Worry, uncertainty, and doubt (FUD) dominated the cryptocurrency market this week as volatility took over and most cryptocurrencies crashed. Bitcoin (BTC) has additionally suffered from this bearish sentiment, making a situation favoring an imminent quick squeeze for the asset.

Specifically, the derivatives market open curiosity (OI) in Bitcoin stays at all-time excessive ranges, as beforehand reported. On June 15, Finbold retrieved up to date information from CoinGlass displaying a $34.5 billion OI with BTC at $66,224.

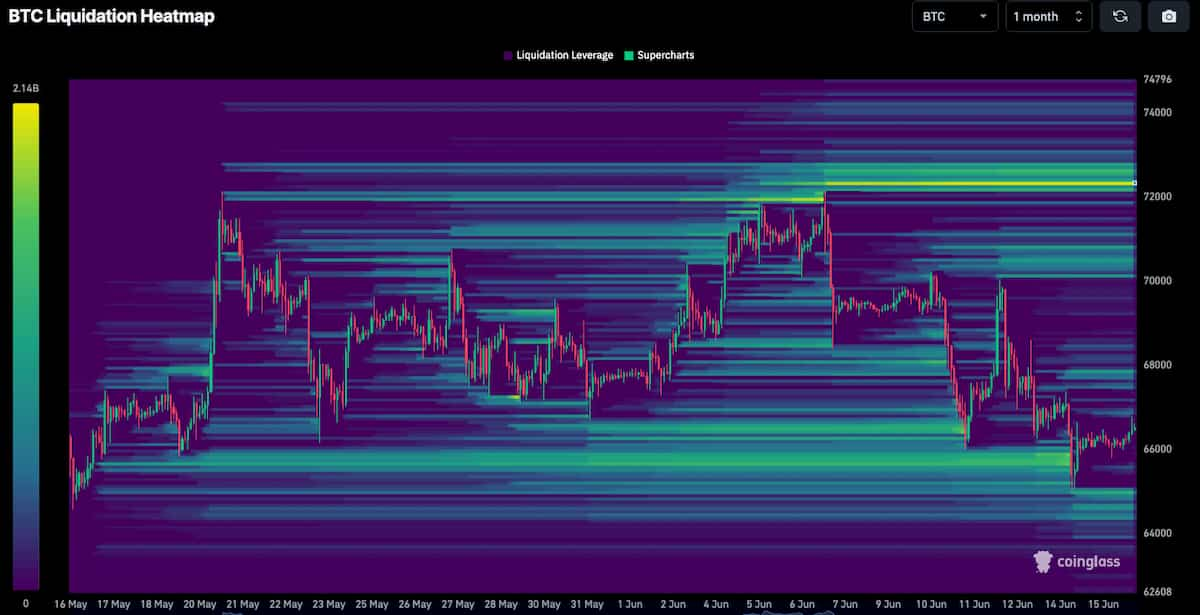

The excessive speculative demand for opened lengthy and quick positions has crafted notable imbalances, which might favor quick squeezes. It is because short-sellers leveraged trades created upward liquidity swimming pools, particularly on the $72,000 stage, a key value resistance.

Trying intently, there are over $2 billion value of Bitcoin quick liquidations, with smaller—however nonetheless related—swimming pools going as excessive as $73,000. Subsequently, the $72,000 to $73,000 zone turns into a possible goal within the case of a brief squeeze.

Brief squeeze incoming? Bitcoin bullish divergence

Notably, the skilled dealer and analyst who goes by Credible Crypto has noticed different indicators suggesting a brief squeeze. In a latest publish on X, the analyst pointed to a bullish divergence with the cumulative quantity delta (CVD).

In a remark, Credible Crypto defined {that a} down-trending CVD means there are extra market promote orders than buys. Thus, the BTC value was anticipated to go down following the elevated promoting strain, which isn’t taking place. The dealer believes it is a bullish indicator that purchase orders are being consumed and a provide shock is imminent.

“CVD just isn’t the identical as volume- CVD measures the online distinction between market purchase and promote orders- so when it’s trending down it means there are extra market sells than market buys. Sometimes this is able to trigger value to drop, however when value isn’t dropping regardless of there being plenty of market promoting…what does that inform us?”

— Credible Crypto

However, technical analyses and awaiting liquidations should not conclusive proof {that a} quick squeeze will occur. The market’s state modifications each second as cryptocurrency merchants reevaluate their positions and alter their exposures, market orders, and open curiosity—altering the chance of high-volatility occasions and shifting developments.

Disclaimer: The content material on this web site shouldn’t be thought of funding recommendation. Investing is speculative. When investing, your capital is in danger.