Right now, benefit from the Empire publication on Blockworks.co. Tomorrow, get the information delivered on to your inbox. Subscribe to the Empire publication.

Completely happy Fri-yay!

It’s been a bizarre week as we not solely clear the skeletons out of our closets but in addition put together for the previous couple of months of the yr.

However nobody’s had a worse week than ETH, which is down 10% to this point this week (although issues are beginning to lookup right this moment). A lot for a bullish begin to This fall.

All that apart, there are some bullish developments on the horizon. For instance, Permissionless is only a few sleeps away and there’ll be loads of of us weighing in on the place we go from there with a wholesome sprinkle of what’s making individuals bullish…or bearish.

Now I’m off to pack my baggage. See y’all subsequent week!

— Katherine Ross

The clock’s ticking

By now, most loyal Empire readers find out about Binance govt Tigran Gambaryan and his ongoing imprisonment by the Nigerian authorities.

However, ICYMI, Gambaryan was detained in Nigeria initially of this yr after taking a gathering with authorities officers on behalf of Binance. The nation and Gambaryan’s employer are — to place it frivolously — not on nice phrases. And, sadly, Gambaryan turned a pawn within the ongoing dispute between the 2.

Quick ahead to now, and Gambaryan’s affected by well being points but remains to be imprisoned on the Kuje Jail. And I want I might report that there was, nicely, extra to report. However sadly, at this level, there’s not.

Gambaryan will seem in courtroom subsequent Wednesday, Oct. 9 for a listening to the place the decide will resolve whether or not to launch him on bail

Nonetheless, I wished to convey him up not solely due to the continuing scenario, but in addition as a result of the extra I’ve regarded into Gambaryan, the extra I’ve realized simply how intensive his crypto ties are.

After I first began reporting on the scenario again in February, I referred to Tigran as an ex-IRS official. However, expensive reader, do you know he turned a specialist (based on a 2015 affidavit, which we’ll get to) in digital forex again when he was with the IRS?

Wired’s Andy Greenberg — who wrote the guide Tracers within the Darkish: The World Hunt for the Crime Lords of Cryptocurrency with Gambaryan because the protagonist — known as the previous IRS agent “type of a legendary determine within the crypto crime investigation world.”

Gambaryan served as a particular agent concerned in taking down former Drug Enforcement Administration agent Mark Power and former Secret Service agent Shaun Bridges, who have been each concerned within the Silk Highway.

He wrote that the 2 “abused their positions” as federal brokers in a 2015 affidavit. When detailing his expertise, he mentioned that he “developed a specialty in cyber and digital forex crimes.”

Following his authorities profession, Gambaryan went on to hitch Binance simply over three years in the past, in 2021.

“Tigran led a number of multi-billion greenback cyber investigations, together with the Silk Highway corruption investigations, BTC-e bitcoin alternate, and the Mt. Gox hack,” Binance mentioned in its press launch asserting the rent.

Earlier this week, Tigran’s spouse, Yuki Gambaryan, did an interview with Illicit Edge’s new podcast “Designated” about his imprisonment.

“Tigran is harmless, he didn’t do something improper,” she informed host Yaya Jata Fanusie. She additionally pushed for extra “decisive actions” from the US authorities.

“I’m having this fixed concern of dropping Tigran,” Yuki went on to say.

— Katherine Ross

IYKYK

May BitGo’s stablecoin providing dump your entire stablecoin market on its head?

Empire’s Jason Yanowitz appears to assume so. In right this moment’s Empire episode, he mused that the launch of USDS might spur extra firms to launch their very own stablecoins.

“We’re going to see the custodians launch stablecoins. We’re going to see the exchanges launch stablecoins. We’re going to see FinTechs like Robinhood launch stablecoins…Visa helps BBVA launch a stablecoin. We’re going to see the banks launch stablecoins. All people and their mom goes to launch a stablecoin,” Yanowitz mentioned.

We’ve got to notice, although, that Robinhood’s Johann Kerbrat informed us earlier this week that they’re not at present wanting right into a stablecoin.

Yanowitz additionally thinks that the stablecoin issuers’ “fingers are going to be compelled and so they’re going to want to determine how you can give yield again to the customers. And the way in which that they’re going to try this will not be by giving yield on to the customers, however by giving it to the individuals, in all probability the exchanges who’re sitting on the yield.”

Maybe this may very well be sufficient to dethrone Tether. Maybe not.

And now you recognize.

It’s formally This fall (the place did the time go?) which could simply be the right time to have a look again finally quarter and see if we will parse the tea leaves right here.

Admittedly, unrest within the Center East makes these leaves a bit murkier than we maybe would have hoped. However, with out counting unknown occasions or catalysts, the overall expectation for This fall is a constructive one.

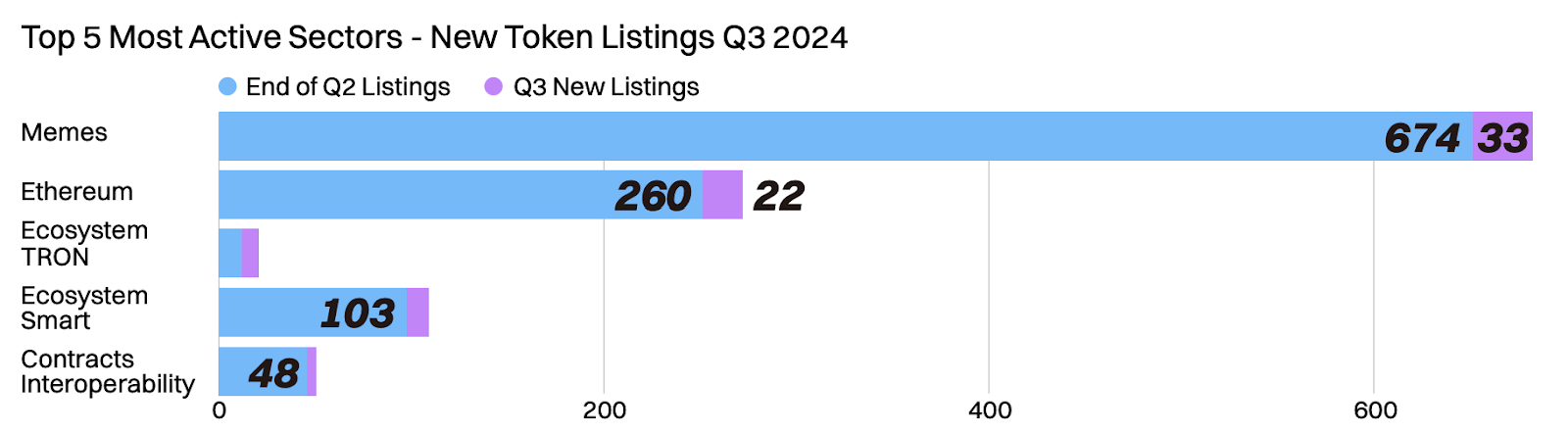

I do know we’ve been gentle on the charts this week, so I’ve dug up a couple of to finish the week, beginning with this one courtesy of a CoinMarketCap report that recapped final quarter.

Supply: CoinMarketCap

We already coated why this may not be an Uptober earlier this week, however maybe there’s nonetheless an opportunity for both/each November and December to tackle a extra constructive tone.

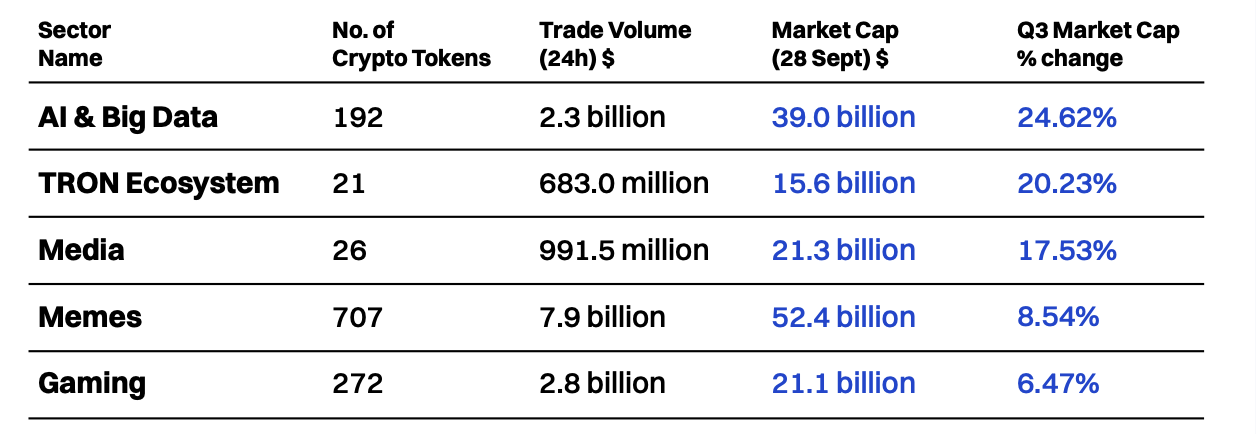

A rising tide floats all boats, proper? Nicely, some sectors of crypto may not even want bitcoin to go on a inexperienced spree to notch positive factors.

Supply: CoinMarketCap

To nobody’s shock, memes have been on hearth final quarter. However, maybe barely stunning, the info from CMC exhibits a “shift from DeFi and infrastructure initiatives in the direction of extra speculative and consumer-focused sectors like AI, media, and memes previously quarter.”

Supply: CoinMarketCap

Analysts at CMC are basically consensus with folks I’ve talked to: This fall may very well be extra constructive as a result of it will get a whole lot of unknowns out of the way in which, such because the US presidential election.

“Traditionally, This fall has typically been a robust interval for Bitcoin, and on common BTC has yielded 90.33% value enhance in This fall for the previous 10 years. Particularly, this yr we’re getting into This fall from a comparatively low value degree. With these elements in thoughts, there’s a major probability that we might see a value pump throughout the the rest of the yr, doubtlessly even pushing Bitcoin in the direction of one other all-time excessive,” analysts wrote.

However extra unknowns will in all probability result in drawdowns. If solely we had a crystal ball to steer the course.

— Katherine Ross