Ethereum has entered a consolidation correction part, retracing again towards the damaged decrease boundary of the multi-month wedge.

This motion suggests a possible pullback to the beforehand breached stage, indicating a probable continuation of the bearish pattern within the upcoming days.

By Shayan

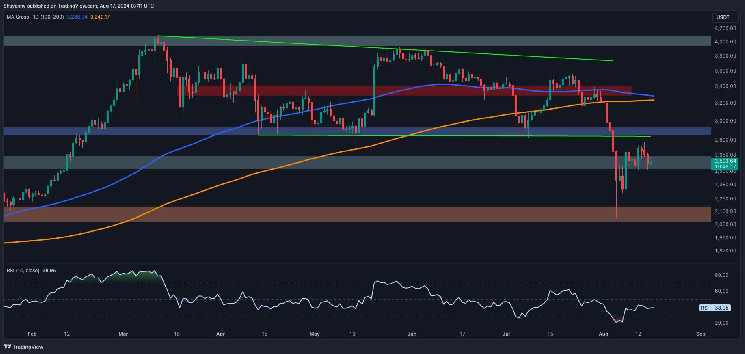

The Day by day Chart

A better examination of Ethereum’s day by day chart exhibits that the cryptocurrency has entered a corrective part, with value motion signaling a possible pullback towards the wedge’s damaged decrease boundary at $2.8K. After discovering assist close to the essential $2K stage, ETH initiated a bullish retracement, shifting again towards this key resistance zone.

Nonetheless, this space is probably going stuffed with provide, resulting in elevated promoting strain.

If the cryptocurrency fails to interrupt above $2.8K, it is going to verify the completion of the pullback, suggesting a continuation of the preliminary bearish pattern. The important thing ranges to observe this week are the $2.8K resistance and the $2K assist.

The 4-Hour Chart

On the 4-hour chart, Ethereum’s consolidation part is extra pronounced as the worth retraces towards the $2.8K resistance. Nonetheless, the cryptocurrency is at the moment inside a crucial vary, between the 0.5 ($2.6K) and 0.618 ($2.7K) Fibonacci ranges performing as vital resistance.

ETH has additionally shaped an ascending wedge sample, a identified bearish continuation formation, with the potential for a downward break.

If the worth fails to push above this resistance zone and drops under the wedge’s decrease boundary, the bearish pattern will probably proceed towards the $2K assist stage. Monitoring Ethereum’s value motion within the coming days is essential for anticipating its subsequent transfer.

By TradingRage

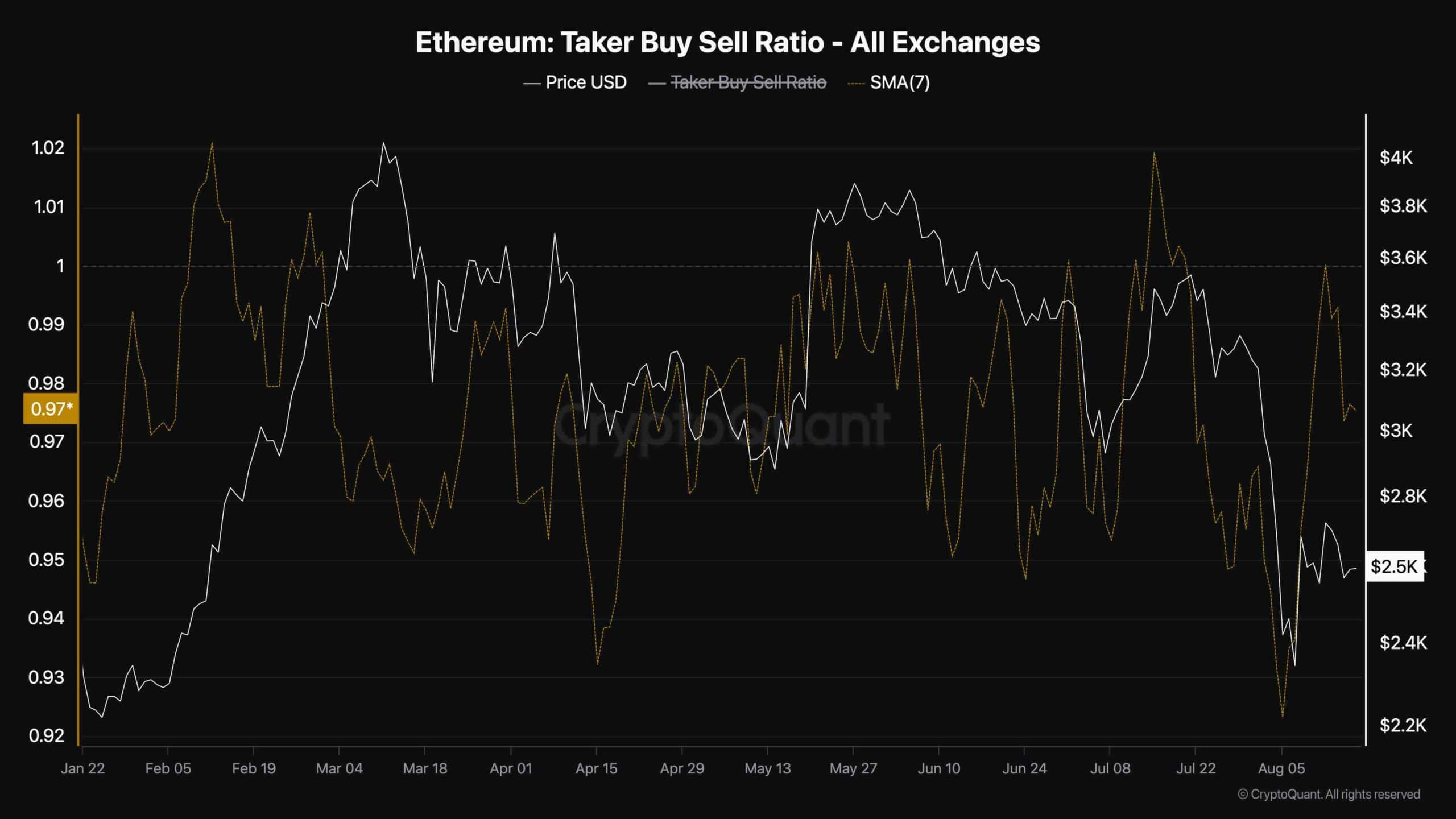

Following a latest bullish retracement in Ethereum’s value, market individuals are unsure in regards to the sustainability of this upward transfer. To raised perceive present market dynamics, an evaluation of the futures market, particularly the Taker Purchase/Promote Ratio, supplies worthwhile insights.

This ratio measures the aggressiveness of consumers versus sellers in executing orders. As proven within the chart, after Ethereum confronted rejection on the $3K stage, the Taker Purchase/Promote Ratio cascaded, indicating a major quantity of market promote orders. Though the metric noticed a restoration throughout a subsequent bullish corrective motion, it nonetheless hovered close to zero, suggesting that the bullish transfer lacked energy. The lack to reclaim earlier ranges implies that sellers keep the higher hand.

The ratio has lately declined, signaling that sellers are probably making ready to push Ethereum’s value decrease. Except there’s an surprising surge in demand, the present pattern factors towards a possible continuation of bearish strain within the coming days.