How do Polkadot’s monetary practices, spending $87M with a web lack of $108M yearly, evaluate to FTX’s pre-collapse habits?

Desk of Contents

Polkadot (DOT), one of many early rivals to Ethereum (ETH), has just lately come below the highlight after publishing its newest treasury report.

The report revealed that Polkadot spent a whopping $87 million value of DOT tokens within the first half of this 12 months. This spending spree is double the tempo in comparison with the earlier six months, elevating eyebrows from observers and traders.

The majority of Polkadot’s spending, over $36 million, about 42.4%, went in the direction of advertising and marketing and outreach actions. This included ads, influencer endorsements, occasions, meetups, and convention internet hosting aimed toward attracting new customers, builders, and companies to the Polkadot ecosystem.

Supply: Polkadot Treasury Report

Growth accounted for the second-largest chunk of Polkadot’s funds, with about $23 million (26.7%) allotted to constructing important providers comparable to wallets and toolkits for builders.

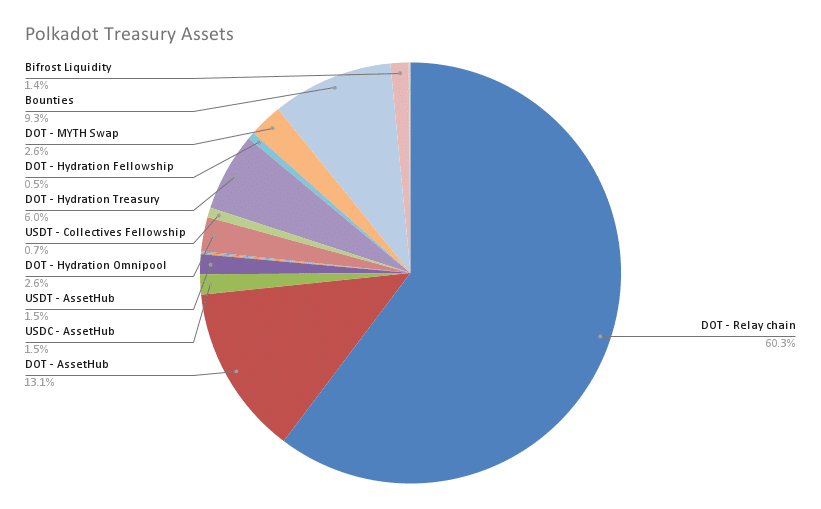

Polkadot’s head ambassador, Tommi Enenkel, highlighted within the report that the Treasury holds about 32 million DOT (roughly $200 million) in liquid belongings, with an annual web lack of 17 million DOT (round $108 million).

At this charge, Polkadot has about two years of runway left if the DOT to USD charge stays fixed, portray a precarious image, particularly when juxtaposed with the extravagant spending habits.

This state of affairs brings again reminiscences of FTX, which additionally exhibited an analogous sample of lavish spending earlier than its downfall.

Critics argue that Polkadot’s heavy give attention to advertising and marketing over improvement may very well be a crimson flag. Others fear concerning the sustainability of its monetary practices.

Polkadot rebranded to KOLKADOT after losing $37m on advertising and marketing with none tangible consequence.

This is my query

After spending enormous quantity on KOL, how are they going to trace the consequence?

Crypto remains to be a wild west.

The CMO and the advertising and marketing staff deserves a correct questioning. pic.twitter.com/tMg0HuV8il

— Victor Fawole.nft (@Victorfawole0) July 3, 2024

Let’s delve deeper into the criticisms Polkadot has confronted, the controversies surrounding its current monetary strikes, and whether or not it’s headed for an abrupt finish much like FTX.

Public backlash and controversies

Polkadot’s current treasury report has sparked widespread criticism on social media, with many customers expressing outrage over the venture’s spending habits and inner practices.

One of the vital contentious factors is Polkadot’s allocation of practically $5 million to influencer advertising and marketing within the first half of 2024.

Observers like Stacy Muur have identified that for this quantity, Polkadot ought to have garnered roughly 100 million views, given the common price per view of 5 cents. Nevertheless, the venture’s visibility on platforms like Twitter (rebranded as X) stays minimal.

Right here we slide to the influencer advertisements half ($4.9M complete spend).

For $4.9M, with a mean price per view of 5 cents, Polkadot ought to have obtained 100M views.

On X, they continue to be just about invisible, however most posts in high talk about the Treasury spendings. https://t.co/Y3ai7Dv0Px

— Stacy Muur (@stacy_muur) July 2, 2024

Delving deeper into the expenditures reveals why these considerations have surfaced. Polkadot engaged a number of companies for its advertising and marketing efforts, together with EVOX, an Italian Web2 company specializing in Esports and Gaming, which obtained $2.2 million.

Lunar Technique, a Web3 company, achieved 2.7 million views and 180 collaborations for $1.3 million, equating to $0.48 per view and $7,000 per collaboration—figures that many discover excessively excessive.

In influencer advertising and marketing, I’ve quite a few stories at my disposal and take into account it a catastrophe if prices exceed $0.1 per view.

In media placements, whereas the main focus is on consciousness and fame, it’s a very poor supply for person acquisition.

Polkadot’s outcomes are only a facepalm.

— Stacy Muur (@stacy_muur) July 2, 2024

Moreover, extravagant expenditures comparable to paying CoinMarketCap $500,000 for an animated emblem and utilizing branded non-public jets have been derided as pointless and extreme.

Polkadot paid Coinmarketcap $500k to place an animated emblem on the homepage

Glad to see VC funds being put to good use 🤝 pic.twitter.com/hWjVdnZBUW

— Taiki Maeda (@TaikiMaeda2) July 2, 2024

Past the monetary scrutiny, Polkadot has additionally been accused of discriminatory habits in the direction of its builders, notably these of Asian descent.

A developer named Victor from the Polkadot China group just lately alleged that Asian builders, particularly these from China, face unfair remedy inside the ecosystem.

By responding, I hope the core members of the Polkadot staff can publicly state whether or not there may be any unfair and even discriminatory habits in the direction of Asian builders, particularly Chinese language builders. If I hadn’t spoken up yesterday, neither the Polkadot staff nor non-Asian builders… pic.twitter.com/sbA0oVHeUR

— victorji.eth ✨🌊✈️EthCC (@victorJi15) July 3, 2024

Victor has additionally alleged that his accusation resonates with different builders in the neighborhood, together with these from initiatives like Bifrost, Phala Community, and OneBlock, who’ve, in keeping with him, voiced related grievances about discrimination and a perceived lack of true democratic processes inside Polkadot.

Because the criticism mounts, it turns into obvious that Polkadot’s strategy to managing its sources and group relations might have a major overhaul.

The venture’s heavy give attention to advertising and marketing over improvement and the reported discriminatory practices inside its ranks elevate critical questions on its sustainability and moral grounding.

Are advertising and marketing and improvement Aligned?

Polkadot’s advertising and marketing expenditures, when in comparison with its developmental efforts, reveal misaligned priorities.

Initially, there was immense hype surrounding Polkadot, particularly with the launch of its DOT token. Establishments have been bullish, and Messari ranked it because the third most-held token by establishments, following Bitcoin (BTC) and Ethereum.

The potential appeared limitless, with billions of {dollars} value of DOT locked up. Nevertheless, actuality rapidly set in—past staking, there was infant might do with their DOT tokens.

Promised functionalities in DeFi have been both non-existent or severely restricted. Previously, customers encountered essential challenges utilizing decentralized exchanges (DEXs), which starkly contrasted with the seamless experiences supplied by competing chains like Ethereum and Solana (SOL).

The introduction of governance additional difficult issues. As an alternative of supporting innovation, it turned a battleground for grifters to use the treasury, draining sources that might have been allotted to significant improvement.

The core difficulty lies in Polkadot’s failure to prioritize usability and liquidity. The person interface, particularly Polkadot JS, has confronted widespread criticism for being troublesome to navigate. Even with wallets like NovaWalletApp and FearlessWallet, the method stays cumbersome.

Liquidity on DEXs is one other essential difficulty. Swapping tokens or onboarding stablecoins like USDC and USDT entails complicated steps that deter many customers.

Such practices have eroded belief and diverted funds from extra essential improvement efforts. Furthermore, Polkadot’s strategy to dealing with its developmental challenges has prioritized public relations efforts over substantial technological developments.

As an example, Chainwire, a press launch distribution company, was paid $490,000, and Unchained, a generally used company title, obtained $460,000, as per the current treasury report.

Whereas different chains like Ethereum and Solana confronted their very own points with excessive gasoline charges and community congestion, they continued to draw customers and builders by delivering tangible worth and sustaining a robust ecosystem.

In distinction, Polkadot appeared extra centered on advertising and marketing and public posturing, typically criticizing different initiatives slightly than addressing its inner shortcomings.

With out obligatory modifications, Polkadot dangers fading into obscurity, very like EOS and Tezos, regardless of its early promise and technical benefits.

May Polkadot collapse like FTX?

The query of whether or not Polkadot might collapse like FTX is on many minds, particularly given the current scrutiny of its monetary practices. To know the potential dangers, let’s evaluate the 2.

FTX was a serious crypto change that gained speedy reputation by aggressive advertising and marketing and high-profile sponsorships. It spent tens of millions on advertisements, movie star endorsements, and naming rights for sports activities arenas.

Nevertheless, behind this facade of success, FTX had critical monetary mismanagement and hidden money owed. When these points got here to gentle, it led to a catastrophic collapse, wiping out billions in investor funds.

Polkadot, equally, has been spending closely on advertising and marketing, about 40% of its complete expense, far increased than typical advertising and marketing budgets of 8-15%.

Regardless of this, Polkadot’s visibility and person engagement haven’t seen proportional development. For the sake of argument, this mirrors FTX’s strategy of prioritizing picture over substance.

Financially, Polkadot’s current treasury report reveals troubling indicators. With $87 million spent in simply six months and a web lack of 17 million DOT (round $108 million) per 12 months, Polkadot’s runway is restricted to about two years if present spending continues. This monetary pressure raises considerations about sustainability, particularly if market circumstances worsen and revenues decline.

One other parallel is the dealing with of governance and useful resource allocation. FTX confronted inner turmoil and poor decision-making, which contributed to its downfall. Polkadot’s governance has additionally been criticized for approving questionable proposals and inefficient spending, diverting funds from essential improvement wants.

Nevertheless, it’s essential to notice key variations. FTX’s collapse was accelerated by its function as an change, the place liquidity points can rapidly spiral uncontrolled.

Polkadot, as a blockchain platform, operates in another way. Its collapse would possible be slower, pushed by a lack of person and developer belief slightly than a right away liquidity disaster.

Polkadot’s success hinges on its means to pivot. Addressing person expertise points, bettering liquidity on its DEXs, and higher governance are essential steps.

In contrast to FTX, Polkadot has an opportunity to right course and leverage its technological strengths to regain group belief.

Polkadot can keep away from the pitfalls that led to FTX’s dramatic collapse. The subsequent few months will probably be essential in figuring out whether or not Polkadot can realign its methods and maintain its development.