Over the previous hour, bitcoin’s worth holds tight at costs between $101,696 to $102,057 on Dec. 19, 2024, with a market cap of $2.01 trillion. It danced between $98,839.87 and $104,967 through the day, backed by a full of life $104 billion in trades over 24 hours.

Bitcoin

On the every day chart, bitcoin rocketed from round $87,000 to just about $108,000 earlier than encountering heavy promoting. The following dip took costs all the way down to a significant assist round $98,000. This stage has stood its floor regardless of elevated sell-offs, hinting it could be the springboard for the subsequent climb. The commodity channel index (CCI) at 32 and the relative energy index (RSI) at 57 point out a balanced momentum, however the transferring common convergence divergence (MACD) reveals a bearish flip with a promote sign on the horizon.

BTC/USD 1H chart on Dec. 19.

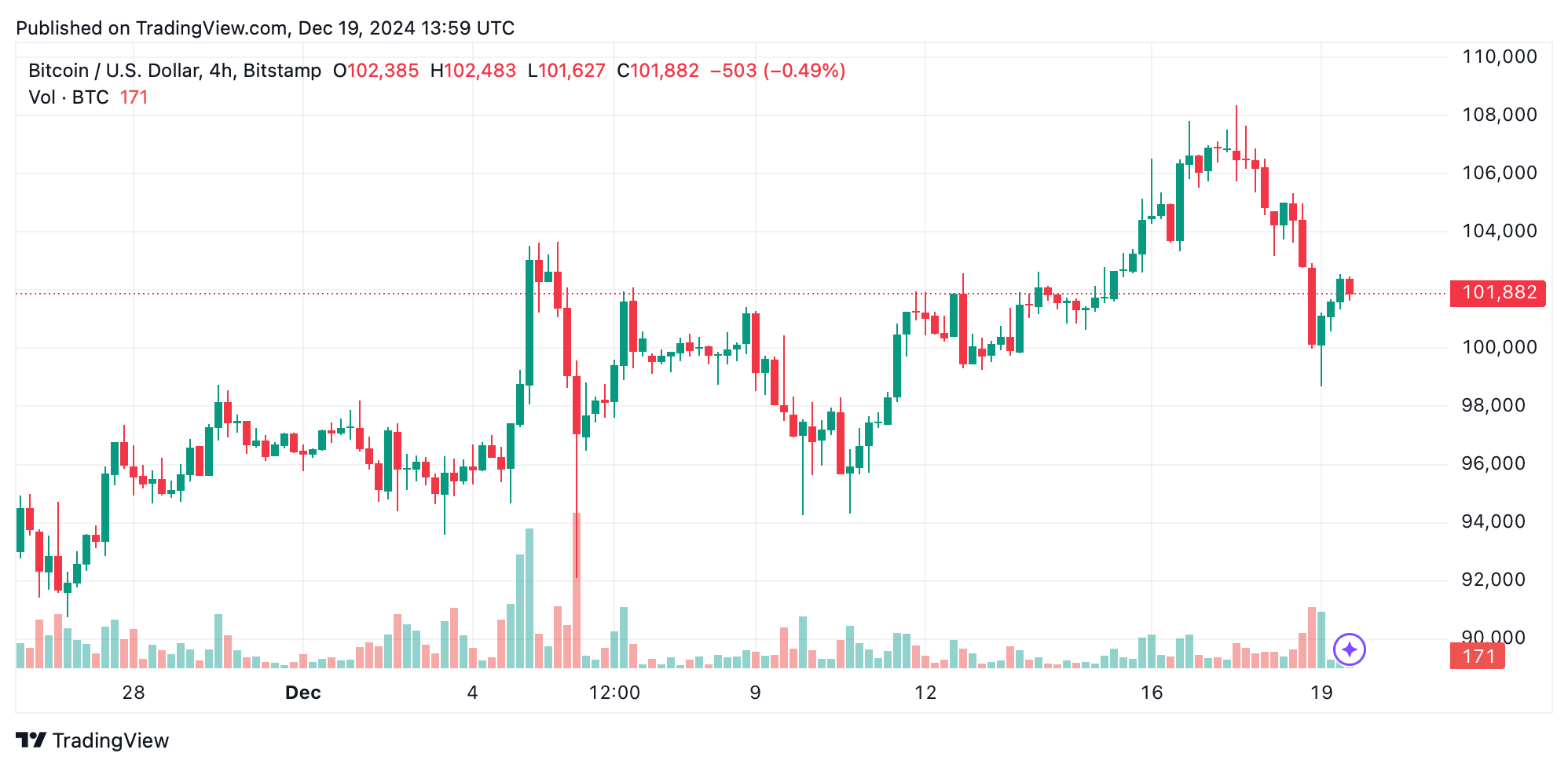

The 4-hour chart reveals a dramatic fall from $108,000 to roughly $98,000, with feeble makes an attempt at restoration. The formation of decrease highs factors to a short-term bearish temper. Quantity evaluation reveals robust sell-offs through the decline, whereas shopping for appears lackluster. Each the 10-period exponential transferring common (EMA) and easy transferring common (SMA) are flashing promote indicators, supporting this development. Preserve an eye fixed out for a breakout over $103,000 or a plunge under $98,000 for decisive strikes.

Bitcoin’s 1-hour chart is presently hovering between $101,000 and $103,000, with $98,000 appearing as a strong intraday assist. The reducing quantity throughout this era indicators {that a} breakout could possibly be simply across the nook. Momentum oscillators like Stochastic at 63 and the superior oscillator (AO) at 6,305 are impartial, however momentum at 4,280 offers a purchase sign. A robust push above $103,000 with elevated quantity may herald a bullish development, whereas slipping under $101,000 might result in revisiting $98,000.

Oscillators current a blended bag, with most indicators displaying impartial indicators, apart from momentum and the MACD. Shifting averages are cut up; the shorter-term ones (EMA and SMA for 10 intervals) recommend promoting strain, whereas the longer-term averages, like EMA (50) and SMA (50), trace at a shopping for likelihood. This distinction highlights the necessity for vigilant remark of worth actions to substantiate any directional shifts.

Bull Verdict:

Bitcoin’s potential to keep up robust assist close to $98,000 regardless of current profit-taking suggests resilience within the broader uptrend. A breakout above $103,000 with growing quantity might verify bullish momentum, paving the best way for a retest of the $108,000 resistance and even greater ranges. Lengthy-term transferring averages, just like the EMA (50) and SMA (50), additionally align with a bullish perspective, supporting additional upside potential.

Bear Verdict:

The emergence of decrease highs on shorter timeframes, coupled with promote indicators from short-term transferring averages just like the EMA (10) and SMA (10), factors to potential bearish strain. If bitcoin breaks under the $98,000 assist with robust quantity, it might speed up promoting, with the subsequent main assist stage round $92,000. Merchants ought to look ahead to indicators from the MACD and quantity traits to substantiate a bearish reversal.