Ethereum’s value has been gaining bullish momentum lately after experiencing a correction within the final couple of months.

With the asset approaching its latest excessive, buyers are hoping for brand new data, however breaking the $4,000 resistance appears more durable than anticipated.

Technical Evaluation

By TradingRage

The Every day Chart

Within the each day timeframe, the value blasted via the upper boundary of the massive descending channel some time in the past. The market has been consolidating since, however there isn’t any signal of a deep correction.

With the $3,600 space turning right into a assist stage, the market will probably break via the important thing $4,000 resistance zone. On this case, market contributors will be optimistic {that a} mid-term rally towards the $4,800 all-time excessive would possibly start quickly.

The 4-Hour Chart

The 4-hour chart can be demonstrating some bullish indicators. The value has been declining inside a bullish flag sample this week. Nonetheless, it seemingly breaks the flag to the upside, a basic bullish continuation sign.

With the Relative Energy Index additionally on the verge of rising above 50%, the momentum can be shifting in favor of a bullish transfer. Subsequently, if issues don’t change drastically, it may solely be a matter of time earlier than the value breaks above the $4,000 resistance stage.

Sentiment Evaluation

By Shayan

Open Curiosity

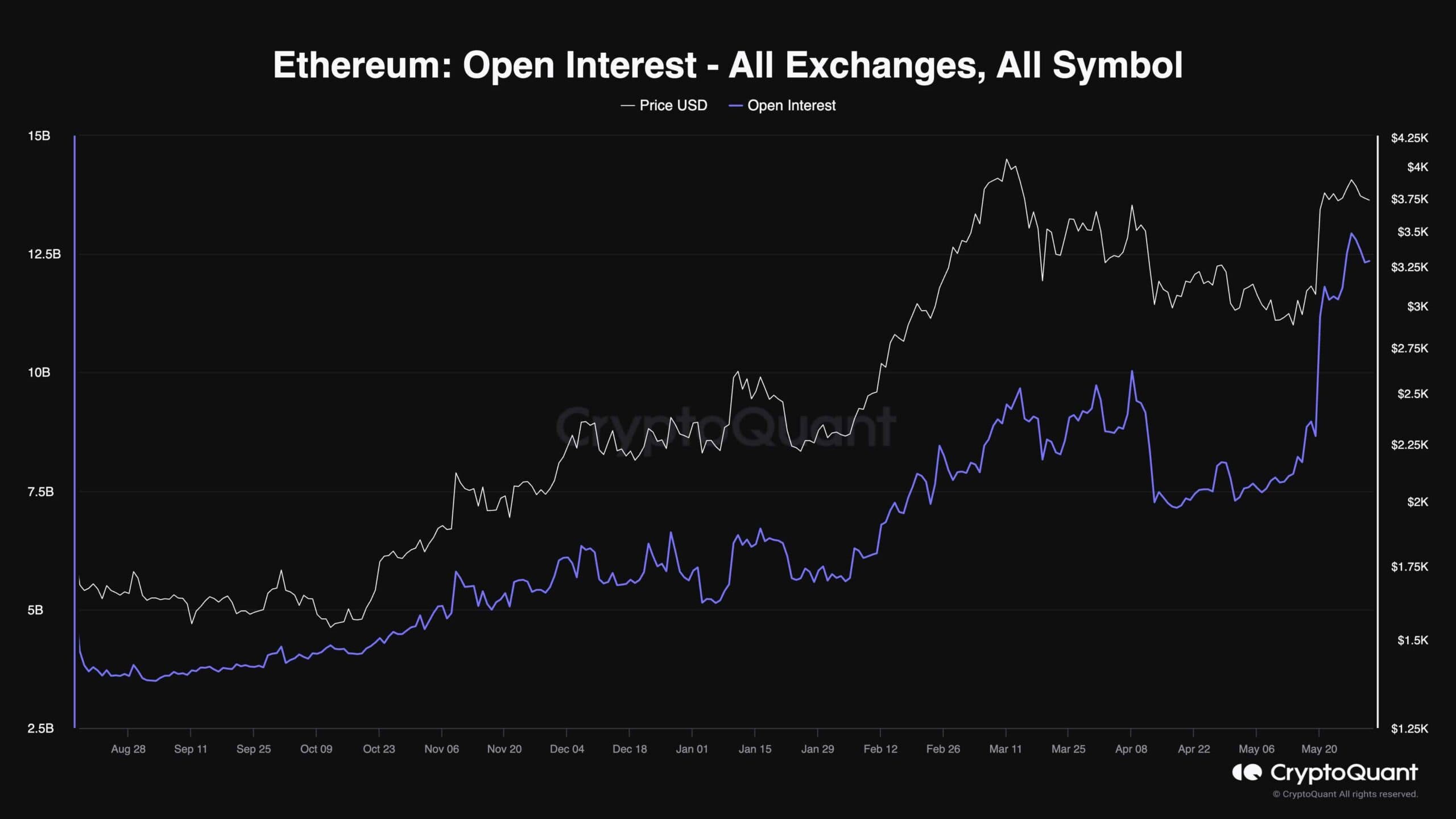

Ethereum’s value skilled a fast impulsive surge final week, nearing the $4K mark. This uptrend has sparked renewed demand and heightened purchaser exercise as merchants chase substantial earnings.

The accompanying chart highlights Ethereum’s open curiosity, a vital metric for gauging futures market sentiment. Typically, larger open curiosity values are related to bullish sentiment, whereas extraordinarily excessive values can result in elevated volatility and potential liquidation cascades.

The chart reveals a steep rise in open curiosity alongside the latest bullish run. Whereas this surge in open curiosity usually alerts sturdy bullish sentiment, it additionally introduces potential volatility and the chance of sudden, surprising value actions in both course. Given the excessive open curiosity values and the inherent dangers of heightened volatility, it’s advisable for buyers to handle their threat rigorously within the quick time period.