The NFT (non-fungible token) public sale market has cooled down considerably from its 2021 frenzy, characterised by fewer auctions and cheaper price ranges, however specialists are likening the section to a wholesome consolidation that can usher in additional sustainable development through the years.

In line with Artprice’s 2024 Up to date Artwork Market report, over the previous 12 months, NFT public sale gross sales fetched solely $9.3 million.

This was a far cry from the height of hypothesis in 2021, when digital artist Beeple offered an NFT for an astounding $69 million at Christie’s, propelling him into the worldwide highlight.

Because the occasion despatched shockwaves via each the tech and artwork worlds, marking NFTs as a revolutionary new asset class, that 12 months, the NFT market raised a powerful $110.5 million via regulated auctions, with items by rising artists like Fewocious and collections like CryptoPunks commanding thousands and thousands.

2023 noticed the market shifting away from dizzying worth tags, with fewer auctions and extra reasonable worth ranges changing into the brand new norm.

The report says,

What was as soon as a chaotic and speculative bubble has now calmed right into a extra secure market, permitting area for collectors and traders to evaluate the true influence of this digital artwork revolution.

Fewer headline-grabbing gross sales, however NFT collections see sustained curiosity

Because the peak of the NFT growth, the market’s main artists have seen their costs fall to extra cheap ranges.

Fewocious, a teenage sensation in 2021 who offered a bit for $2.8 million at Sotheby’s, hasn’t had any work provided at public sale this 12 months.

Equally, Larva Labs’ CryptoPunks, as soon as a darling of the NFT area, not appeal to the wild bids they as soon as did.

Even Beeple, whose work ignited the NFT explosion, noticed a much more modest sale of $177,800 in 2023.

Regardless of this market correction, purchaser curiosity stays regular, notably for established NFT collections, the report says.

Yuga Labs, the creator of the Bored Ape Yacht Membership (BAYC), has continued to see sturdy demand. At a latest Sotheby’s on-line sale, 100% of Yuga Labs’ NFTs had been offered, with essentially the most helpful lot fetching $264,000.

This means that whereas the broader NFT market has cooled, there’s nonetheless vital enthusiasm for high-quality collections.

Cooling in NFT auctions in keeping with the broader cooling of the artwork market

The autumn in NFT public sale values should not be checked out in isolation.

In line with Artnet’s mid-year evaluate of 2024, the primary half of 2024 noticed a complete of $5.05 billion being spent on artwork at auctions, a decline of 29.5% because the similar interval final 12 months.

Artprice’s report provides that the worldwide marketplace for modern artwork has additionally not produced any main public sale information final 12 months, despite the fact that the amount of transactions on reasonably priced works elevated.

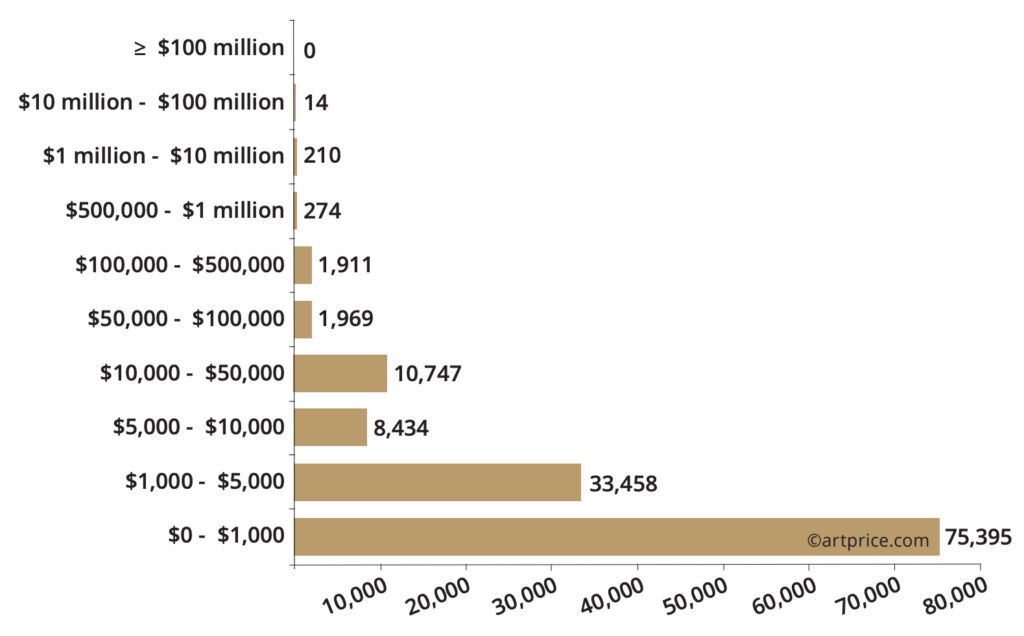

Up to date artwork public sale outcomes by worth vary 2023-24, Supply: Artprice

In line with the report, the 2023-24 monetary 12 months noticed a notable contraction in modern artwork auctions with nearly a billion {dollars} much less in comparison with the historic peak two years in the past.

Nonetheless, with a complete of $1.888 billion, it says the market has returned to pre-pandemic ranges whereas surpassing the typical of the 5 years previous the well being disaster by 200 million.

The worldwide context, with its persistent geo-political and financial tensions, has slowed down the marketplace for status works. Convincing sellers

to place their most respected possessions up for public sale is understandably a frightening job in unsure occasions. In the meantime, giant consumers are clearly in a cautious temper, scrutinizing the long-term outlook.

What subsequent for NFT public sale market?

Consultants see a silver lining within the droop.

Artprice says collectors can now buy works from main digital artists for much lower than the sky-high costs of 2021.

Famend artists reminiscent of Refik Anadol, who just lately exhibited on the Museum of Fashionable Artwork (MoMA), and Dmitri Cherniak, a pioneer in generative artwork, have seen their NFTs out there at auctions for between $15,000 and $20,000.

Moreover, for lower than $10,000, consumers can discover practically 200 NFTs by artists like Moxarra Gonzalez, Matt Deslauriers, and Hideo, all chosen by main public sale homes over the past 12 months.

As NFTs enter their second decade of existence, however solely their third 12 months on the regulated public sale market, the speculative wave and the FOMO phenomenon have each subsided and the hype has subsided. We at the moment are a golden alternative to construct a strong and sustainable market, removed from the joys of the thrill.

This shift indicators that the NFT market is maturing, shifting away from a speculative frenzy to a extra sustainable mannequin.

The market is now targeted on constructing a strong basis somewhat than chasing viral moments.

Whereas the spectacular worth surges of the previous might not dominate headlines, the digital artwork world is carving out a measured, extra resilient future.

With this newfound stability, there’s a golden alternative for collectors and artists alike to foster a sustainable marketplace for years to come back.

The publish NFT public sale market cools considerably: is there a silver lining for traders? appeared first on Invezz