staking.

Some analysts consider the shortage of staking capabilities for spot Ethereum ETFs is constructive general. In a put up on X, the analyst argued that if spot Ethereum ETF issuers are allowed to stake, yields will drop, lowering returns for solo stakers. This, in flip, will make particular person staking much less engaging, impacting community decentralization.

Characteristic picture from Canva, chart from TradingView