With Bitcoin sitting close to $70K, is $100K the following cease? How will the U.S. election, ETF approvals, and market sentiment affect its future path?

Desk of Contents

Bitcoin is bitcoining

Bitcoin (BTC) has been on a powerful bull run, gaining over 2% previously week because the “Uptober” impact sweeps by the crypto market.

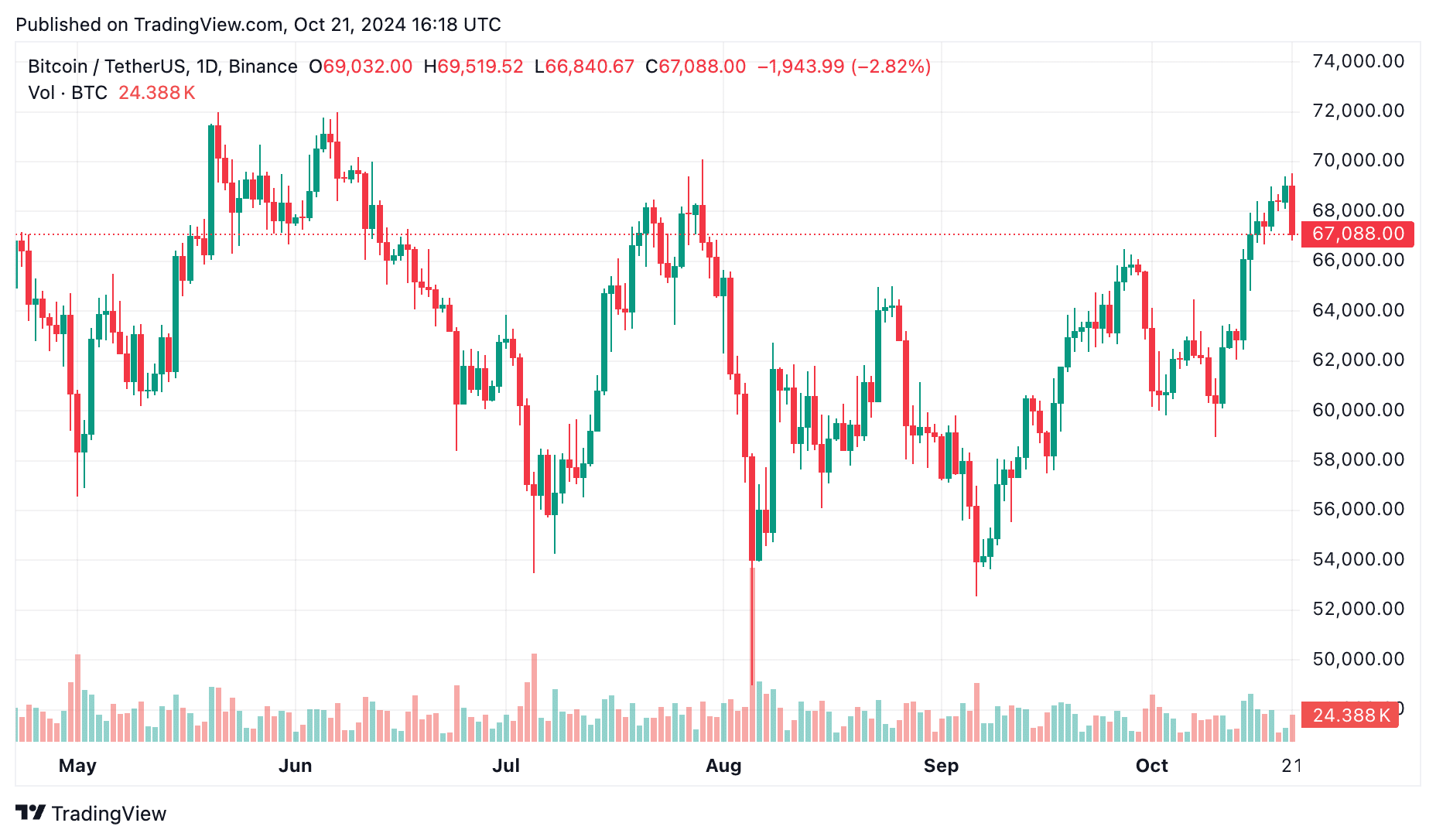

As of Oct. 21, BTC is buying and selling at $67,100—a stage it hasn’t seen since late July, marking a 3-month excessive. In actual fact, BTC briefly touched $69,500 earlier than retreating as bears stepped in to curb the rally.

BTC 6-month value chart | Supply: TradingView

The market sentiment is shifting quick, too. The crypto worry and greed index now sits at 63, signaling “greed,” a pointy distinction to the yearly low of 26 on Sep. 7, when worry dominated the market.

Traders appear optimistic, particularly with the U.S. presidential election simply across the nook on Nov. 5. Former President Donald Trump, who has proposed crypto-friendly insurance policies, is gaining momentum in election polls.

Many consider his potential win might push Bitcoin to new heights, as his insurance policies are seen as useful for the crypto trade.

So, what’s subsequent for BTC? With key financial occasions on the horizon and a extremely charged political area, the place may BTC head within the coming days? Let’s discover out.

Spot Bitcoin ETFs acquire traction as optimistic modifications roll in

In a giant win for the Bitcoin market, spot Bitcoin exchange-traded funds are set to see extra motion, because of a current rule change by the U.S. Securities and Trade Fee.

On Oct. 18, the SEC authorized a brand new rule permitting the New York Inventory Trade (NYSE) and the Chicago Board Choices Trade to supply choices buying and selling for a number of spot Bitcoin ETFs. This transfer opens the door to better liquidity and smoother value actions within the crypto area.

Some massive names are affected by this transformation. The NYSE now has the inexperienced gentle to record choices for the Grayscale Bitcoin Belief (GBTC), Grayscale Bitcoin Mini Belief (BTC), and Bitwise Bitcoin ETF (BITB).

In the meantime, Cboe International Markets can record choices for the Constancy Clever Origin Bitcoin Fund (FBTC) and the ARK 21Shares Bitcoin ETF (ARKB).

These developments come simply weeks after the SEC granted Nasdaq approval to record choices for BlackRock’s iShares Bitcoin Belief (IBIT).

Choices are monetary contracts that give buyers the fitting—however not the duty—to purchase or promote an asset at a set value earlier than a sure date. On this case, the underlying asset is a Bitcoin ETF.

Though no launch dates have been confirmed for these choices, consultants consider the approval might have an enormous affect.

Extra monetary merchandise on main U.S. exchanges imply broader entry to crypto, which might appeal to a wider vary of individuals—from institutional gamers to on a regular basis buyers.

The timing couldn’t be higher. Bitcoin ETFs have seen a powerful surge in inflows just lately. In response to knowledge from CoinGlass, spot Bitcoin ETFs raked in over $2.13 billion in inflows within the week ending Oct. 18, pushing whole property underneath administration to a strong $52 billion.

Final week’s inflows marked the strongest efficiency for Bitcoin ETFs in about seven months, signaling that investor confidence in crypto is on the rise.

You may additionally like: BlackRock’s $26b Bitcoin ETF topped quickest rising fund

Is a breakout imminent?

As Bitcoin flirts with the $70K mark, many consultants have taken to social media to share their insights on the place the market may head subsequent.

Bitcoin is the “Boring Zone”

Crypto analyst Michaël van de Poppe has dubbed the present state of Bitcoin as being within the “Boring Zone.” Nonetheless, this doesn’t sign unhealthy information.

#Bitcoin is presently within the Boring Zone.#Altcoins are presently reversing and ending the longest bear market in historical past.

This implies it is time for Banana Zone, and relying on how lengthy it would take with liquidity, this Banana Zone goes to be epic. pic.twitter.com/XNNBpvUomr

— Michaël van de Poppe (@CryptoMichNL) October 21, 2024

Bitcoin has been consolidating across the $68,000 stage, whereas behind the scenes, altcoins have began to indicate indicators of restoration.

In response to van de Poppe, this part is harking back to a coiled spring ready for a jolt of liquidity. “Altcoins are presently reversing and ending the longest bear market in historical past,” he explains.

This “Boring Zone” is an important interval for Bitcoin, the place the worth hovers in a decent vary however builds momentum beneath the floor. Traditionally, related phases in Bitcoin’s value motion have led to giant upward actions, as buyers bounce again in as soon as they sense the ground has been established.

Bullish momentum alerts are flashing

On the technical entrance, Ali, one other outstanding crypto analyst, has turned to a selected metric to gauge Bitcoin’s subsequent transfer.

Considered one of my go-to indicators for gauging #Bitcoin’s development, the MVRV Momentum, has flipped bullish once more!!! pic.twitter.com/qOtIJgXTWe

— Ali (@ali_charts) October 20, 2024

The market worth to realized worth momentum indicator, which compares Bitcoin’s present value to the worth at which most BTC was final moved, has just lately flipped bullish.

When this indicator flashes bullish, it’s typically an early signal of extra value positive factors to come back. Basically, individuals are holding onto their Bitcoin, believing the market is primed for a push greater — an necessary psychological think about value motion.

As buyers really feel assured and maintain their Bitcoin, promoting stress reduces. With much less promoting stress, upward momentum turns into simpler to maintain, pushing Bitcoin greater.

Rising open curiosity

One other key issue is the rise in Bitcoin CME Futures Open Curiosity, which just lately hit an all-time excessive of $12 billion, as famous by Maartunn, a crypto futures professional.

Bitcoin: CME Futures Open Curiosity hits an ALL-TIME-HIGH with $12.0B$BTC #OpenInterest #Futures pic.twitter.com/NSDCy6ozMS

— Maartunn (@JA_Maartun) October 20, 2024

Open curiosity refers back to the whole variety of excellent futures contracts that haven’t been settled. A rise in open curiosity means extra merchants are putting bets on Bitcoin’s future value motion.

The surge in open curiosity matches into the broader image of Bitcoin’s present momentum. Merchants are clearly anticipating a breakout, seemingly pushed by the macroeconomic occasions at play.

Nonetheless, there’s a catch—greater open curiosity can typically result in elevated volatility, particularly if numerous merchants are on the identical facet of the commerce, whether or not bullish or bearish. If the market strikes towards these positions, it might set off liquidations, resulting in sudden value swings.

U.S. elections and Fed price cuts

Macroeconomic elements are additionally at play, with the U.S. presidential election on Nov. 5 and the Federal Reserve’s subsequent assembly on Nov. 7 probably influencing Bitcoin’s value motion.

Former President Donald Trump, who leads in a number of polls, is seen as crypto-friendly. A Trump victory may enhance Bitcoin’s value as buyers develop extra assured in regulatory readability and assist for the trade.

However, if Kamala Harris wins, the market response is more durable to foretell. Harris hasn’t made her stance on crypto clear, which might introduce uncertainty.

Then there’s the Federal Reserve’s upcoming choice on rates of interest. At the moment, there’s a 90.5% probability the Fed will lower charges by 25 foundation factors at their Nov. 7 assembly.

A price lower would inject extra liquidity into the financial system, typically benefiting threat property like Bitcoin. Extra liquidity means extra money flowing into markets, and Bitcoin might immediately profit from this elevated capital.

If each a Trump win and a Fed price lower materialize, the mixed impact might create an ideal storm for Bitcoin’s value to surge past $70K.

The place might Bitcoin head subsequent?

One crypto analyst believes that Bitcoin’s subsequent goal is $98,000. A preferred sentiment throughout the group is that momentum is steadily constructing, with rising confidence that BTC is prepared for its subsequent leg up.

#Bitcoin Subsequent Goal: $98,000 🎯

Momentum is constructing.

Issues are beginning to odor good for #BTC 🚀 pic.twitter.com/30kOF5GA1w— Titan of Crypto (@Washigorira) October 20, 2024

In the meantime, in accordance with famend crypto analyst Rekt Capital’s evaluation, we’re presently within the $65,000 to $70,000 vary, and the following main cease could possibly be wherever between $90,000 and $160,000.

#BTC

We’re right here (orange circle)

We will probably be there (inexperienced circle)$BTC #Crypto #Bitcoin pic.twitter.com/cdom1cxnpm

— Rekt Capital (@rektcapital) October 18, 2024

As Bitcoin builds energy across the $70K mark, the following logical resistance could possibly be at $90K. But when Bitcoin breaks by $90K with sturdy momentum, it might shortly speed up towards $100K and past.

It is because as soon as Bitcoin enters value discovery (buying and selling above earlier all-time highs), market euphoria tends to drive costs a lot greater in a comparatively brief interval.

For now, the momentum appears to favor Bitcoin’s rise. Nonetheless, buyers ought to stay vigilant, watching each the technicals and broader financial indicators to gauge BTC’s subsequent motion. As at all times, commerce properly and by no means make investments greater than you may afford to lose.