The cryptocurrency market has skilled important turbulence lately, elevating questions in regards to the longevity of the present bull market in Bitcoin and altcoins.

Analysts and trade insiders supply various views on the way forward for Bitcoin and altcoins, reflecting on market tendencies, macroeconomic components, and investor conduct.

Analysts’ Predictions on Bitcoin, Altcoins

Bitcoin investor Murad Mahmudov highlighted two doable eventualities for Bitcoin’s future. He urged that if the worth stays above $60,000, the bull market would possibly proceed following the everyday four-year cycle.

Nonetheless, relying on macroeconomic circumstances, a worldwide recession may drive Bitcoin’s worth all the way down to $30,000.

Bitcoin Value Evaluation. Supply: TradingView

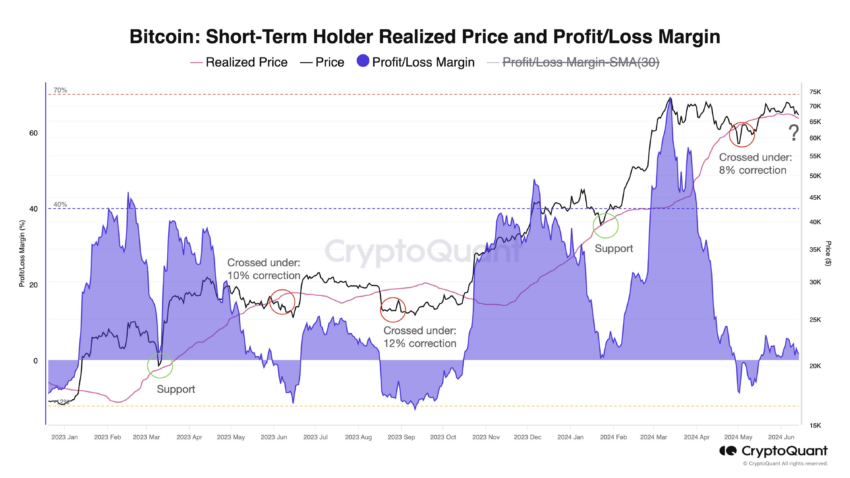

Likewise, Julio Moreno, Head of Analysis at CryptoQuant, identified the excessive chance of Bitcoin reaching $60,000. He mentioned that Bitcoin is at an important worth stage, across the short-term holders’ realized worth of $62,800.

This metric may both present assist or result in an 8% to 12% correction if the worth drops under this stage, doubtlessly bringing Bitcoin all the way down to about $60,000.

From a technical perspective, buying and selling veteran Peter Brandt warned that breaking by means of the $60,000 assist ranges may result in additional declines. He famous {that a} drop under $60,000 would possibly see Bitcoin reaching $48,000.

Learn extra: Bitcoin (BTC) Value Prediction 2024 / 2025 / 2030

Bitcoin Quick-Time period Holder Realized Value. Supply: CryptoQuant

In the meantime, market analyst Bob Loukas took a extra average stance, predicting a interval of consolidation just like what was noticed final summer season. He emphasizes the potential for a repeated sample, suggesting that endurance is perhaps required because the market stabilizes.

“Final summer season’s consolidation, visualized this summer season. Not saying it’s going to repeat, however serves as a reminder of what’s doable and the endurance that is perhaps wanted,” Loukas mentioned.

Will Clemente, co-founder of Reflexivity Analysis, additionally anticipates a consolidation part. He has adjusted his funding technique, retaining solely core Bitcoin holdings and some different positions.

Clemente believes that whereas Bitcoin would possibly expertise a sideways motion throughout the summer season, there may be potential for larger costs within the fourth quarter, influenced by financial information and Federal Reserve actions.

Bitcoin Value Evaluation. Supply: TradingView

Relating to altcoins, Andrew Kang, co-founder of Mechanism Capital, expressed warning. He stays uncertain if the momentum generated by Bitcoin exchange-traded fund (ETF) approval will lengthen to altcoins, significantly Ethereum. Whereas Bitcoin would possibly see elevated curiosity, he doubts the identical for Ethereum ETFs.

Learn extra: What Is Altcoin Season? A Complete Information

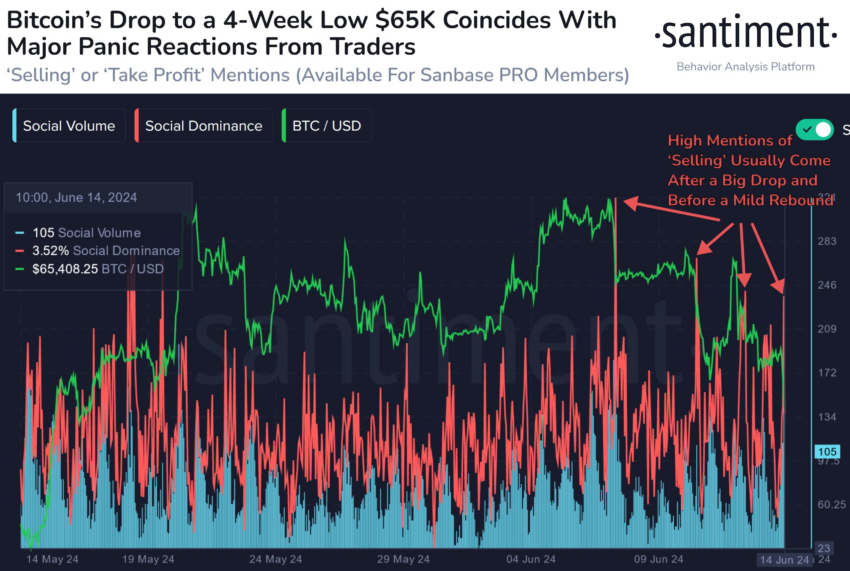

Regardless of the pessimistic outlook, analysts at blockchain analytics agency Santiment famous the present market sentiment. They observe heightened concern amongst traders as Bitcoin’s worth drops to $65,000. If panic promoting continues, this concern may result in a short lived bounce and a shopping for alternative.

“Spikes in mentions of promoting or taking revenue are widespread after a drop, and a short lived bounce and purchase alternative could kind if we see continued FUD and panic from small merchants,” Santiment defined.

Bitcoin’s Social Media Sentiment. Supply: Santiment

In abstract, the way forward for the Bitcoin and altcoin bull market is unsure. Potential outcomes vary from important corrections to intervals of consolidation. The path will largely rely upon macroeconomic components and shifts in investor sentiment.