Injective piques buyers’ curiosity as on-chain developments proceed on the platform. These new integrations and knowledge excite buyers, bumping the token’s worth by over 21%. The continual constructive developments are anticipated to additional steer the INJ on the bullish path.

Given the situations and constructive developments of Injective, its buyers and merchants have chosen the standing of INJ as a first-rate crypto for its native token, offering values to customers and merchants.

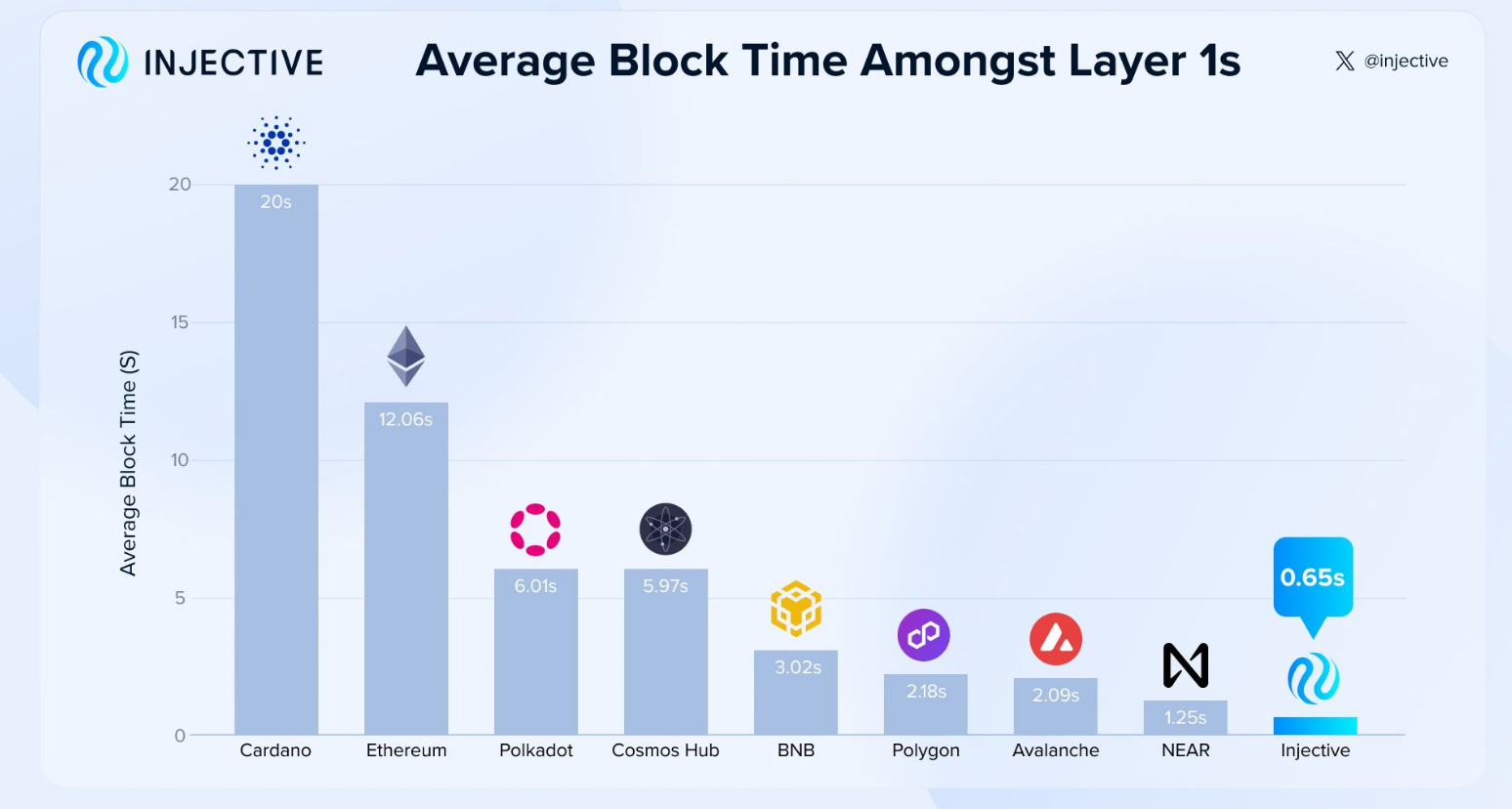

‘Quickest Layer 1 Blockchain’ Slashed Blocktimes To Simply 0.65 Seconds

Injective not too long ago posted a thread detailing the platform’s most up-to-date achievement: slashing finality instances to simply 0.65 seconds. The platform’s finality instances had been in comparison with different layer 1 blockchains like Close to, BNB, and Ethereum. In line with the thread, the community’s finality instances are brought on by “fastidiously engineered optimizations targeted on a number of key areas from optimized state synchronization and knowledge dealing with to enhanced useful resource administration.”

1/5 Injective continues to push the boundaries of blockchain scalability, with latest upgrades delivering the quickest speeds conceivable.

Injective block instances have now been slashed to simply 0.65 seconds, making it one of many quickest layer 1 blockchains ever created ⚡️ pic.twitter.com/lFN3W1w2Ve

— Injective 🥷 (@injective) August 21, 2024

This helps enhance consumer expertise on-chain whereas offering builders with a sturdy platform to construct on. One other facet that Injective is wanting in the direction of is the institutional facet of crypto. The extraordinarily low block instances will assist appeal to conventional monetary establishments to the platform with speeds rivaling that of the highest crypto networks.

Injective Integrates With Stability, Increasing Community Companies

This week, Injective additionally introduced the mixing of Stability, a cross-chain decentralized finance platform (DeFI), on the Injective mainnet. The mixing opens new alternatives for buyers and merchants because it introduces new belongings like bnUSD, Stability’s native stablecoin.

The partnership additionally permits overcollateralized loans on the platform. This permits customers to make use of any asset as collateral, giving them as much as two-thirds of the collateral’s worth as a mortgage. With a low 2% mounted curiosity, customers on the platform can versatile mortgage phrases with quick block time finality with Injective.

INJ Faces Rejection On This Stage, However With A Potential Rebound

As of press time, the token’s momentum, though nonetheless considerably bullish, is going through rejection on the $0.39 ceiling, trapping the token within the slim $0.36-$0.39 vary. This vary would possibly strain the bulls to lose momentum within the quick time period.

At this level, the token’s correlation with Bitcoin and its most up-to-date developments has squeezed the final little bit of bullishness out of INJ, probably opening the doorways to a downward trajectory within the coming days.

With the relative energy index signaling that the bulls are almost or already exhausted, buyers and merchants ought to count on the bears to aim a breakthrough on the $0.36 ground earlier than stabilizing on the token’s present buying and selling vary. If the bulls are unsuccessful in defending this buying and selling vary, the value ground of Injective would possibly transfer again to $0.32 quickly.

Featured picture from Snopes, chart from TradingView