- Bitcoin worth continues its corrective plunge main many to panic-sell.

- One analyst shares an in depth put up reminding merchants of the larger image.

- He concludes saying that the bull run isn’t over, simply taking a breather.

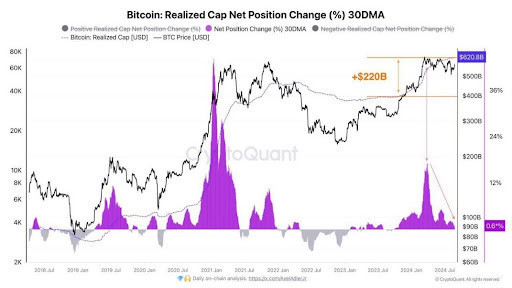

The crypto market has been rattled as Bitcoin (BTC) plunged from $108,000 to $96,000 inside 48 hours, resulting in widespread panic-selling. Nonetheless, analysts argue that this dip isn’t the tip of the bull run however quite a wholesome consolidation inside an ongoing upward pattern. To interrupt it down, one analyst shares his ideas on what stays essential.

Finish of the Crypto Bull Run?

Is the crypto bull run over?📉

Markets are panicking after #Bitcoin fell from $108K to $96K in 48 hours. However don’t be fooled – this isn’t the tip of the bull market.

Right here’s why this dip is a large alternative 🧵👇

— VirtualBacon🦇🔊 (@VirtualBacon0x) December 20, 2024

To start, he states that Bitcoin has skilled a ten% decline after a outstanding 54% rally over 40 days, a transfer many see as a pure correction. Historic patterns recommend that such pullbacks typically pave the best way for brand spanking new highs. Key help ranges stay intact, with the weekly 21 EMA at $79,000 and the day by day 200 EMA at $73,000, indicating the bull market construction continues to be stable.

Moreover, market jitters had been exacerbated by Federal Reserve bulletins. Whereas FED Chair Jerome Powell said that the FED isn’t allowed to carry Bitcoin, many took this as a bearish perspective. In the meantime, the U.S. economic system continues to indicate resilience, with unemployment dropping to 4.1% and inflation at 2.75%, barely above the FED’s goal.

The FED’s gradual strategy to fee cuts and slowing of quantitative tightening (QT) means that stability will return within the close to future, doubtlessly igniting one other crypto rally. Analysts anticipate Bitcoin to consolidate round present ranges, with the following main worth surge anticipated as soon as QE resumes.

Crypto Bull Run Far From Over

Altcoins, nevertheless, stay extremely risky, experiencing steeper declines than Bitcoin through the current correction, main new merchants to ponder promoting or holding whereas seasoned merchants proceed to build up. Buyers are suggested to deal with high-conviction tasks and keep away from leverage throughout this era of uncertainty.

The analyst concludes by saying that whereas the market stabilizes, endurance is vital. Historic tendencies present the largest positive factors come throughout unsure instances like these. With key Federal Reserve conferences scheduled for early 2025, the crypto market’s subsequent large transfer might align with coverage adjustments. Lastly, he says that for now, the bull run isn’t over—it’s simply taking a breather.