Bitcoin’s worth cycles have lengthy been a supply of intrigue for buyers and analysts alike. We will acquire insights into potential worth actions by evaluating present tendencies to earlier cycles, particularly with Bitcoin seemingly coming to an finish of its consolidation interval, many surprise if the following leg up is across the nook.

Evaluating Bitcoin Cycles

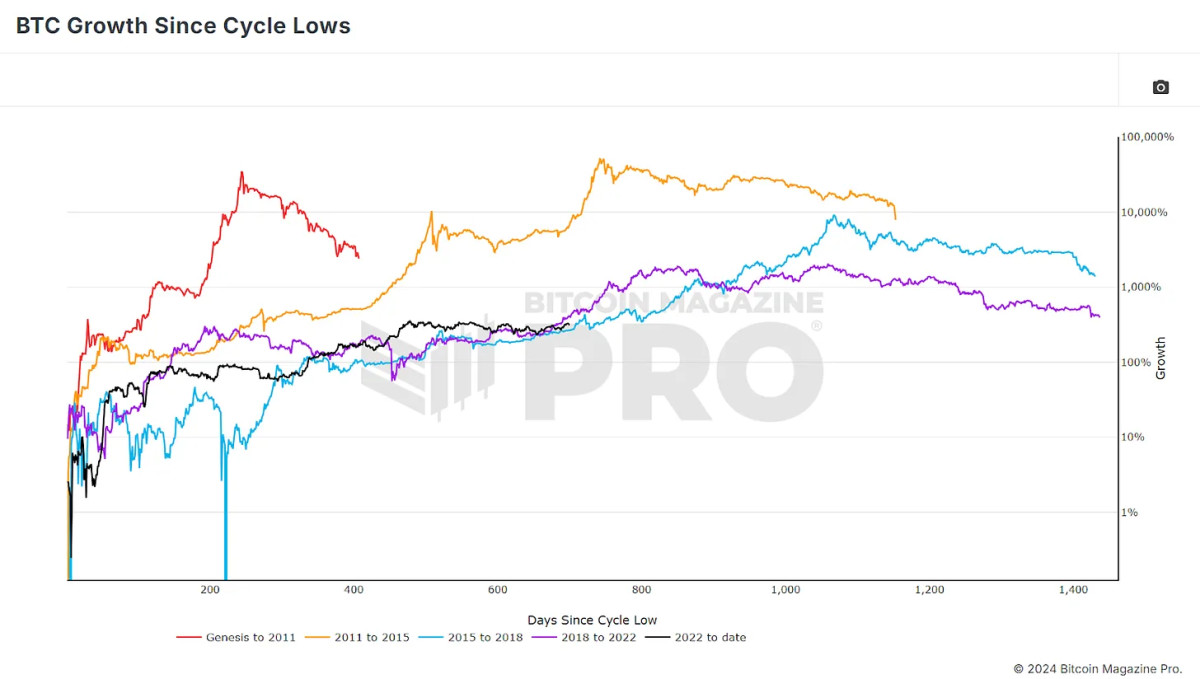

To start, it’s essential to have a look at how Bitcoin has carried out since hitting its latest cycle low. As we look at the information, a transparent image begins to kind: Bitcoin’s present worth motion (black line) is displaying patterns just like earlier bull cycles. Though it has been a uneven consolidation interval, the place the worth has been comparatively stagnant, there are key similarities after we evaluate this cycle to these in 2015-2018 (purple line) and 2018-2022 (blue line).

Determine 1: BTC Progress Since Cycle Lows displaying similarities with our earlier two cycles. View Stay Chart 🔍

The place we’re right now, when it comes to share features, is akin to each the 2018 and 2015 cycles. Nevertheless, this comparability solely scratches the floor. Value motion alone would not inform the total story, so we have to dive deeper into investor conduct and different metrics that form the Bitcoin market.

Investor Conduct

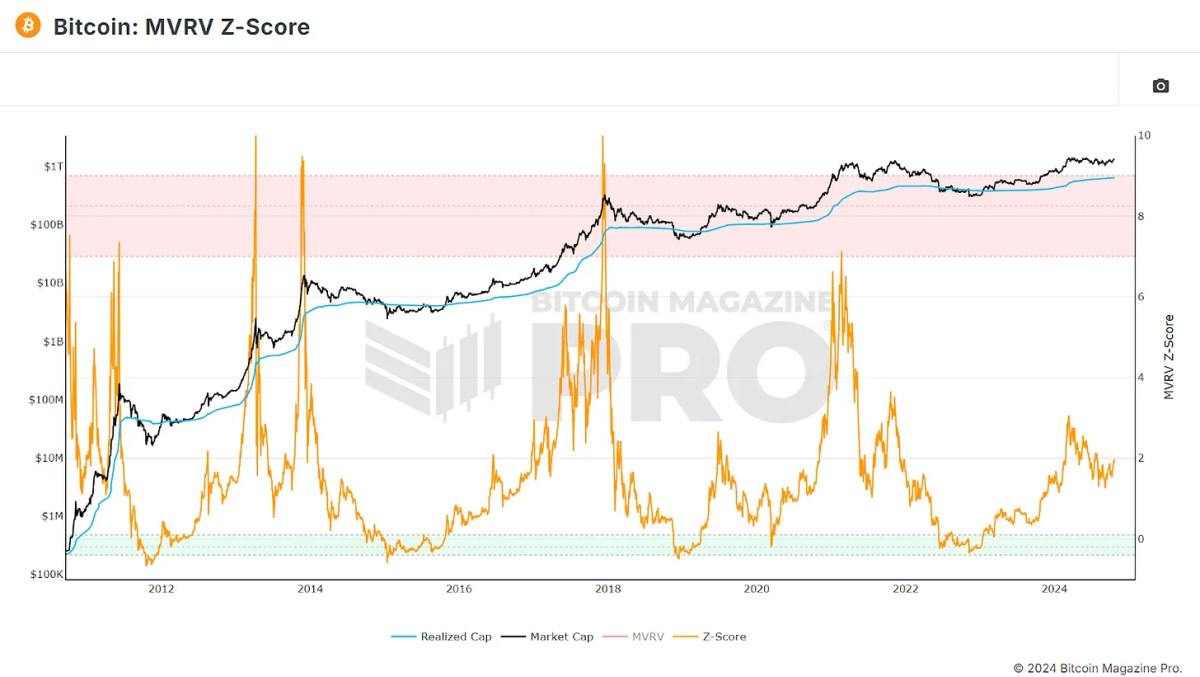

One key metric that provides us perception into investor conduct is the MVRV Z-Rating. This ratio compares Bitcoin’s present market worth to its “realized worth” (or value foundation), which represents the typical worth at which all Bitcoin on the community was amassed. The Z-Rating then simply standardizes the uncooked MVRV information for BTC volatility to exclude excessive outliers.

Determine 2: Bitcoin MVRV Z-Rating offers insights into earnings and losses for the typical investor. View Stay Chart 🔍

Analyzing metrics comparable to this one, versus purely specializing in worth actions, will permit us to see patterns and similarities in our present cycle to earlier ones, not simply in greenback actions but additionally in investor habits and sentiment.

Correlating Actions

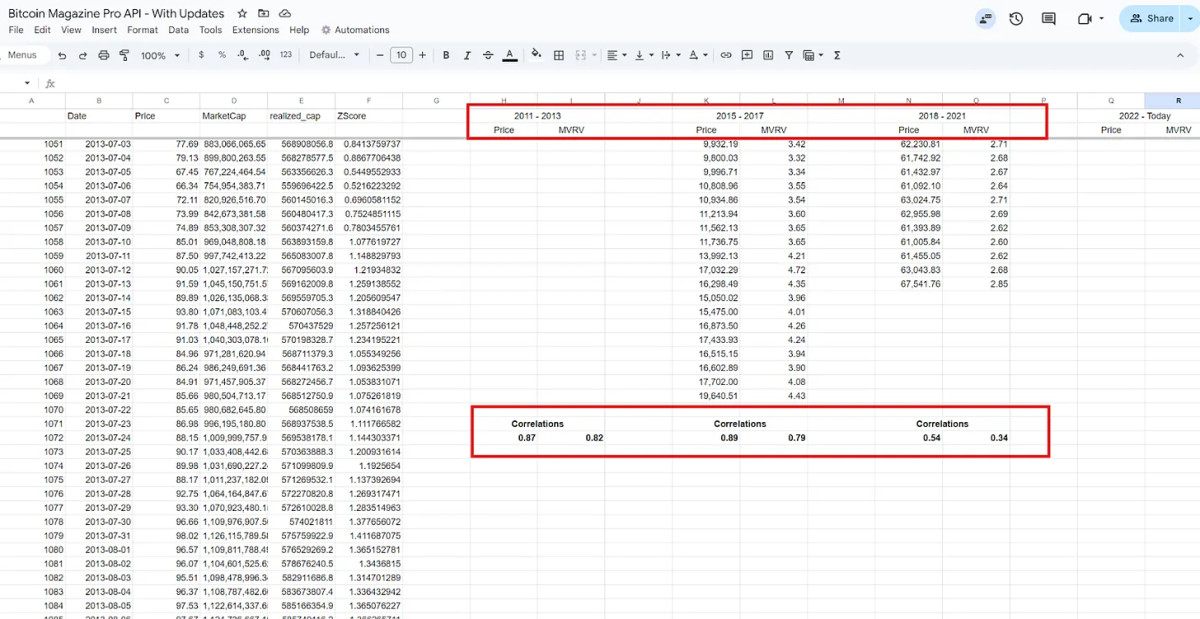

To higher perceive how the present cycle aligns with earlier ones, we flip to the information from Bitcoin Journal Professional, which gives in-depth insights by means of its API. Excluding our Genesis cycle, as there’s little correlation and isolating the worth and MVRV information from Bitcoin’s lowest closing costs to its highest factors in our present and former three cycles, we are able to see clear correlations.

Determine 3: Value and MVRV correlations between this cycle and our earlier three.

2011 to 2013 Cycle: This cycle, characterised by its double peak, reveals a robust 87% correlation with the present worth motion. The MVRV ratio additionally reveals a excessive 82% correlation, which means that not solely is Bitcoin’s worth behaving equally, however so is investor conduct when it comes to shopping for and promoting.

2015 to 2017 Cycle: This cycle is definitely the closest when it comes to worth motion, boasting an 89% correlation with our present cycle. Nevertheless, the MVRV ratio is barely decrease, suggesting that whereas costs are following comparable paths, investor conduct could be barely completely different.

2018 to 2021 Cycle: This most up-to-date cycle, whereas optimistic, has the bottom correlation to present tendencies, indicating that the market might not be following the identical patterns it did just some years in the past.

Are We in for One other Double Peak?

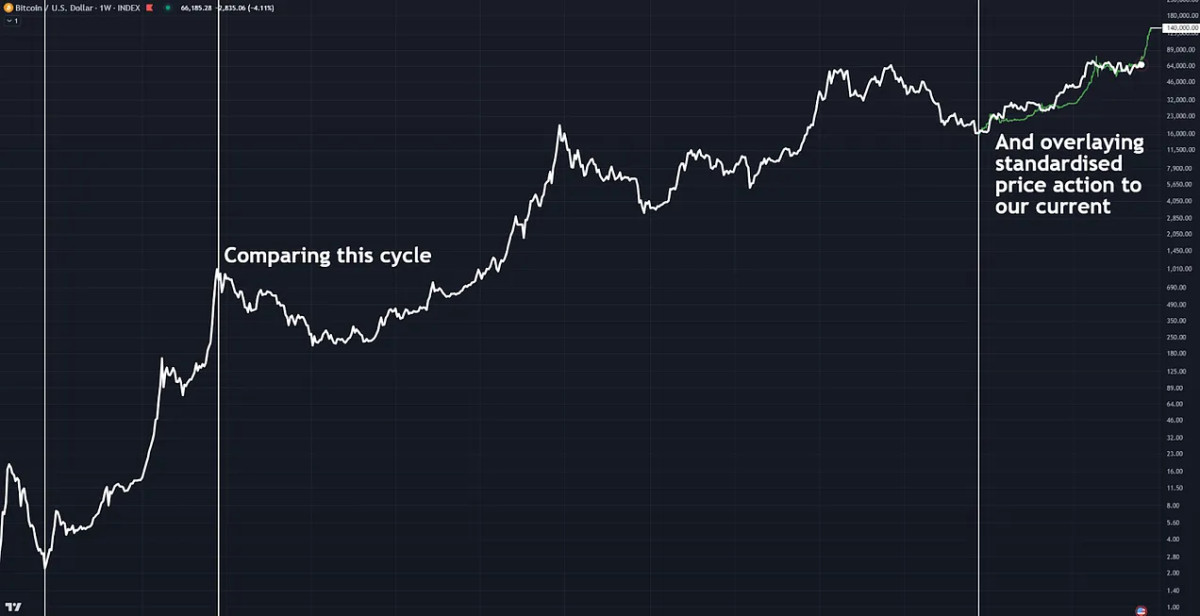

The sturdy correlation with the 2011-2013 cycle is especially noteworthy. Throughout that interval, Bitcoin skilled a double peak, the place the worth surged to new all-time highs twice earlier than getting into a chronic bear market. If Bitcoin follows this sample, we could possibly be on the verge of great worth actions within the coming weeks. After overlaying the worth motion fractal from this era over our present cycle and standardizing the returns, the similarities are immediately noticeable.

Determine 4: Overlaying a standardized fractal of the 2013 double peak cycle on our present worth motion.

In each circumstances, Bitcoin had a speedy run-up to a brand new excessive, adopted by a protracted, uneven interval of consolidation. If historical past repeats itself, we might see a large worth rally quickly, probably to round $140,000 earlier than the tip of the yr when accounting for diminishing returns.

Patterns In Investor Conduct

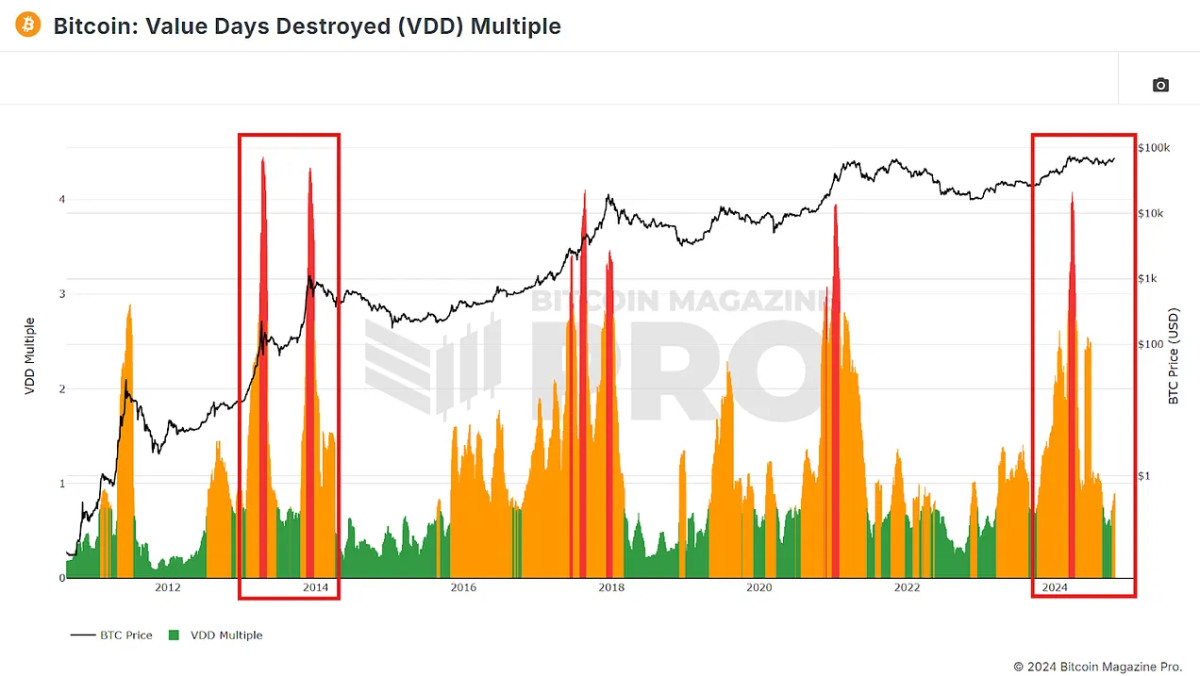

One other precious metric to look at is the Worth Days Destroyed (VDD). This metric weights BTC actions by the quantity being moved and the time because it was final transferred and multiplies this worth by the worth to supply insights into long-term buyers’ conduct, particularly profit-taking.

Determine 5: VDD preliminary run-up and cool-off verify similarities in investor conduct. View Stay Chart 🔍

Within the present cycle, VDD has proven an preliminary spike just like the purple spikes we noticed throughout the 2013 double peak. This run-up as BTC ran to a brand new all-time excessive earlier this yr earlier than a sustained consolidation interval might see us reaching new highs quickly once more if this double peak cycle sample continues.

A Extra Real looking State of affairs

As Bitcoin has grown and matured as an asset, we’ve seen prolonged cycles and diminishing returns in our two most up-to-date cycles in comparison with our preliminary two. Due to this fact, it’s in all probability extra probably that BTC follows the cycle through which we’re seeing the strongest correlation in worth motion.

Determine 6: Overlaying a fractal of the 2017 cycle on our present worth motion.

If Bitcoin follows the 2015-2017 sample, we might nonetheless see new all-time highs earlier than the tip of 2024, however the rally would probably be slower and extra sustainable. This state of affairs predicts a worth goal of round $90,000 to $100,000 by early 2025. After that, we might see steady progress all year long, with a possible market peak in late 2025, though a peak of $1.2 million if we observe this sample precisely could also be optimistic!

Conclusion

Historic information suggests we’re approaching a vital turning level. Whether or not we observe the explosive double-peak cycle from 2011-2013 or the slower however regular rise of 2015-2017, the outlook for Bitcoin stays bullish. Monitoring key metrics just like the MVRV ratio and Worth Days Destroyed will present additional clues as to the place the market is headed, and evaluating correlations with our earlier cycles will give us higher insights into what could also be coming.

With Bitcoin poised for a breakout, whether or not within the subsequent few weeks or in 2025, if BTC even remotely follows the patterns of any of our earlier cycles, buyers ought to put together for important worth motion and potential new all-time highs sooner reasonably than later.

For a extra in-depth look into this matter, try a latest YouTube video right here: Evaluating Bitcoin Bull Runs: Which Cycle Are We Following