Ethereum is in a vital part, with an inverted head and shoulders sample forming on the every day chart and a double-bottom sample on the 4-hour chart, each pointing towards the potential for a slight bullish reversal.

The $2.7K neckline and $2.1K help degree shall be key areas to observe, as a breakout or breakdown will decide the following major course.

By Shayan

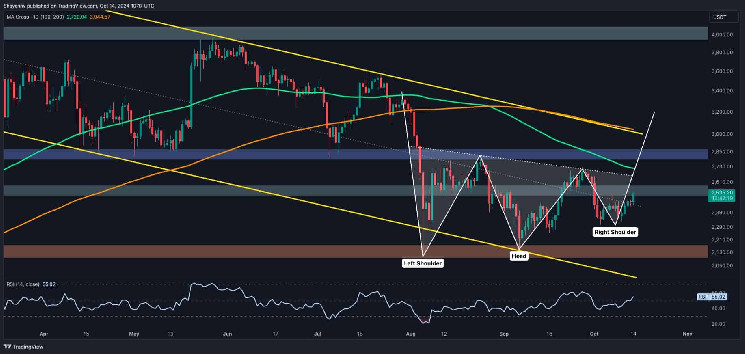

The Every day Chart

Ethereum is present process a descending consolidation part, with no clear directional bias rising just lately. Nonetheless, an vital inverted head and shoulders sample has fashioned close to the $2.1K help zone, a vital degree the place consumers have managed to carry floor.

This sample is usually a bullish reversal sign, suggesting {that a} shift in direction of upward momentum could also be on the horizon, significantly if ETH can break by way of the neckline, which is round $2.7K.

Ethereum has roughly reclaimed the midpoint of the multi-month channel, which lies round $2.5K. If this breakout seems to be legitimate, consumers’ subsequent focus will shift to the neckline of the inverted head-and-shoulders sample at $2.7K. A breakthrough at this degree may solidify a bullish reversal, doubtlessly concentrating on the $3K resistance zone within the close to time period.

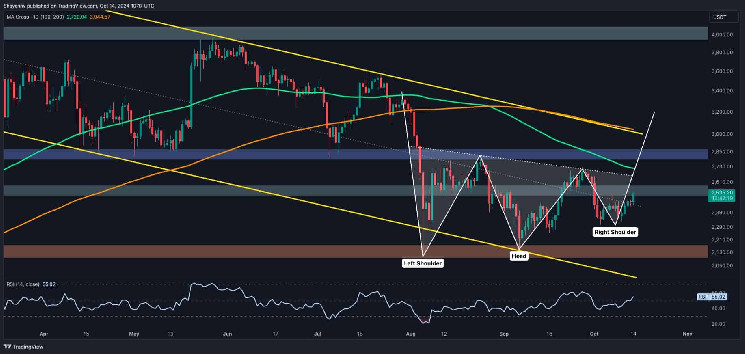

The 4-Hour Chart

On the 4-hour chart, Ethereum sellers have struggled to push the value under the ascending flag sample’s decrease boundary, which sits close to $2.3K. This dynamic help degree has been examined a number of occasions, and a breach right here may set off a long-squeeze occasion, sending the value quickly right down to the $2.1K help area. Nonetheless, Ethereum has additionally fashioned a double-bottom sample on this timeframe, which generally indicators a short-term bullish reversal.

The worth is presently confined between the ascending flag’s help and a vital resistance zone outlined by the 0.5 Fibonacci degree at $2.6K and the 0.618 Fibonacci degree at $2.8K. Ethereum will doubtless proceed consolidating inside this tight vary till a decisive breakout, both upward or downward, happens.

By Shayan

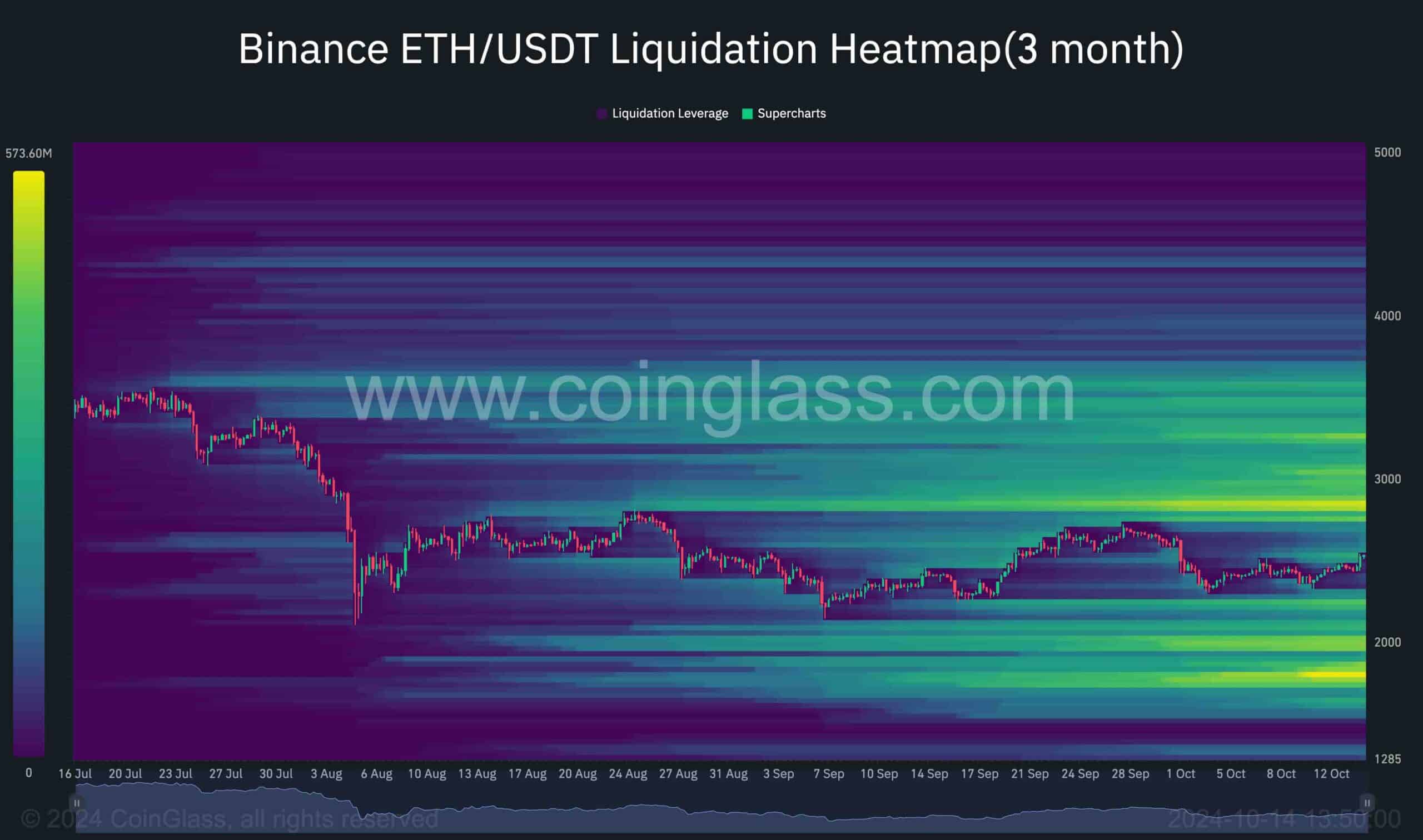

Ethereum is presently trapped inside a value vary between $2.1K and $2.7K, and an in depth have a look at the Binance liquidation heatmap reveals the important thing liquidity zones that would affect an impending breakout. The heatmap shows areas of concentrated liquidity, akin to stop-loss orders and liquidation ranges, that are predominantly pushed by extra important market individuals, together with whales.

The cryptocurrency faces a interval of slight consolidation with minimal volatility, reflecting the equilibrium between consumers and sellers. On the draw back, the $2K area is closely defended by whales and institutional merchants, as evidenced by important liquidity swimming pools concentrated on this space. Then again, the $2.8K resistance zone represents a formidable barrier, because it holds a big quantity of liquidity.

This liquidity focus means that many merchants, significantly massive ones, have positioned their liquidation factors round this value degree, making it vital. A breakout in both course may result in a liquidation cascade, triggering a series response of stop-loss orders and liquidations that would amplify the prevailing pattern.